The S&P 500 index touched a record high on Friday for the 15th time this year, but stock market futures are pointing to a more muted start to the trading week.

Even if stocks can keep rallying, the upside will be very limited, said Matt Maley, a strategist at investment firm Miller Tabak + Co., in our call of the day.

Maley said there “is no question that the stock market could rise further from current levels,” but his team believes that any more gains won’t be due to fundamentals.

This is largely because the market has already priced in fundamental growth expectations over the next 12 to 18 months. Some of those headline projections include year-over-year economic growth estimates as strong as 8% for 2021 and earnings growth of 25% this year.

And the strategist said that these bullish growth projections are out of focus. “Those are extraordinary numbers, but if you compare them to a normal year, they’re not anywhere near as impressive as they initially seem,” Maley said. The year-over-year estimates are comparisons to 2020—when the global economy all but shut down and company earnings were battered by the COVID-19 pandemic.

“More importantly, they do not justify a further rally in the stock market,” Maley said. “Something else is going to have to fuel a rally of significance.”

Valuations are “extreme,” according to Maley, and this expensive market “tells us that the upside is very limited,” with the risks “quite high” that a full-blown correction is coming.

The investment firm’s main concern right now is the divergence between the S&P 500 SPX, -0.15% index and technology stocks. The blue-chip index can hold up if there is weakness in the tech sector, but “once that weakness becomes more pronounced, it has always had a negative impact on the broader stock market,” Maley said.

Every time the Nasdaq COMP, -0.60% has fallen between 12% and 14% in the last 40 years, it has created “material pullback” in the S&P 500, the strategist said. “If that correction becomes more than 15% in the Nasdaq, the S&P has always fallen at least 10% as well (and usually quite a bit more than 10%),” Maley said.

The divergence between the S&P 500 and Nasdaq is reasserting itself once again, Maley said. If the tech-heavy index moves much lower, it will “raise a serious warning flag” for both the Nasdaq and the broader stock market.

The buzz

The massive container ship that has blocked the Suez Canal and disrupted global trade for the last week is still stuck, but perhaps not for long. The Ever Given was successfully refloated early on Monday morning and tug boats are working to straighten the ship out.

The end of last week was marked by massive block trades worth around $30 billion, triggered by a margin call of U.S. investor Archegos Capital Management. The selloff pushed shares in media groups ViacomCBS VIACA, -1.82% and Discovery DISCA, +0.84% down more than 27% on Friday and hit some Chinese internet stocks.

And banks tied to the fire sale on Friday are feeling the heat. Shares in Japan’s Nomura 8604, -16.33% and Switzerland’s Credit Suisse CSGN, -13.83% dived on Monday, after both groups extended credit to a major client that couldn’t meet its obligations. The Swiss group said losses from exiting positions as a result could have a “highly significant and material” impact on earnings.

It is a light day on the economic front, with the Chicago Fed national activity index for February due at 8:30 a.m. Eastern, followed by existing home sales data for February at 10 a.m.

Lawmakers in Albany reached a deal on Saturday to allow sales of cannabis for recreational use, opening the door for New York to join the growing list of states that have legalized marijuana. A vote on the bill could come by Tuesday.

British online car retailer Cazoo is set to float on the New York Stock Exchange in a listing worth $7 billion, after agreeing to a merger deal with a blank-check, special-purpose acquisition company (SPAC). Cazoo’s planned merger with AJAX I will bring the SPAC’s billionaire investor Dan Och onto the company’s board.

The markets

U.S. stock market futures are pointing down YM00, -0.07% ES00, -0.37% NQ00, -0.58%, set for a weak open to start the new trading week. Bank stocks remain under pressure in the fallout from Friday’s Archegos unwinds, with Deutsche Bank DBK, -3.32% and UBS UBS, -2.62% among the fallers and shares in Goldman Sachs GS, -1.28% and Morgan Stanley MS, -2.58% lower in the premarket.

European indexes were mixed UKX, -0.07% DAX, +0.47% PX1, +0.45% while Asian equities NIK, +0.71% HSI, +0.01% SHCOMP, +0.50% finished Monday in the green.

The chart

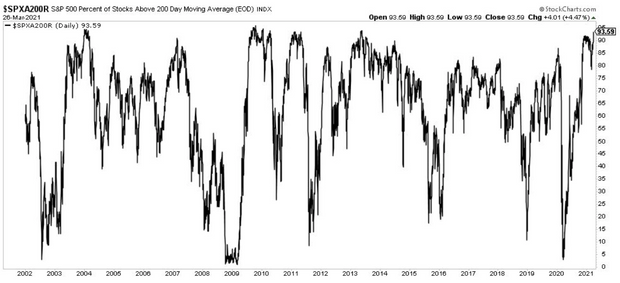

The market “is in a very healthy place right now,” said Michael Batnick of The Irrelevant Investor financial blog. In our chart of the day, Batnick shows that 93% of the stocks in the S&P 500 are above their 200-day moving average—the highest reading since 2013 levels.

Random reads

There is a game about the ship stuck in the Suez Canal and you’re the bulldozer.

Life on Mars: Here’s what the planet’s first city might look like.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Add Comment