If a financial bubble is indeed brewing, it may continue for longer than many expect, TS Lombard strategists said.

AFP via Getty Images

Familiar hopes of a new U.S. stimulus deal are once again occupying the minds of investors.

House Speaker Nancy Pelosi has set a 48-hour deadline for the White House to strike a deal with the Democrats over a stimulus package before November’s election.

Strong China growth data, which showed third-quarter gross domestic product rising 4.9% compared with the year-ago period, also buoyed investors early on Monday.

On the 33rd anniversary of the “Black Monday” market crash, the Dow Jones Industrial Average DJIA, -0.31% was 0.3%, or 72 points lower, in early trading, losing its initial gains.

In our call of the day, TS Lombard strategists said the outperformance of technology — and therefore Growth — stocks was set to continue “for a while longer” yet.

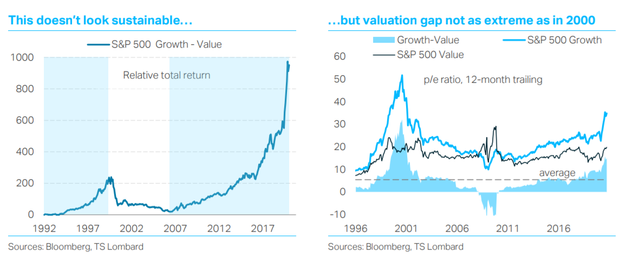

Chief U.S. economist Steven Blitz and head of strategy Andrea Cicione said they were “not alone in being nervous” about Tech stocks valuations. “Growth has had an unprecedented surge for more than 13 years and the recent acceleration appears completely unsustainable,” they said, noting that the recent swell was more extreme than the Growth outperformance during the dot-com bubble — as seen in the chart below (left). They described it as the ‘dot com bubble on steroids,’ in a note.

However, on closer inspection they said the argument for rotating into Value was “less convincing,” as the first two years of stronger Value returns post-2000 were during a bear market. “If the same were to happen this time around, rotating into Value would be at best a defensive strategy.”

But Blitz and Cicione said if a bubble was indeed inflating in tech, there was no guarantee Growth’s outperformance would stop now. “Through its aggressive policy choices, the Fed has engineered a rebound in equity prices since March that is giving investors the perception of lack of risk. So why stop betting on a winning horse now, especially if there is no downside,” they said.

The chart below (right) shows that while the valuation gap between Growth and Value is above average, it is not as extreme as it was in 2000. But Growth’s run may be more advanced that the valuation gap suggests, they added, particularly as many tech companies are now both large and very profitable — in contrast to the late 1990s — making it harder to justify the multiples seen at the height of dot-com mania.

“Investors looking to rotate from Growth to Value would be better off doing so in small-caps, where the odds of a sustained period of Value outperformance are more favorable.

“However, they should bear in mind that if a financial bubble is indeed brewing, it may continue to do so for longer than many expect — under such a scenario, Growth will probably keep doing better until the bubble pops,” they said.

The markets

After closing 112 points higher on Friday, the Dow Jones Industrial Average DJIA, -0.31% edged higher in early trading, on hopes for a U.S. stimulus package and China growth data signaling a continued recovery, before falling back. The S&P 500 SPX, -0.42% was 0.4% down and the Nasdaq COMP, -0.37% was 0.3% down.

European stocks SXXP, -0.28% climbed at the start of the week before dipping to trade 0.3% down for the day. The U.K.’s internationally-exposed FTSE 100 UKX, -0.59% also fell as the pound GBPUSD, +0.66% rallied 0.7% to $1.3002 despite ‘no-deal’ Brexit fears.

The buzz

Tesla TSLA, -0.87% and Netflix NFLX, +0.73% — two of 2020’s hottest companies — will look to keep their momentum going in a big week of earnings for investors.

Advance orders for Apple’s AAPL, -0.37% latest iPhone 12 model reportedly sold out on Chinese e-commerce retailer JD.com JD, +0.40% in just three days.

Trading was disrupted by a glitch at Euronext on Monday morning. It affected trading in Paris, as well as Belgium, Portugal, Ireland and the Netherlands.

French food company Danone BN, +0.26% restored guidance for the full year and laid out a reorganization of its structure as it reported falling sales in the third quarter. The stock rose 1.4% in early trading.

The door is “still ajar” for post-Brexit talks with the European Union if officials in the bloc change their stance on key points, British cabinet minister Michael Gove said Sunday.

Random read

Scottish pubs warned of fake funerals to get around COVID-19 rules.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Add Comment