U.S. President Donald Trump and Chinese President Xi Jinping are going their own ways.

brendan smialowski/Agence France-Presse/Getty Images

So, you may have heard there is an electoral contest in the world’s largest economy.

But the coming U.S. presidential election isn’t the only major uncertainty hanging over the world’s financial markets. Savvas Savouri, chief economist at U.K. hedge fund Toscafund Asset Management, says there are three major events due to be resolved imminently, the other two being the European Union-U.K. trade negotiations, and the U.S.-China currency trade tensions.

Savouri doesn’t hold any doubt that former Vice President Joe Biden will win. Where he differs in view from others is the socially radical turn he thinks the U.S. government will take. “At 77, Biden may see out one term, but cannot reasonably expect a second. His first and only term then will be one where the free radicals within the Democratic Party face off its long stable order; and we have all been taught that free radicals are ‘unstable molecules.’ Those then looking for plus ça change should bear this in mind,” he says. The congressional onslaught, as he calls it, will result in pushes for antitrust breakups, greater regulation, and higher corporate taxation.

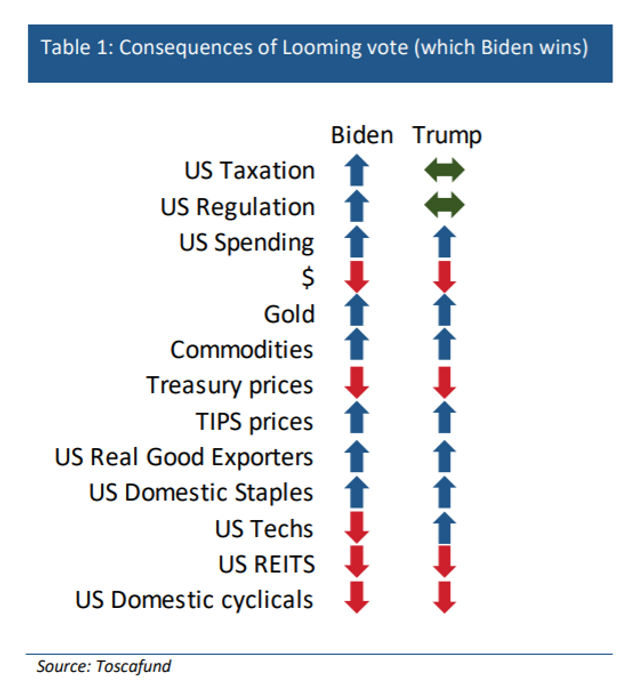

Savouri expects gains for gold GCZ20, +0.22%, commodities, and domestic staples if Biden wins, and losses for the dollar DXY, -0.16%, Treasurys, and technology companies, real-estate investment trusts and cyclicals. He expects the same moves for a President Donald Trump victory, except that the tech sector would continue to rise.

A “peaceful” resolution on Brexit also will make its mark on financial markets. “With Brexit finally resolved peacefully — as I have always been convinced it would be, though at the very last moment — the pound cannot fail to gap-up to its fair value,” he says. He says that means the pound GBPUSD, -0.20% spiking up, possibly beyond €1.30 and $1.60. That rise shouldn’t be viewed as a negative competitive shock, but as a signal for a wave of risk-averse international capital to flow back into the U.K., he says.

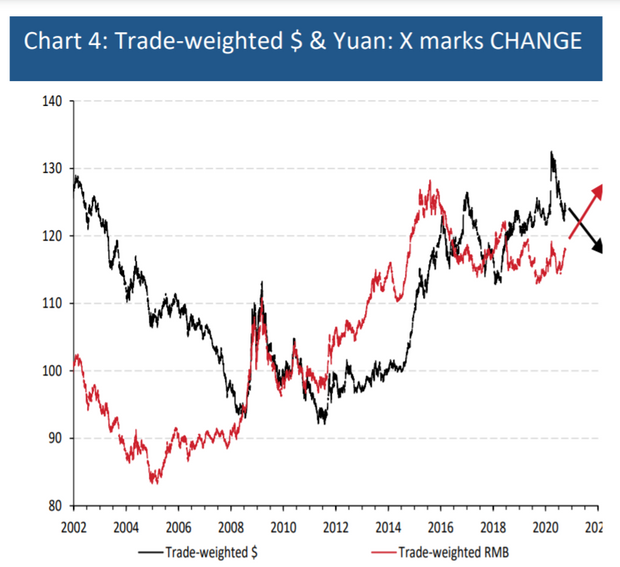

He expects the third game-changer to be resolved by China opting to let the yuan USDCNY, -0.38% move more freely. “The coronavirus crisis has compromised the internal markets on either side of the North Atlantic to such extents that it has shone a very strong light in Beijing on the importance of strength in the domestic Chinese economy. On top of this, the Old World’s manic debt printing — adding to the debt created over the last decade and more — has made it all the clearer to those wielding power in Beijing that they have by far the strongest fiscal and monetary hand to show of anywhere on Earth, and a currency to boot,” he says. He dryly put “bunkers” in New Zealand and “tinned food” as assets to buy if China doesn’t revalue.

“We are fast approaching culmination of the three bouts, the results of which are only still being guessed at, and whose culmination, whatever their results, will markedly shift the tectonic plates on which all asset prices are ultimately determined: exchange rates,” he says.

The buzz

Trump and Biden held opposing town halls on Thursday night. Biden generated the most newsworthy comment, saying voters will know his position on so-called court packing after the U.S. Senate decides on the Supreme Court nomination of Amy Coney Barrett. NBC’s Savannah Guthrie probably had the most memorable comment, after Trump said he just “put it out there” by retweeting a theory arguing the killing of Osama bin Laden had been staged. “You’re the president,” Guthrie said. “You’re not like someone’s crazy uncle who can just retweet whatever.”

Retail sales, industrial production and consumer confidence data are due from the U.S.

First Citizens FCNCA, +2.42% said it is buying CIT Group CIT, +3.18% in an all-stock deal, which will give First Citizens 61% of the combined bank. The companies said their merger will create the number-19 bank in the U.S., with over $100 billion in assets.

Boeing BA, +0.61% rose in premarket trade, after Bloomberg reported the head of the EU’s aviation safety agency said the 737 Max plane could be ready to fly by the end of the year.

Pfizer PFE, -0.84% said it is on track to file for emergency use authorization of its COVID-19 vaccine by the third week of November.

The earnings calendar features Bank of New York Mellon BK, +1.74%, which beat expectations on earnings, and rival custodian bank State Street STT, +1.39%. LVMH Moët Hennessy MC, +6.40% rallied in Paris, as the luxury-goods giant reported a smaller-than-forecast decline in third-quarter sales, helped by demand from its leather goods and fashion business.

Social network Twitter TWTR, +0.10% had a brief outage, as it separately changed its policy on hacked materials, following its controversial decision to prevent a New York Post story on Biden and his son Hunter Biden from being shared. Separately, trading app Robinhood said a limited number of customer accounts were hacked.

London is among the English cities being moved to “high” restrictions due to the coronavirus outbreaks, while Germany and the Czech Republic each set daily records for coronavirus cases.

The markets

U.S. stock futures ES00, +0.10% NQ00, +0.11% turned higher after the Pfizer vaccine news, after a 0.2% drop for the S&P 500 SPX, -0.15% on Thursday.

The yield on the 10-year Treasury TMUBMUSD10Y, 0.724% slipped to 0.73%.

The pound GBPUSD, -0.20% slipped after U.K. Prime Minister Boris Johnson said the country should “get ready” for an Australian-styled, limited trade deal with the European Union. He didn’t end talks, however.

Random reads

A rocket booster and a dead satellite narrowly avoided a collision.

China shows off video of a “barrage swarm” drone launcher.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Add Comment