Be careful what you wish for.

The Dow Jones Industrial Average DJIA, +0.15% , bolstered by the Fed’s return to its easy-money mind-set, is on pace for its best June since 1938.

Read: The Dow could hit 30,000 faster than you think

And, the S&P 500 SPX, -0.01% , as of Friday’s intraday high, was up 7.7%, putting the broad-market gauge on track to be the sixth best June ever.

What could possibly go wrong?

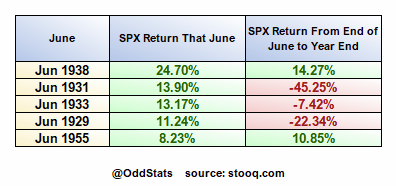

The OddStats Twitter TWTR, +1.61% account, in our stat of the day, points to the S&P’s action and asks the question: “Do you really want to join this list?”

Here’s what happened the other five times June’s been this strong:

This time it’s different? Well, in the time-honored tradition of selecting timelines to suit one’s narrative, here’s a follow-up tweet:

We’ll see… for now, those June gains are holding steady.

The markets

The Dow DJIA, +0.15% , S&P SPX, -0.01% and Nasdaq COMP, -0.09% are all off to a mostly flat start to the trading week. The dollar DXY, -0.16% is dipping and the yield on the 10-year U.S. bond TMUBMUSD10Y, -1.52% is just over 2%. Gold GCQ19, +1.34% is charging ahead once again. Oil CL00, -0.19% is lower.

Europe stocks SXXP, -0.25% struggled to find direction and ultimately ended in the red, while Asian ADOW, +0.31% stocks finished with a bit of green, as cautious bullish optimism emerged for a thaw in U.S.-China trade talks.

In cryptocurrencies, bitcoin BTCUSD, -0.33% broke through $11,000 level and notched its highest level since March 2018.

The chart

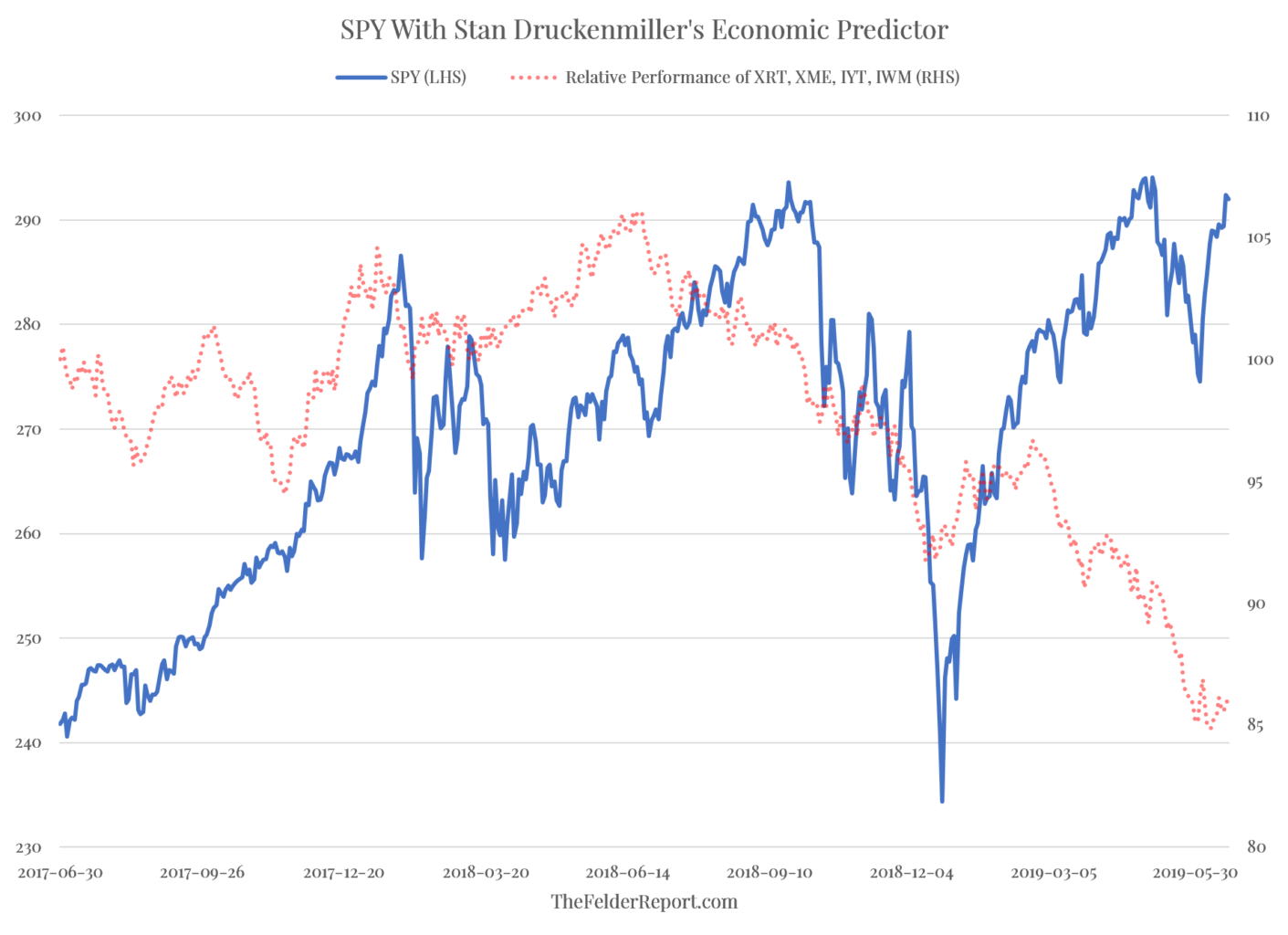

At a recent interview at the Economic Club of New York, investing legend Stanley Druckenmiller said “the best economic predictor I’ve ever met is the inside of the stock market.” And by that, he meant cyclical companies within the market — “trucking, retail, that kind of stuff, the Russell 2000 RUT, -0.68% .” He determined that the inside of THIS market is telling us to exercise caution.

Jesse Felder of the Felder Report agrees, and he made this visual representation of what Druckenmiller was talking about to back his point:

“‘You better be careful and keep your eyes open,’ indeed,” Felder wrote in his most recent blog post, quoting Druckenmiller.

The call

The Fed is going to cut rates. We know that. But will it cut rates twice this year? How about three times? James Bianco of Bianco Research says four — FOUR! — cuts this year alone. And he believes the stock market will eat it up. “Trust the market. It wants a lot of rate cuts. It’s been saying that for months,” Bianco told CNBC. “They’re saying, ‘Look, you’ve got room to lower rates. Lower the cost of capital and maybe provide more stimulus without the fear of inflation. So, do it.’”

Watch the full interview:

The buzz

Merger Monday: Shares of Caesars Entertainment CZR, +15.02% are climbing on news of a buyout by Eldorado Resorts ERI, -11.27% in a deal that values the rival casino operator at $8.6 billion.

It might seem like there’s absolutely no way the TV version of Fox News host Sean Hannity is an actual real person, but one look at his cozy text conversations with Paul Manafort reveals, well, he IS the same guy in real life.

Disney’s DIS, -1.01% “Toy Story 4” opened to a solid $118 million in the U.S. and Canada to lead the weekend’s box offices, but it was a bit of a letdown.

Nike NKE, -0.23% will give some insight later in the week into how tariffs are affecting the bottom line — analysts say Nike’s doing just fine. Nevertheless, the U.S./China trade war has been a cause for concern for retailers.

The quote

Reuters

Reuters

“Neither Iran nor any other hostile actor should mistake U.S. prudence and discretion for weakness. No one has granted them a hunting license in the Middle East” — U.S. national security adviser John Bolton, as quoted by CNN.

The tweet

Random reads

A journalist tells his story of his run-in with the border patrol and the “terrible power” they are all too eager to wield.

The long, cruel history of the antiabortion crusade.

That melting Arctic ice is about to reveal some nasty stuff.

Star quarterback Cam Newton was ready to pay a LOT of cash to switch seats with a guy on a flight to France, but he got denied.

How an asteroid could destroy Earth before impact.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.