This article is reprinted by permission from NerdWallet.

Travel insurance can safeguard your nonrefundable reservations and reimburse you for any unexpected emergency medical costs that you incur while traveling. However, the travel insurance needs of those taking several short vacations a year will vary from those of digital nomads, who may spend significant portions of the year living and working from abroad.

Digital nomads may also return home less often, travel with equipment (e.g., laptop, camera, etc.), participate in adventurous activities and be less concerned with health care coverage if they are traveling to a country with inexpensive medical costs.

Given the prevalence of remote work and increasing options to live and work from abroad, here you’ll find some of the most popular travel insurance options for digital nomads.

World Nomads

World Nomads is a travel insurance provider that offers coverage for residents of many countries and allows you to extend your coverage mid-trip. It is underwritten by Nationwide Insurance. Importantly, the provider does not have a pandemic exclusion, so COVID-related claims are covered. However, World Nomads specifically states that fear of travel is not a valid reason for trip cancellation. So if you’d like the option to cancel a trip at your discretion, you’ll want to consider plans that offer Cancel For Any Reason coverage.

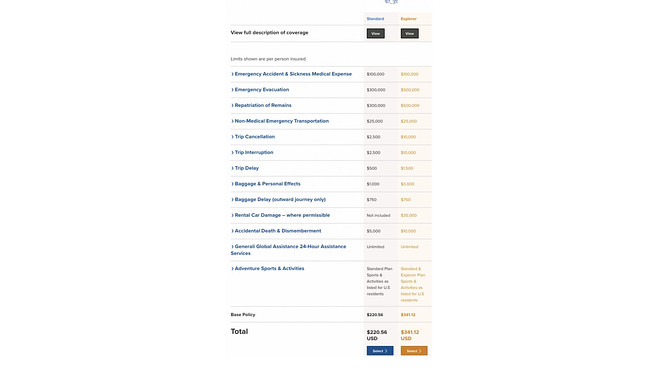

There are two trip insurance policies available from World Nomads: Standard and Explorer. The Standard Plan has lower coverage limits and includes more than 200 sports (including some adventure sports), while the Explorer Plan adds on 60 other activities and sports, including more dangerous ones such as shark cage diving, skydiving and paragliding.

Also see: Countries that will give you a remote-work visa, and how to get to them

The inclusion of athletic activities in both World Nomads plans is unique, since most traditional travel insurance plans exclude them.

Here’s a list of what’s included with World of Nomads coverage:

- Trip cancellation, interruption and delay.

- Emergency medical expenses, evacuation, repatriation and 24-hour assistance services.

- Accidental death and dismemberment.

- Nonmedical emergency transportation.

- Baggage delay and loss.

- Rental car damage (Explorer Plan only).

- Adventure sports and activities.

And here are a few items of note that are excluded (not a comprehensive list):

- Pre-existing conditions.

- War.

- Self-harm or accidents occurring while intoxicated.

To see how World Nomads compares to other travel insurance providers, we considered a sample two-month trip to Italy by a 32-year-old resident of New York.

How World Nomads compares to other travel insurance providers.

Due to the lower limits and less coverage for adventure activities, the World Nomads Standard Plan is priced at $221, which is meaningfully cheaper than the $341 Explorer Plan. It’s important to note that if your nonrefundable prepaid trip costs are more than $2,500, the Standard Plan will cover you only up to $2,500 on trip cancellation. In this case, you’d want to consider the pricier Explorer Plan, which provides coverage up to $10,000 on trip cancellation.

A search on insurance comparison site Squaremouth revealed a range of plans from other providers priced between $105 and $406 based on a $2,500 trip cost (to compare to the Standard Plan) and between $415 and $1,131 based on a $10,000 trip cost (to compare to the Explorer Plan).

Good read: Venice plunges back into ‘victorious solitude’

The most significant advantage of World Nomads is coverage for adventure activities, which none of the plans listed on Squaremouth offered. In this case, assessing the suitability of the plan has more to do with the type of coverage you’re looking for than price.

SafetyWing

SafetyWing is another popular digital nomad travel insurance option that also offers COVID coverage. You can purchase your policy while you’re abroad, which makes it easy for those who are already traveling and decide to get insurance coverage mid-trip. Unless you are a resident of North Korea, Cuba or Iran, you can purchase a SafetyWing policy. The default length of coverage is 28 days, and the policy will continue to renew unless canceled (maximum policy length is 364 days).

SafetyWing also provides U.S. citizens with incidental coverage in the U.S. for up to 15 days out of every 90 days. Despite the U.S. coverage, SafetyWing is meant to provide medical and travel insurance coverage while you’re abroad; it does not meet the medical insurance requirement under the Affordable Care Act.

Included:

- Trip interruption and delay.

- Emergency medical and dental expenses.

- Emergency medical evacuation, repatriation of remains and accidental death.

- Lost checked luggage and lost visa/travel documents.

- Return of minor children and pets.

- Political evacuation and border entry protection.

Excluded (not a comprehensive list):

- Pre-existing conditions.

- Mental health disorders.

- Intentional acts or damages sustained under the influence of drugs or alcohol.

The cost of a SafetyWing policy is based on your age and whether you’d like coverage while you’re in the U.S. For example, a four-week policy for someone age 30-39 who does not need coverage in the U.S. will cost $40. If you would like coverage while in the U.S., the policy cost jumps to $73.

To compare the price of a four-week SafetyWing policy to those of other insurers, we ran a search on Squaremouth using a four-week trip to Italy by a 32-year-old. We included COVID-19 coverage but excluded trip cancellation from our search. The policies ranged from $12 to $90, and the price variance was attributable to different coverage limits.

Read: Heathrow boss hopeful of London-New York air bridge by Thanksgiving

Overall, the abilities to purchase a plan mid-trip and receive coverage while in the U.S. are some of the main benefits of a SafetyWing policy.

Atlas Travel Insurance

Atlas Travel Insurance offers plans for long-term travelers looking for medical coverage (including for COVID-19) and some supplemental trip benefits (e.g., trip interruption). When selecting a policy, you’ll need to specify if you’d like to include the U.S. within your coverage area. Coverage limits decrease with age, and the plans offer varying levels of deductibles.

Included:

- Medical expenses and emergency dental.

- Emergency medical and political evacuation.

- Trip interruption; travel delay.

- Lost checked luggage and stolen visa/passport.

- Natural disaster and border entry protections.

- Return of minor children and pets.

- Repatriation of remains; accidental death and dismemberment.

Excluded (not a comprehensive list):

- Many adventure sports.

- Pre-existing conditions.

- Mental health disorders.

- Various diseases including cancer.

- Self-inflicted injuries and those arising when under the influence of drugs or alcohol.

To compare these plans, we used the same search as the preceding example (which showed travel insurance plans on Squaremouth ranging from $12 to $90): a four-week trip to Italy by a 32-year-old. We found that Atlas offers two plans: Atlas International and Atlas International Premium, which cost $43 and $105, respectively. The main difference between these two Atlas plans is that the Premium option offers higher coverage limits.

Also read: How safe is it to fly now? Are passengers getting sick?

Although Atlas plans are more expensive than those found on Squaremouth, Atlas plans seem to provide more coverage for medical expenses, which is an important consideration for long-term travelers and expats.

The bottom line

Expats and digital nomads have different travel insurance needs than the average traveler, so choosing a policy that aligns with your travel style is advisable. If you’re looking for adventure sports coverage, a World Nomads policy is your best bet. However, if those benefits aren’t relevant to you and you’d instead prefer to have the option of medical coverage when you’re abroad (and to a certain degree while you’re in the U.S.), consider SafetyWing or Atlas, which offer this feature. Importantly, all of these plans cover COVID-related medical claims, which is an important consideration if you’re already abroad or plan on traveling in the near future.

More from NerdWallet:

Elina Geller is a writer at NerdWallet. Email: [email protected]. Twitter: @elina_geller.