Investors who have been unsure about the Fed’s no-mercy inflation policy, have likely got the message now.

And as markets adjust to the prospect of more hikes from a central bank that plans to “keep at it until it’s done,” with threats of an escalating war in Europe and energy crisis hovering in the background, the S&P 500 SPX, -1.71% may struggle to revisit the summer nadir.

“Given today’s [Wednesday’s] downside reversal and a continued lack of any capitulatory signals, we think the path to the June lows (3,640) might be faster than many anticipate,” BTIG’s chief market technician Jonathan Krinsky tells clients, though he dangles some hope.

“The bad news is we are still in one of the weakest seasonal windows of the year, especially in a midterm year. The good news is that it quickly reverses by mid-October. We think we test or break the June lows before then, which should set up a better entry point for a year-end rally,” said Krinsky.

Investors would be forgiven for feeling like they’ve been backed into a corner right now when it comes to investment options. That brings us to our call of the day from Credit Suisse, which offers a “protective moat for uncertain times” via dozens of companies with solid business models.

Note the bank is currently recommending an underweight stance on equities owing to “potential downside risk to 2023 earnings estimates to the tune of 15% to 20% for the S&P 500.” They see a “highly uncertain” growth outlook caused by aggressive central bank responses to sticky wage growth and Europe’s energy crisis. Strategists expect U.S. growth to reach just 0.9% in 2023, with a 0.2% contraction in the eurozone.

Still, Richard Kersley, head of global equity research and his team asked analysts across several regions to “identify companies whose earnings may not be immune to, but should be better shielded from economic uncertainty thanks to the high barriers to entry that surround their businesses.“

“Stocks selected reflect examples of companies that have shown a superior ability to innovate, their first mover advantage or simply a scale advantage that has developed a market leading position and with it stronger pricing power,” he said.

And rather than limiting picks to defensive sectors or styles, they cast a wide net and come up with 35 outperform-rated stocks with an “economic moat across regions.” Bolded names represent those with above-consensus earnings estimates and target prices, as well most anti-consensus calls.

Americas: Air Products APD, -1.40%, Autodesk ADSK, -1.31%, McDonald’s MCD, -1.69%, Microsoft MSFT, -1.44%, NextEra NEE, -2.01%, PPL PPL, -1.63%, Reynolds REYN, +0.66%, Hershey HSY, +0.42%, Thomson Reuters TRI, -1.13%, Union Pacific UNP, -0.65%, Visa V, -2.63%.

EMEA: Air Liquide AI, -1.02%, ASML ASML, -1.52% ASML, -2.00%, Assa Abloy ASSA.B, -1.99%, Coloplast COLO.B, -1.30%, Diageo DGE, +0.62% DEO, +0.09%, Edenred EDEN, -0.49%, Experian EXPN, -0.94%, Haleon HLN, -1.79%, Legal & General LGEN, , LSEG LSEG, -0.67%, National Grid NG, -0.39%, Reckitt Benckiser RKT, -0.89%, Schneider SU, -1.03%, Sika SIKA, -0.92%, Smurfit Kappa SK3, -0.26%, Wolters Kluwer WKL, -0.35%.

Asia Pacific: AIA 1299, -2.38%, CP All PCL CPALL, -0.43%, CTOS Digital 5301, -0.71%, Hindustan Unilever 500696, +2.64%, Intl Container ICT, , PT Bank Mandiri (Persero) Tbk , Samsung Biologics 207940, -0.13%, Samsung Electronics 005930, -1.63%

Check out Day two of MarketWatch’s Best New Ideas in Money Festival. It’s not too late to sign up, and here’s an interview you may have missed with legendary investors Ray Dalio and Carl Icahn.

The markets

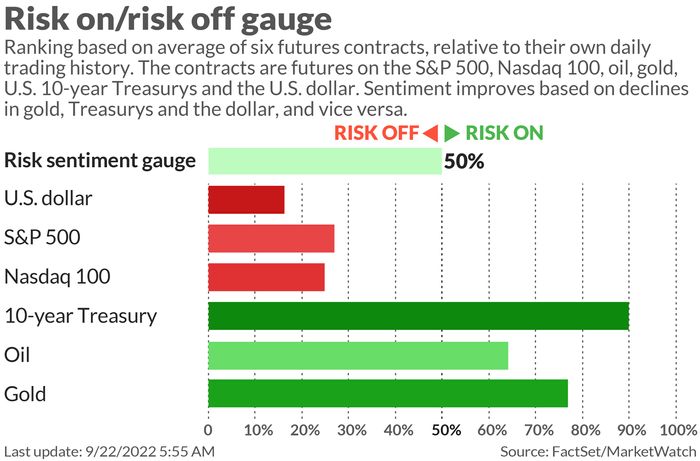

Stock futures ES00, +0.11% NQ00, +0.03% YM00, +0.18% are struggling for traction, with 2-year Treasury yields TMUBMUSD02Y, 4.100% at the highest since 2008. The dollar index DXY, +0.24% was hovering at 2002 highs, until the Bank of Japan stepped in for the first time in 25 years after it left key interest rates unchanged. Asian equities NIK, -0.58% HSI, -1.61% stumbled and the Korean won USDKRW, +0.54% hit its lowest in 13 years. Europe equities SXXP, -0.72% aren’t faring much better.

The buzz

After last week’s warning and cost-cutting plans FedEx FDX, -2.64% will report after the close. Investors will zero in on what the management has to say about that and a global slowdown.

The Swiss National Bank matched the Fed’s 75 basis-point hike, and marked the end of negative interest rates for global central banks. Norway’s central bank hiked 50 basis points, with the Bank of England decision still to come.

Weekly jobless claims and the current-account deficit are coming ahead of the market open, followed by leading economic indicators.

More than two hundred Ukrainians and foreigners, including soldiers who defended a Mariupol steel plant, have been freed in exchange for one ally of Russian President Vladimir Putin.

“If you’re the president of the United States, you can declassify just by saying ‘It’s declassified.’ Even by thinking about it.” That was former President Donald Trump just before a federal court lifted a hold on Mar-a-Lago classified records.

Best of the web

After the passage of a California law, Uber and Lyft drivers are making less than $7 an hour

Why the world should be wary of a cornered Putin

How Mahsa Amini has become a powerful symbol for women in Iran

The chart

Here’s an upate on a popular analog chart comparing the S&P 500’s progress in 2022, to what happened in 2008 from blogger The Market Ear. Looking dicey:

The tickers

These were the most active stock-market ticker symbols as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, -2.57% | Tesla |

| GME, -2.47% | GameStop |

| AMC, -1.26% | AMC Entertainment |

| AAPL, -2.03% | Apple |

| NIO, -10.34% | NIO |

| BBBY, -4.34% | Bed Bath & Beyond |

| APE, -5.91% | AMC Entertainment preferred shares |

| AVCT, +1.13% | American Virtual Cloud Technologies |

| AMZN, -2.99% | Amazon |

| NVDA, +0.65% | Nvidia |

Random reads

The unborn give a tiny thumbs-down to kale.

$625 per head for a dinner — at Disney World DIS, -2.86%.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.