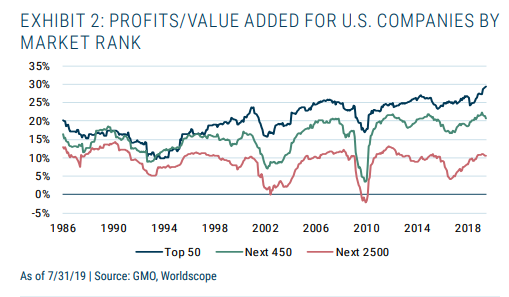

It’s been a great time to be a corporate giant. Since 2004, the biggest companies have, unusually, been able to maintain profit margins throughout economic cycles.

At the same time, the relationship between profits and business investment has broken down.

“The largest firms fund their investments more or less entirely out of internal cash flow,” says Ben Inker, head of GMO’s asset allocation team, in a quarterly letter to shareholders. Inker says this is the result of increased industry concentration and market power. “Because the firms are already dominant in their spaces, there may not be a lot of expanding they can do short of branching out into new business lines, where their position will likely not be as dominant and their profit margins far less enticing.”

Inker says this won’t last forever. “The recent announcement of antitrust investigations against the largest technology and related communications firms seems unlikely to be a one-off. Apart from the simple issue of their growing dominance and staggering profits, the negative societal and privacy impacts of their basic business models make it harder to paint them as plucky upstarts improving the world and easier for critics to characterize them as disturbing big-brother entities feeding off the worst instincts of humanity,” he says. Health-care sector firms also face greater scrutiny.

In the call of the day, he said even with no reversion to trend in large-cap margins, the outlook over the next seven years for the S&P 500 SPX, -0.69% doesn’t look great, with expected annual returns of 1.4%. It’s even worse if those margins do fall back to Earth. “The groups we are excited about within global equities—U.S. small value, international developed value, and, above all, emerging markets value—are all at least at a 4.5% higher forecast return in the friendliest version of the forecast for the S&P 500, with EM value a stunning 10% to 10.6% higher,” he says.

The markets

Risk on. U.S. stock futures ES00, +0.86% YM00, +0.82% NQ00, +1.07% rallied on Wednesday after a 285-point drop for the Dow industrials DJIA, -1.08% on Tuesday. Read Market Snapshot.

Gold futures GC00, -0.73% fell, and the yield on the 30-year Treasury TMUBMUSD30Y, +1.55% rose.

Markets in Europe SXXP, +0.97% and Asia ADOW, +1.85% rallied.

The buzz

News that Hong Kong leader Carrie Lam was withdrawing the extradition bill, which would have allowed criminal suspects to be extradited to mainland China, gave a huge lift, not only to Hong Kong HSI, +3.90% stocks, but markets world-wide. The British pound GBPUSD, +0.9682% advanced after Prime Minister Boris Johnson’s parliamentary defeat on Tuesday decreased the probability of a no-deal Brexit.

It’s a busy day in Fedland, with speeches from New York Fed President John Williams, Gov. Michelle Bowman, and the release of the Beige Book. St. Louis Fed President James Bullard said late Tuesday that he was in favor of a 50 basis-point cut. Trade data for July also is due for release.

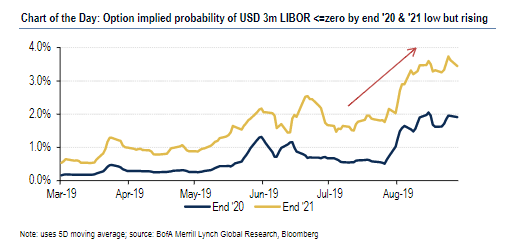

Chart of the day

Markets still aren’t expecting the Federal Reserve to cut interest rates all the way to zero, though those odds are increasing. Analysts from Bank of America Merrill Lynch say the Fed also will be constrained from unconventional action—what’s the point, for instance, of quantitative easing or a twist into longer-dated securities with interest rates so low and a persistently flat yield curve? This could push the Fed to even more unconventional policies, like yield-curve control, twisting from mortgage-backed securities into Treasurys or negative interest rates.

Random reads

Here are the vainest cities in the world.

Comedian Kevin Hart will need weeks of rehab after a car accident.

SpaceX blamed a ‘bug’ for a near miss with a European Space Agency satellite.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.