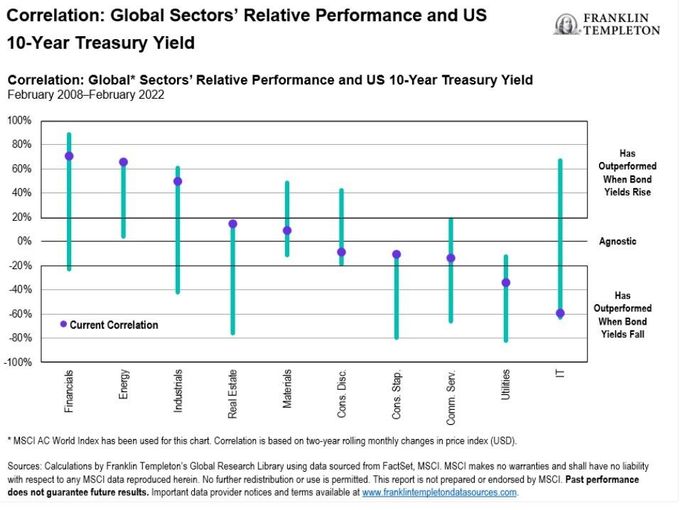

The Federal Reserve just made its first interest-rate hike in four years and is expecting 11 quarter-point increases this cycle. Loan origination is also rising as consumers burn through the savings accumuluated through stimulus checks and extra unemployment benefits. So it’s a great time to load up on financials, right?

The surprising answer from managers of the Franklin Mutual Financial Services Fund TFSIX, -0.16% is, not necessarily, at least in the U.S.

Sure, rising rates are a nice backdrop as banks raise the cost of loans faster than they boost deposit rates. But there’s a lot already baked in, say portfolio managers Andrew Dinnhaupt and Luis Hernandez.

They see opportunities in Europe. “Europe remains behind the United States both in terms of economic recovery and when the first interest-rate increase might occur,” they say.

What about the war raging on their doorstep? “Although the greater economic uncertainties in Europe stemming from the spike in energy prices and any exposure to Russia and Ukraine may temper the outlook in the near term, particularly if banks are forced to raise their provisions for bad debts, we expect any jolt is likely to be to bank earnings and not banks’ capital. Moreover, we view the recent selloff in banks across the region as overdone given the potential impact,” they say.

Even a slightly less negative interest-rate environment in Europe should improve banks’ earnings outlook, and the European Central Bank will eventually follow the Fed in raising rates, they say. Plus, there are opportunities for several European banks to unlock value by making their operations more efficient and selling assets.

The SPDR S&P Bank ETF KBE, -1.05% has been steady this year, compared to a 6% drop for the iShares MSCI Europe Financials ETF EUFN, -0.11%

The fund managers didn’t name companies in their analysis. Their top two holdings at the end of January were American banks, Wells Fargo WFC, -0.23% and Citizens Financial CFG, -1.19%. (They did say, “large-cap U.S. banks that have been improving their businesses offer some good opportunities for value investors.”) Their European exposure included Spain’s CaixaBank CABK, -1.06%, France’s biggest lender, BNP Paribas BNP, -0.23%, U.K. bank Barclays BCS, -0.75%, Dutch bank and insurer ING ING, -0.38%, and Germany’s Deutsche Bank DB, +0.49%.

The chart

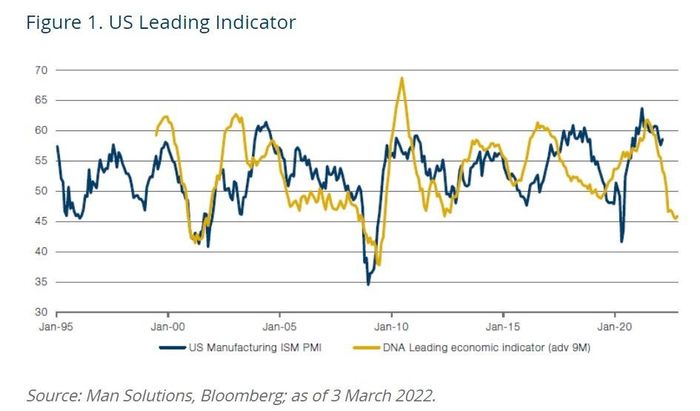

Did investors buy the dip too early? Analysts at U.K. hedge fund Man Group say their leading indicator points to slowing growth, though not a recession, in the U.S. “Buying a dip is not a bad strategy per se. But our analysis suggests that it may be best to patiently wait for a better entry point,” they said.

The buzz

U.S. President Joe Biden and China President Xi Jinping are due to hold a call at 9 a.m. Eastern, after the U.S. said Russia was requesting Chinese military equipment. Russian strikes on Friday hit the western city of Lviv as well as the Ukraine capital of Kyiv, with no diplomatic breakthrough as yet.

China separately eased COVID-19 restrictions in the key manufacturing hub of Shenzhen.

FedEx FDX, +0.91% reported weaker-than-forecast fiscal third quarter results and kept its annual outlook mostly unchanged.

Meme-stock video game retailer GameStop GME, +0.97% swung to a surprise loss in the fourth quarter.

Existing-home sales data is expected to show a slowdown in housing transactions.

The market

U.S. stock futures ES00, -0.68% NQ00, -0.70% dropped ahead of the expiration of key contracts, as well as a nearly 6% runup in the S&P 500 SPX, +1.23% over the last three days.

Crude oil CL.1, +1.48% futures were trading around $104 per barrel.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

Random reads

At the age of 94, Minnie Mouse is recording a chill-out album.

The NCAA tournament had upsets galore, including number-two seed Kentucky.

Robot dogs have joined the New York Fire Department.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.