Rattled by rising non-China coronavirus cases — notably in South Korea — investors appear unwilling to load up on stocks heading into the new week.

That is as they headed for perceived safe-haven assets, bonds TMUBMUSD10Y, +0.00% and gold GCJ20, -0.18% of Friday.

You’ve heard of helicopter parents? Welcome to the world of helicopter investing and our call of the day from Barclays Wealth Management’s chief investment officer William Hobbs, who finds overly anxious investors living in the “long shadow” caused by the financial crisis.

“The most common narrative in markets is what to do when the next recession comes along — own Treasurys, own gold, own quality to such an extent that my concern would almost be that if the next recession is of a more normal variety, such as a stock retracement of 10% to 15% and moderate declines in unemployment, you’ll find that you have overprotected yourself and the underperformance could actually be in the areas which you thought were giving you safety,” Hobbs told MarketWatch.

“Those companies that offer a degree of economic dependability, that enjoy strong competitive advantages, and strong visible cash flows, their worth may be being exaggerated,” said Hobbs, adding that some government bonds seem to be “return-free risk rather than risk-free returns.”

The truth is, investors can’t reliably predict recessions, and shouldn’t be obsessing about it, he said. “What we can say is some of the previous causes of some of the nastiest recessions in history are so far substantially absent” and Barclays thinks the economic cycle can carry on for a little while longer.

Of course, coronavirus ripples could “roll up in potentially much more cyclical and disruptive ways that we anticipate,” he cautioned.

But a smart investor mindset for the next five to 10 years is one that accepts all the bumps in the road can’t be dodged, whether from the economy or otherwise. Or, said Hobbs, you miss out on the reason for investing in the first place — “to harvest returns from ongoing human ingenuity.”

That means “diversified exposure to the world’s stock markets, and that is the beauty of the modern world relative to the worlds of decades past. I can now get…almost free access to all of the world’s stock markets, and exposure to that global ingenuity,” said Hobbs.

Where to find all that ingenuity? He said Barclays is leaning toward emerging markets, in particular Asia, but away from one area that looks a bit pricey — the U.S. megacap space.

Read: The American dream of retirement isn’t going to be fulfilled says Raoul Pal

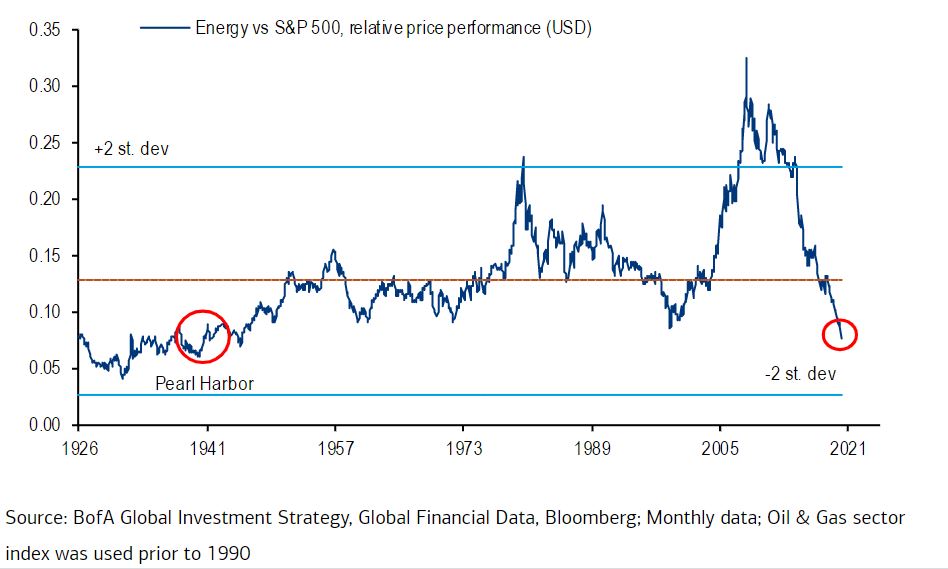

The chart

Bank of America Merrill Lynch’s chart takes us way back — showing U.S. energy stocks are at the lowest price relative to the S&P 500 since the Pearl Harbor attack of 1941.

Random reads

President Donald Trump and Korean Oscar winner “Parasite” trade barbs.

A misleading coronavirus map went viral.

When Silicon Valley’s homeless have nowhere else to go, they ride the ‘Motel 22’ night bus.

Follow MarketWatch on Twitter, Instagram, Facebook.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>