Just how bad is the world economy going to get?

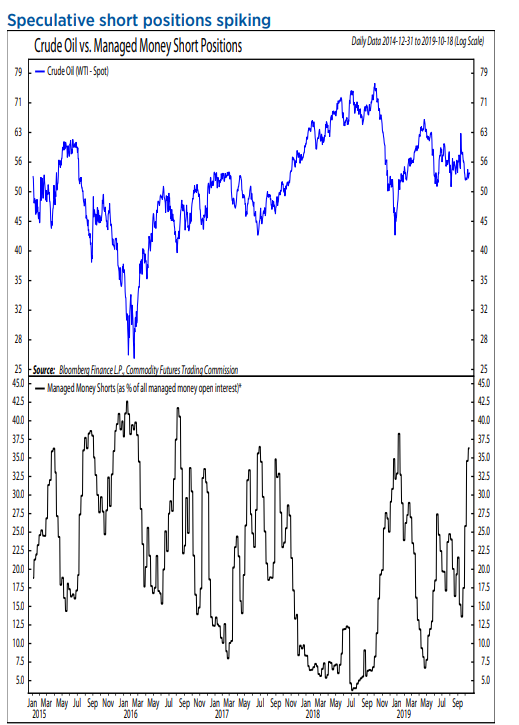

The answer to that question is key to whether hedge funds have gone out on too far a limb in aggressively shorting, or betting against, oil CL.1, -1.03%.

Warren Pies, an energy strategist at Ned Davis Research, says hedge funds are too bearish on oil compared with the fundamentals. Citing CFTC data, he says short positions make up more than 35% of the open interest of professional money managers, for only the sixth time since the 2014 crash.

But this time, Pies says in the call of the day, the fundamental data for oil—in inventories, refining margins and other key indicators—does not support the pile-up of shorts. If the economy does not enter recession, short positions could unwind quickly, he says.

The buzz

A warning from chip maker Texas Instruments TXN, -1.80% cast a bearish pall on markets. While earnings season has been benign so far, after good results from the financial sector, sell-side analysts have begun to lower their estimates for 2020 earnings, according to BNP Paribas.

Opinion: Texas Instruments tanks the chip sector and investors’ hopes for a rebound

Construction and mining equipment maker Caterpillar CAT, +1.10% lowered its 2019 outlook while health insurer Anthem ANTM, +2.84% reported stronger-than-forecast results. Struggling planemaker Boeing BA, +1.79% reported third-quarter results far below analyst estimates. After the close, software group Microsoft MSFT, -1.49% and electric-car maker Tesla TSLA, +0.82% will report earnings. Alphabet’s GOOGL, -0.25% GOOG, -0.27% Google said it has made a breakthrough in quantum computing, performing a target computation that would take the world’s fastest supercomputer 10,000 years, in 200 seconds.

The markets

U.S. stock futures ES00, -0.29% YM00, -0.46% NQ00, -0.22% fell, after a 46-point advance for the Dow Jones Industrial Average DJIA, -0.15% on Tuesday.

A little bit of fear in the air—gold futures GC00, +0.53% rose nearly $8 an ounce, and the yield on the 10-year Treasury TMUBMUSD10Y, -1.73% fell 2 basis points.

Chart of the Day

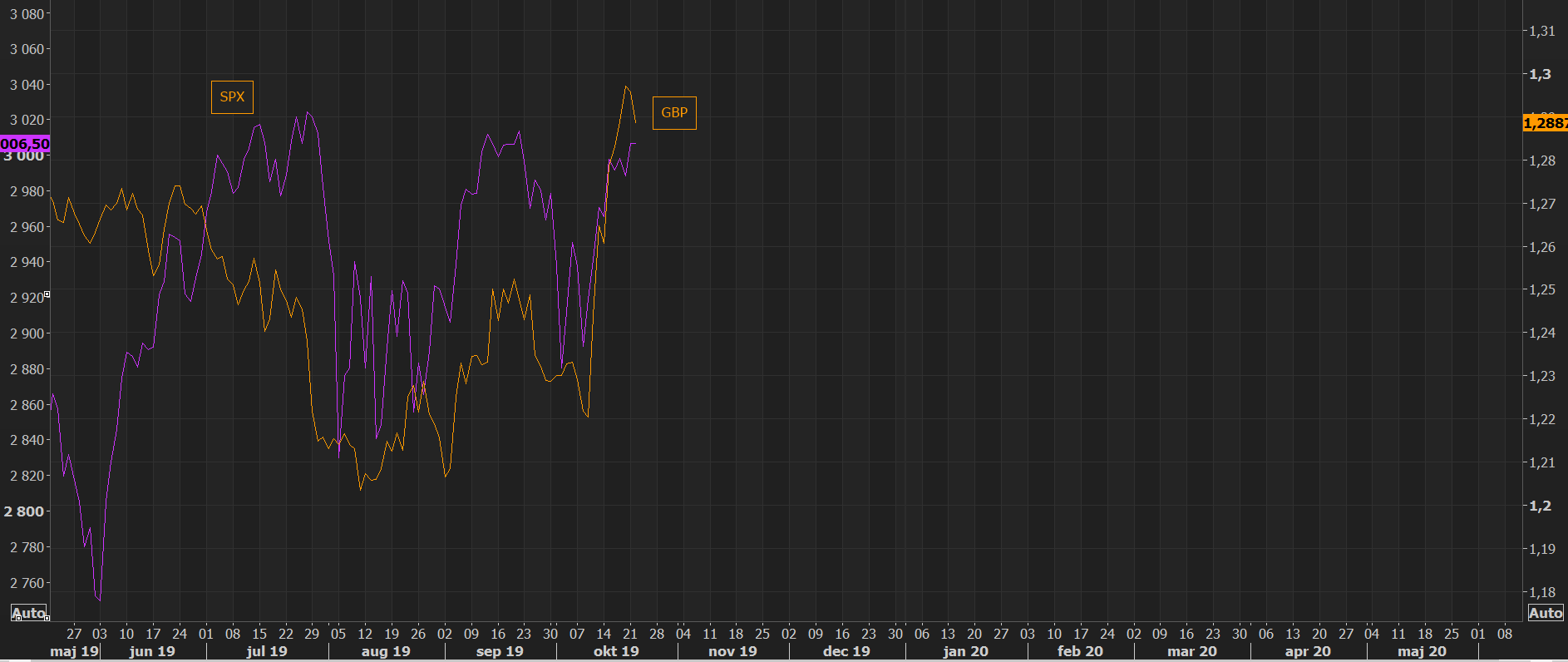

Order. ORDER. Looks like the U.S. is stuck paying as much attention to the never-ending Brexit process as the U.K. is, given this chart from The Market Ear, showing the close correlation between the S&P 500 SPX, -0.36% and the British pound GBPUSD, +0.0155%. On Tuesday night, U.K. Prime Minister Boris Johnson went one-for-two, as he won a vote on advancing his withdrawal agreement but lost a vote that would have wrapped up proceedings. The market is now waiting for the European Union to extend the U.K.’s departure date beyond Oct. 31.

Random reads

Talking his book? Uber Technologies UBER, +3.57% CEO Dara Khosrowshahi, in Delhi, told Indians not to fall into the trap of buying cars.

Horrific news from the U.K., where 39 bodies were found in a shipping container, believed to have come from Bulgaria.

The world’s happiest rats? These rodents get to drive tiny cars and get rewarded with Froot Loops.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment