(Bloomberg) — Oil extended declines after closing at the lowest level since mid-October as the deadly coronavirus wreaked havoc on China’s economy and threatened to crimp worldwide energy demand.

The director-general of the World Health Organization is heading to Beijing to assess the country’s response to the virus that has so far killed more than 100 people. Chinese authorities have locked down cities with a combined 40 million people around the outbreak’s epicenter in Wuhan, while global companies including Honda Motor Co. are evacuating workers from the hardest-hit areas.

Oil fell around 9% in the four sessions through Monday as alarm over the virus and its potential to curb travel and economic activity worldwide spooked energy markets. Saudi Arabia, the top oil exporter, said Monday that it’s “closely monitoring” the effect of the outbreak on the crude market, but so far believes the crisis will have “very limited impact” on global demand.

Depending on how the situation in China evolves, West Texas Intermediate could drop to $47 to $50 a barrel, while Brent may fall to $55, said Jeffrey Halley, senior market analyst at OANDA in Singapore. “If people stop going to the mall, if they use less electricity, factories slow down, airliners cut flights and use less fuel, it all slows down economic activity.”

See also: Facebook, Nissan Evacuating, Starbucks Stores Shut: Virus Impact

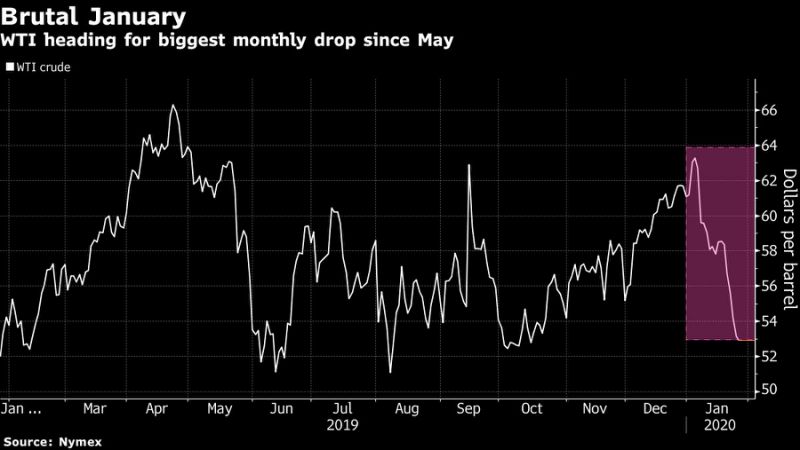

West Texas Intermediate for March delivery fell 0.5% to $52.86 a barrel on the New York Mercantile Exchange as of 11:38 a.m. in Singapore. The contract closed at $53.14 Monday, the lowest since Oct. 15. It’s down around 13% so far in January, set for the biggest monthly decline since May.

Brent for March settlement declined 0.6% to $58.95 a barrel on the London-based ICE Futures Europe exchange after falling 2.3% the day before. The global benchmark crude traded at a $6.09 a barrel premium to WTI.

Rattled by concern about the economic and human impact of China’s deadly coronavirus, global markets from stocks to commodities kept falling on Tuesday. The U.S. said citizens should reconsider travel to China, while Hong Kong announced the temporary closing of all sports and cultural facilities starting Wednesday. Cases of infection have been reported throughout Asia and Australia, as well as in the U.S., France and Canada.

Meanwhile, Libyan oil output could be days from coming to a complete halt as the eastern-based general Khalifa Haftar continues a blockade of the OPEC producer’s ports. The country is currently pumping 262,000 barrels a day and output could fall as low as 72,000 barrels within days, according to National Oil Corp. Chairman Mustafa Sanalla.

–With assistance from James Thornhill.

To contact the reporter on this story: Ann Koh in Singapore at [email protected]

To contact the editors responsible for this story: Serene Cheong at [email protected], Andrew Janes

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”30″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”31″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.