Escalating trade war tensions and recession fears have hammered stocks in recent weeks but things may not be as bad as they seem.

Last Monday was the worst day of the year for U.S. stocks as the Chinese yuan fell below a key level in retaliation to President Donald Trump’s tariffs threat.

Trump maintained his strong stance in a series of tweets over the weekend and a key decision on the U.S. Huawei ban is looming a week today.

But JP Morgan Cazenove says, in the call of the day, that it is too early to expect the next U.S. recession and investors should be optimistic on equities.

“The current macro setup has more similarities to the ‘15-’16 mid-cycle correction episode rather than the end of the cycle, in our view.” JP Morgan’s head of global equity strategy Mislav Matejka said.

“The U.S. continues to be supported by the still better relative earnings / macro backdrop and elevated levels of buybacks,” he added.

Companies with higher domestic exposure have performed well in earnings season, showing that all is well, at home at least.

U.S. stocks endured a wild ride last week and could be set for more turbulence this week.

Goldman Sachs cut its fourth quarter U.S. growth forecast from 2% to 1.8% as it warned the trade war was having a greater impact on the economy than expected and the risk of recession was rising.

Analysts from research firm TS Lombard said the U.S. treatment of Huawei was key to the unfolding of the trade war drama.

In May the U.S. put Huawei on a trade blacklist, requiring firms to obtain a license to do business with the Chinese telecoms giant.

They expected Trump to allow U.S. firms to trade with the Chinese tech giant on a case-by-case basis, which will provide a boost to domestic suppliers.

The market

After the Dow Jones Industrial Average DJIA, -0.34% lost 91 points on Friday, over fears tensions with China could escalate, U.S. stock futures ES00, -0.70% YM00, -0.68% NQ00, -0.79% pointed lower on Monday.

European stocks SXXP, -0.26% dropped in early trading on Monday, while Asian ADOW, -0.23% stocks also fell.

The buzz

The Chinese yuan was still hogging the limelight as the People’s Bank of China fixed the currency’s midpoint below 7 to the dollar for the third consecutive day.

However the 7.0211 per dollar reference was stronger than expected, which provided some respite for international markets.

With a number of public holidays — in Japan, India and Singapore — the buzz around Asian trading was limited, keeping European markets subdued.

Tensions between the U.S. and China show no signs of easing after Donald Trump said it would be “fine” if talks scheduled for September were canceled.

The chart

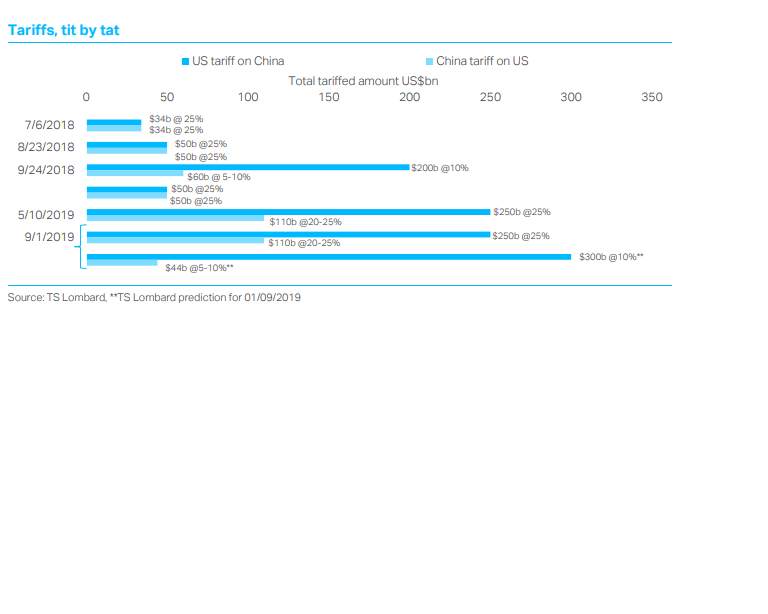

TS Lombard says the latest U.S.-China trade spat is “different” and predicts that China will respond with further tariffs of its own on U.S. imports on 1 September. The chart highlights the rapid escalation of tariffs in recent months.

The tweet

Starbucks’ annual report revealed that the company held $1.6 billion in liabilities from its reward card. The coffee chain has also made $321m in unpaid card balances over the past three years.

Random reads

Police have warned people who have mocked the hairstyle of a wanted drug dealer.

Donald Trump’s best British friend, Nigel Farage, launched a scathing attack on the royal family, branding the late Queen Mother an “overweight, chain-smoking gin drinker.”

British MP Caroline Lucas has called for an “all-women emergency cabinet” to be formed to stop a no-deal Brexit.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.