A “black swan” in the investing world essentially means an unpredictable event resulting in extreme consequences. Unpredictability, however, hasn’t stopped Wall Street pundits predicting the next one looming over this bull market.

INTL FCStone INTL, -0.11% strategist Vincent Deluard is one of those pundits, and his latest note is a real downer for those betting on a sustained rally

Some doubts may have set in recently as President Donald Trump kicked off a fresh trade war with China, with much of that being fought over social media.

“It is not difficult to envision a scenario where this Twitter tantrum turns into a fully-fledged bear market,” Deluard wrote in our call of the day, in which he explains that not one, not two, but perhaps three black swans could broadside investors and lead to a drop of more than 20% from recent highs.

1: Private markets get clipped in the wake of disappointing IPOs from Uber UBER, -3.05% and Lyft LYFT, -0.59% as risk appetite dries up among investors. “Valuations will need to be dropped,” Deluard said. “Skeletons may come out of the closet of many a once-highly valued tech unicorn.”

2: Venezuela or Iran could deliver a shock in global oil prices that could ripple across markets. Deluard warns that it’s not the direct impact of rising prices, rather what they could do to the Fed’s ability to tweak monetary policy the way it wants. “Despite the current euphoria about ‘the death of inflation’ and the ‘goldilocks economy,’ it is still possible for the Federal Reserve to find itself in the 1970s dilemma: accelerating inflation and a slowing economy,” Deluard said.

3: A “leftist takeover” of the Democratic party ahead of the 2020 presidential election could put pressure on stocks, particularly if parts of Democratic presidential hopeful Bernie Sanders’ political plan from his 2016 presidential campaign take hold. “The demographic turning from boomers to millennials and Gen Z will lead to greater demand for redistributionist and inflationary policies in the 2020 election,” Deluard wrote.

There’s no sign of any market-toppling black swan this morning, but stocks aren’t exactly poised to charge higher when that opening bell rings.

The market

Following last week’s stomach-in-mouth stretch that ended in negative territory, futures on the Dow DJIA, -0.15% , S&P SPX, -0.28% and Nasdaq COMP, -1.01% are all weaker in early trading. Meanwhile, the dollar DXY, -0.08% is down just a bit, and crude US:CLU8 has managed to pare gains as the market absorbs comments from oil producers after a Sunday meeting and increased Middle East tensions. Read more in Market Snapshot

Overseas, Europe stocks SXXP, -0.95% are following Wall Street’s lead lower as their week gets underway on a soft note, while Asian equities ADOW, +1.04% closed mixed. Data showed that the Japanese economy enjoyed better-than-expected growth in the first quarter, though the Nikkei NIK, +0.24% got just a small lift. Chinese stocks SHCOMP, -0.41% ended lower.

Bitcoin BTCUSD, -3.60% is in retreat, dropping below the $8,000 level.

The buzz

It’s a big week for biotechs, with three IPOs from the sector set to make landfall. Peloton Therapeutics, Ideaya Biosciences and U.K.-based Bicycle Therapeutics Plc are expected to price Wednesday. The companies are all oncology-focused, targeting everything from transcription factors to the tumors themselves.

Google GOOG, -1.66% has reportedly revoked Huawei’s Android license, in a move that could cripple the Chinese tech giant’s smartphone business. Now, Huawei will be restricted to using only the public, open-source version of Android. Last week, the Trump administration moved to restrict U.S. technology sales to Huawei, having long claimed that telecom equipment from Huawei poses a national security risk. Xilinx XLNX, -5.05% the computer chip maker, is also complying with the U.S. ban.

Commencement season, when U.S. students tend to graduate, is just getting started but it’ll be tough to top the speech Robert F. Smith gave at Morehouse College over the weekend. The billionaire tech investor told the 400 graduating seniors that he will take care of their student debt. Poof! Gone. Smith said he hopes that the graduates would “pay it forward.”

A day after Justin Amash emerged as the lone Republican lawmaker to call for the president’s impeachment, Trump fired back Sunday, calling him a “loser” who opposed him to gain popularity. So far, Amash hasn’t received much support from his party, but there’s bound to be further developments on this front.

Democratic presidential hopeful Pete Buttigieg crossed over dividing lines when he took part in a Fox News town hall. “A lot of folks in my party were critical of me for even doing this. And I get where that’s coming from,” he said, before launching into a critique of two of the conservative network’s top hosts.

How to survive losing $2.2 billion? European private-equity pioneer Guy Hands tells MarketWatch how his past stumbles were a blessing in disguise.

The chart

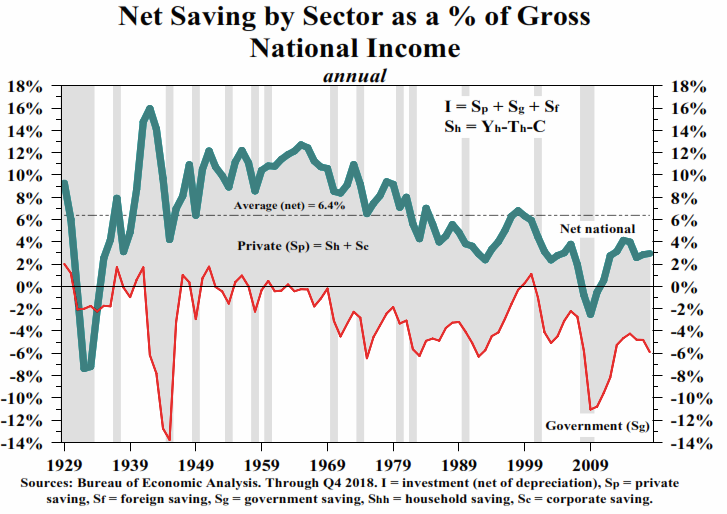

Lacy Hunt of Hoisington Investment Management Company calls this one of the most important charts in all of economics:

The green line shows the U.S. national savings rate while the red line shows the government sector, which is dragging down the national number.

That, he warns, is where the problem lies. “What it says is there is an insufficiency of savings to absorb ever-larger budget deficits,” Hunt explained in a presentation posted on CMGWealth.com. “National savings is not staying at 3%, it is going to decline. Real investment is going to decline. It is possible the private sector will save more but that means there will be less consumption.”

In other words, Hunt says the public sector is going to constrain the private sector and the economy. because debt acts as a noose around the economy’s neck. “We simply have an insufficiency of savings and it cannot be corrected,” he wrote.

The stat

Bloomberg

Bloomberg

$513 million — That’s the massive payday Elon Musk enjoyed during his turbulent 2018, earning the Tesla TSLA, -4.83% boss the top spot in Bloomberg’s annual list of highest paid U.S. executives. Next in the rankings, Tilray’s TLRY, -3.22% Brendan Kennedy at $256 million and Disney’s DIS, +0.00% Bob Iger at $147 million came in second and third, respectively.

The economy

The big numbers this week come from April new and existing home sales, which will be released on Thursday and Tuesday, respectively. On Monday, the Chicago Fed posts its National Activity Index for April at 8:30 a.m. Eastern. We’ll also get a look at the FOMC minutes, but not until Wednesday afternoon. Read:There’s no recession in sight, but the U.S. economy is stuck in second gear

The tweet

Random reads

Saturday Night Live rips anti-abortion laws.

Justin Bieber spoiled an Icelandic canyon for everybody else.

When did boarding a plane get so ridiculous?

An Ohio State team doctor is alleged to have abused more than 177 male students, and the university’s leaders knew all about it.

Trump’s official handicap was hacked — he’s not THAT bad at golf.

“Trapped in the burnout mindset.” Just because you don’t have any children doesn’t mean you don’t deserve work/life balance.

“Game of Thrones” ends… and people have thoughts.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.