Between an attack on Saudi Arabia’s oil and a credit crunch disrupting short-term money markets, there has been a lot to chew on this week. That’s as a Federal Reserve decision looms for later.

The Fed is pegged to cut rates 25 basis points. Investors will be listening up for future policy hints and its thoughts on oil prices and maybe on this scarcity of cash issue. As for the latter, investment firm Blackstone’s vice chairman Tony James, is among those trying to calm the waters.

“The rate spike looks very scary, but it’s only overnight. The actual cost to the system is not high, it’s more of a concern for dealers,” James told Bloomberg TV. The Fed is planning another operation to inject cash into the system Wednesday after a $75 billion operation on Tuesday.

Read: DoubleLine’s Gundlach says Fed took baby step toward QE with repo operation

Onto our call of the day from Liz Ann Sonders, chief investment strategist at Charles Schwab, who warns investors are sleepwalking when it comes to one area of the global economy.

“I think that there may be a bit too much complacency about inflation and interest rates staying low,” Sonders tells MarketWatch in an interview. “I’ve always had the view that we should be as least as intrigued by the story no one’s telling as by the story everyone is telling.”

The Fed has a mandate to keep prices stable, which right now isn’t a problem, but should it become one, interest rate hikes come back into the spotlight. Financial markets and investors have grown pretty comfortable with the idea of central banks stimulating economies rather than slowing them down.

“Even if we’re not going headline into 1970s runaway inflation, hyperinflation, stagflation, I just think consensus became so convinced inflation here and globally was dead and buried forever, that even a slight adjustment in that trajectory and the implications that would have for monetary policy is something that’s not being digested well enough,” says Sonders.

She also worries about a global manufacturing recession, a trade war and the fact markets can get jolted by a single tweet — as we’ve seen when President Trump fires off some zingers. Sonders says a neutral position on global stocks — where Schwab has been for about two years — may be the safest place for investors.

“I think it’s a treacherous environment right now to make a huge bet in either direction, either on the extreme optimistic side or on the pessimistic side because we’re in this stage right now where the needle can go either way. The best advice we can give in this environment of uncertainty is stay at your normal allocation, but use the swings to rebalance,” says Sonders.

Opinion: Stock market’s eerie parallels to September 2007 should raise recession fears

The market

The pre-Fed struggle for direction is real. Dow YM00, -0.13% , S&P ES00, -0.15% and Nasdaq NQ00, -0.18% are edging south, and oil CLV19, -1.69% is down again. Gold GCZ19, -0.13% is off and the dollar DXY, +0.11% is up.

Europe stocks SXXP, +0.06% are slightly higher, while Asia markets ADOW, -0.46% went nowhere ahead of the Fed decision.

The economy

Housing starts — the number of new homes on which construction has begun — came in much stronger than expected, with building permits also climbing. The Fed announcement is due later and a press conference with Chairman Jerome Powell. Read our preview here

The chart

And if you really don’t get that credit crunch (you’re not alone)…this thread will get you there.

The chart

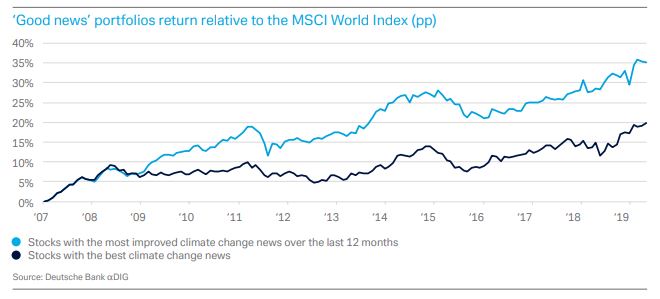

Deutsche Bank provides our chart of the day, the result of a deep dive on how climate change news can affect stocks.

In short, companies can get a boost from positive news on their environmental efforts. That kind of news helps those companies outperform the MSCI World Index — a market-cap weighted stock market index of 1,655 stocks from companies around — by 0.8 percentage points a year, their study shows. That’s an outperformance of 15%.

The full report is here.

The buzz

FedEx FDX, -0.16% shares are down after the logistics group missed profit expectations and cut its outlook, citing “increasing trade tensions,” and global economic sluggishness. Shares of retailer Chewy CHWY, -0.59%, which sells everything you need for your pets, are down after results.

Shares of CDW CDW, +0.71% are climbing on news the tech group will join the S&P 500 this month.

Bankers have reportedly been pushing AT&T T, -0.40% to unload its DirecTV unit, and Dish Network DISH, -2.16% maybe a suitor.

Read: New GoDaddy CEO sticking with the plan, despite stock slump

Random reads

A beloved giant panda died in China and people are super upset

Political deadlock in Israel, as Prime Minister Benjamin Netanyahu stumbles in latest elections

Not even unborn babies are safe from air pollution fallout

Veggie diets can’t save the Earth, but this might.

Dutch YouTube star in hot water for trespassing near Nevada’s top-secret Air Force base — aka Area 51

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.