Yahoo Finance entertainment reporter Allie Canal details how Netflix’s ad-tier subscription plan was reportedly the least popular in November, while Disney is reportedly beginning its spin-off process of ESPN and ABC in 2023.

Video Transcript

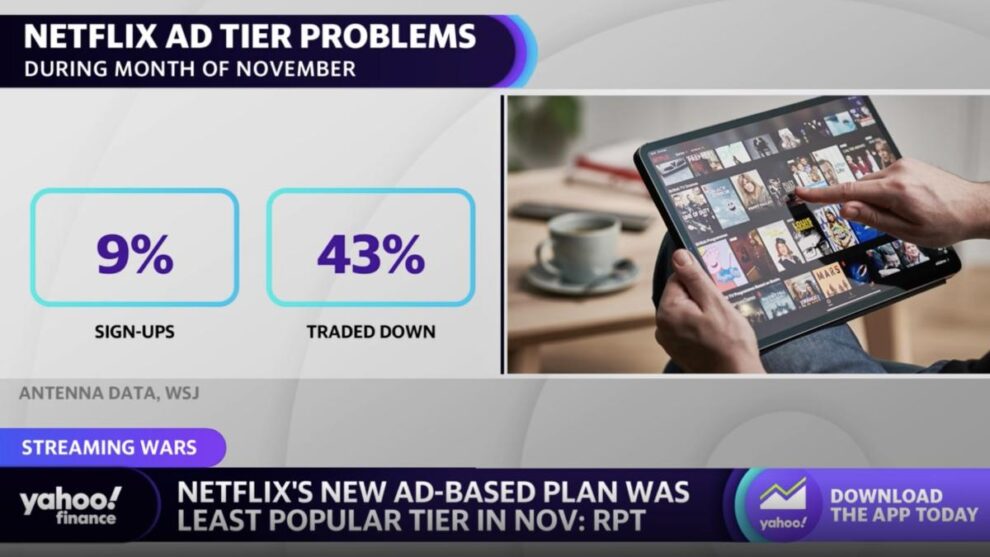

SEANA SMITH: Netflix’s new ad tier appears to be struggling. There’s a new study out saying that the streaming giant’s 6.99 ad plan accounted for just 9% of signups last month. Yahoo Finance’s Alexandra Canal has more on this story. Allie, going into this launch, there was certainly a lot of hype. Maybe this is what Netflix needed to do in order to attract new users. Doesn’t look like that’s happening, or at least, just yet.

ALEXANDRA CANAL: Yeah, not smooth sailing–

DAVE BRIGGS: No.

ALEXANDRA CANAL: –at least from the start, according to these various reports. And that data was from Antenna. It’s a streaming analytics firm cited by the Wall Street Journal. And it noted that the ad tier accounted for just 9% of signups for the month, with 43% trading down to that cheaper plan. Now to compare this to a competitor, we saw HBO Max have stronger results when it launched its own ad supported offering in June 2021. At that time, 15% of new signups were seen in the US during that first month, with just 14% of users trading down.

So if you compare apples to apples there, the Netflix tier is struggling a bit. I did reach out to Netflix for a comment. They said, quote, “there are a number of inaccuracies in this reporting. It’s still very early days for our ad-supported tier, and we’re pleased with its launch and engagement, as well as the eagerness of advertisers to partner with Netflix.”

But let’s talk about that for a second because last week, we saw a report from Digiday, which said the streaming giant fell short on viewership guarantees it made to advertisers for the ad tier and was then allowing ad buyers to take their money back. At the heels of that report, the stock plummeted 9%, the largest intraday drop since April. So this is something that investors are heavily watching.

We spoke with Tim Nollen on the show from Macquarie yesterday. He said that by and large, it’s still early days. This is going to take time. He anticipated incremental revenue will not happen until 2024 or 2025. But if they do fail on this, that’s going to be reflected in the stock price because this was a huge part of Netflix’s growth and recovery story.

DAVE BRIGGS: I don’t see it advertised a lot. I’m curious about that. And maybe people don’t know yet– still the early innings. All right, we want to stay with some media news. A bold prediction from Wells Fargo on the future of ESPN. What is Steven Cahill saying, and why does it matter so much?

ALEXANDRA CANAL: Yes, his 2023 media predictions, and he said this has been a tough year for media. And 2023 will lead to some very tough decisions. And specific to Disney, he said that he anticipates ESPN will spin off, which is a very bold call, very polarizing topic amongst analysts. He wrote, quote, “Disney will begin the spinoff process for ESPN and ABC, including launching ESPN and streaming a la carte. Cost rationalization and balance sheet options are critical to reaching this outcome. The result is a better off remaining Disney.”

Now, Disney has struggled in terms of profitability, particularly with that direct-to-consumer streaming, which includes ESPN+, Hulu, and Disney+. It did lose $4 billion for 2022. However, ESPN has funded a lot of those endeavors. So that’s sort of the flip side of the equation. Some analysts have said, look, how can you get rid of ESPN? This is a really valuable asset to Disney.

But then others have come out and said they could get a pretty big paycheck if they were to spin this off.

DAVE BRIGGS: From who? There seems so few. Apple, Amazon– beyond them, it’s not entirely clear. Cahill very well respected, very plugged in, but most think ESPN is the stickiest thing Disney has for these bundles. All right, Allie, stick around. I want to talk to you about this. As evidenced by the record 16.8 million people that watched the World Cup Final Sunday on Fox, sports viewership has never been bigger.

But could trouble be right around the corner? Perhaps, according to a new study from Morning Consult, which shows that Gen Z watches dramatically less live sports than older generations. In fact, 47% of US adults watch on broadcast or live TV. Just 28% of Gen Z and a full third of Gen Zers don’t watch sports at all. So while these sports media rights are massive and continue to expand, there is some trouble around the corner, which really leans into streaming.

ALEXANDRA CANAL: Yeah, and these industry executives, especially in this space, they want to cater to Gen Z. How do they attract that Gen Z fan base? Also in this study, nearly half of Gen Zers said they have never watched a professional sporting event live, which is crazy to me.

DAVE BRIGGS: Wow.

ALEXANDRA CANAL: But if you think about it, they are growing up in this generation of cord cutters, right? So that barrier to entry is a little tougher than it was when I was growing up. Even for me, I subscribe to YouTube TV. But if I want to watch my Eagles on a Sunday at 1:00 PM, I can if the Giants or the Jets are on. So already, there’s that issue there. So if they’re flocking to those sites like TikTok, YouTube, Snapchat, where you can’t watch a live sporting event, maybe that’s what’s attributing to their lack of interest in it.

SEANA SMITH: Yeah, and I think, just purely, the number of options that they have right now out there, like, I think when a lot of us were growing up, you were more accustomed to maybe watching some of these games. You would sit down with your family. Now there is just a plethora of options out there, just in terms of sitcoms. Anything you want to watch is at your fingertips. So this whole streaming era is very different.

And I also just think that Gen Z doesn’t have maybe the focus to sit there and watch through hours and hours of games. You talk about it all the time. Your son likes to watch RedZone when it comes to NFL. So he’s watching–

DAVE BRIGGS: Bits and pieces, yeah.

SEANA SMITH: So he’s watching the live footage, which a lot of Gen Z isn’t doing. But I think people more want to know what the outcome is, rather than sit down and enjoy the game, which I just don’t really understand.

DAVE BRIGGS: I have a 16-year-old who didn’t watch a single live sporting event until the World Cup this year. They don’t have a whole lot of loyalty to teams either. And that’s not a knock. They just grew up in a different world where teams don’t matter to them. They like content. They consume content, but they won’t sit, to your point, and watch two, three, four hours of one team because they don’t have that loyalty. Big implications.

ALEXANDRA CANAL: I blame the parents for this because I have two young cousins that are very hardcore. And if you have a parent– or so, what about you?

DAVE BRIGGS: I blame the phone.

ALEXANDRA CANAL: You blame the phone, OK.

DAVE BRIGGS: Social media.

ALEXANDRA CANAL: You’re a dad, so I understand.

SEANA SMITH: It’s hard to keep their attention.

DAVE BRIGGS: Social media, it is the TikTok generation. Allie, excellent reporting today. Thank you.