Is talk of a sharp and sudden gain for stocks making you hungry to invest, or queasy?

Bank of America has just predicted that will happen in the first quarter, driven by supportive central bank policies. Often referred to as a melt-up, it’s basically a dramatic or unexpected move up for an asset causing investors to stampede after it due to fear of missing out (FOMO). That surge can mark the end of an asset bubble, and sometimes a pullback will follow that mass move into a stock.

Our call of the day, from Jeroen Blokland, portfolio manager at investment company Robeco, says while this bull market may stretch into its 11th year, one big thing is needed. “It will come down to earnings in the end. If investors see better earnings growth from here, high-odds markets make new highs,” he told MarketWatch.

Blokland said investors need to be prepared for the fact that those corporate earnings may take a bit longer to perk up, testing their patience. For example, he noted Monday’s data showing the eurozone’s manufacturing purchasing managers’ index hit a two-month low in December — a sign improved data may still be a couple of months away.

In the U.S. this week, investors will get an update on consumer spending, a vital part of the economic picture that’s been waning.

“With the phase one [U.S.-China] trade deal virtually done (at least it seems like that), earnings could be pressured for another quarter or so. There could be some kind of vacuum in which stocks struggle for a while,” said Blokland.

Analysts expect earnings for Wall Street to bounce back solidly from scant 2019 growth of just over 1%, rising to 10% for 2020, according to forecasts compiled by Yardeni Research. One of Wall Street’s most bullish forecasters, BTIG’s Julian Emanuel, is expecting growth of 6.7% next year.

Read: Global fund managers turn bullish in a hurry, Bank of America survey finds

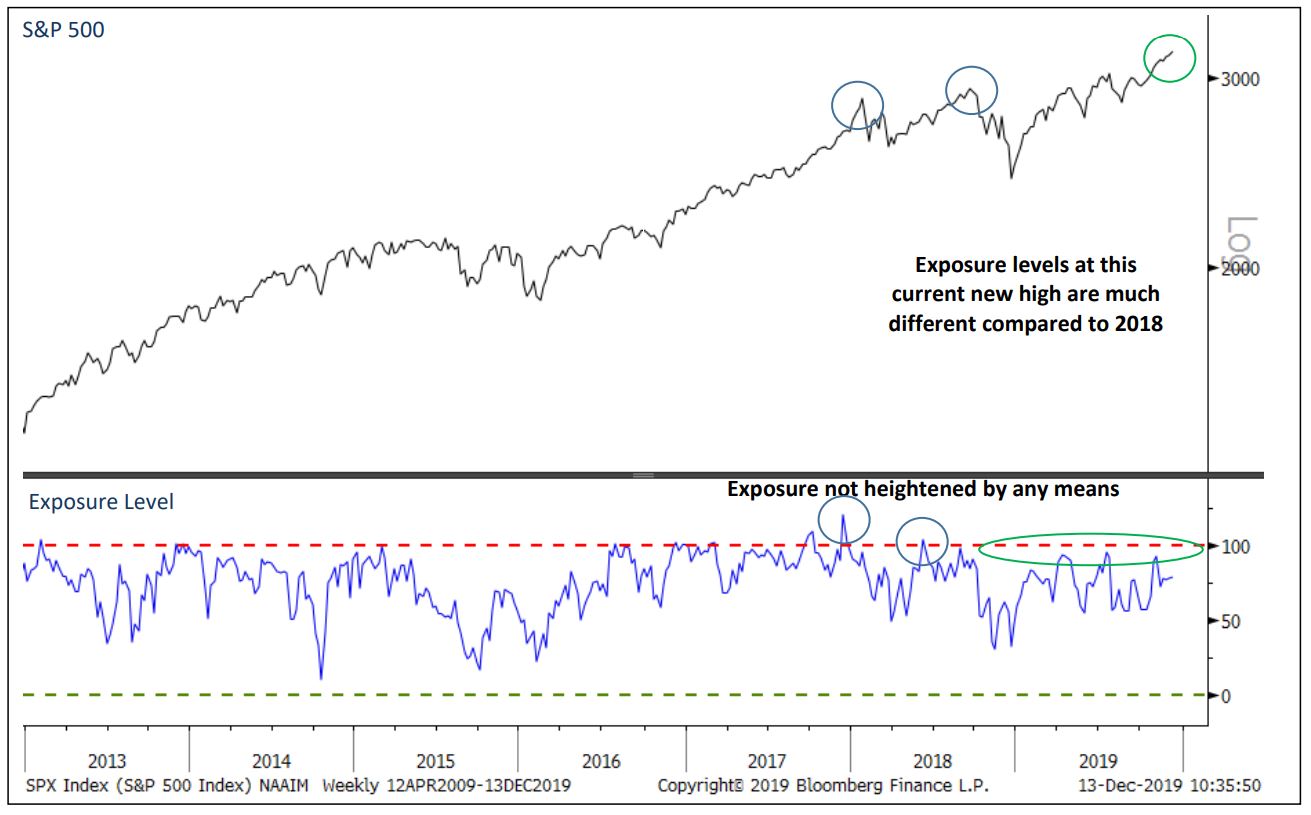

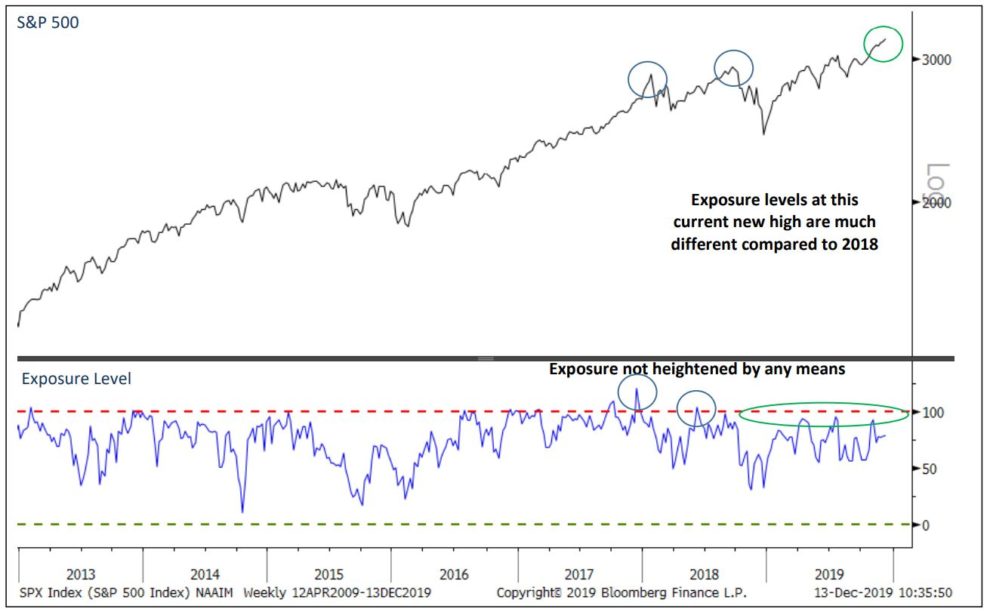

The chart

Our chart from equity research and trading company MKM Partners fits into the discussion about further investor appetite for stocks. Citing data from the National Association of Active Investment Managers, JC O’Hara, MKM’s chief market technician, shows that just 78% of money managers are currently exposed to U.S. equities, meaning they have cash that’s ready to go to work:

MKM Partners

MKM Partners “That has been a pretty steady level over the last few weeks. If they need to chase into year-end, they have the means to do so,” said O’Hara.

Random reads

U.S. lawmakers may approve funding for gun-safety research for the first time in decades

Cocaine Santa sweaters are flying off Amazon’s shelves

Disney heiress slams ripped Instagram photo posted by star of sitcom “Silicon Valley”

Pakistan’s ex-dictator Pervez Musharraf sentenced to death in absentia

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment