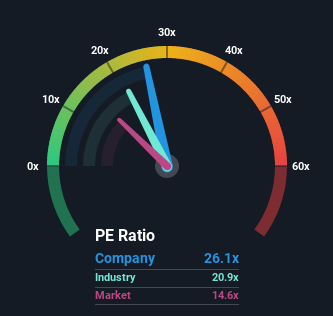

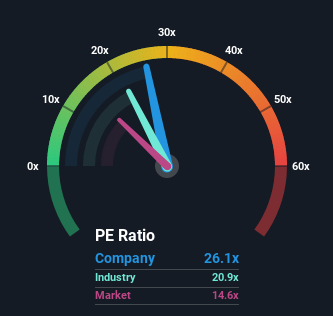

With a price-to-earnings (or “P/E”) ratio of 26.1x Netflix, Inc. (NASDAQ:NFLX) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 14x and even P/E’s lower than 8x are not unusual. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Netflix hasn’t been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You’d really hope so, otherwise you’re paying a pretty hefty price for no particular reason.

View our latest analysis for Netflix

Want the full picture on analyst estimates for the company? Then our free report on Netflix will help you uncover what’s on the horizon.

Is There Enough Growth For Netflix?

The only time you’d be truly comfortable seeing a P/E as steep as Netflix’s is when the company’s growth is on track to outshine the market decidedly.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 251% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the analysts watching the company. That’s shaping up to be similar to the 9.9% per year growth forecast for the broader market.

With this information, we find it interesting that Netflix is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren’t willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We’ve established that Netflix currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren’t likely to support such positive sentiment for long. This places shareholders’ investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company’s balance sheet. Our free balance sheet analysis for Netflix with six simple checks will allow you to discover any risks that could be an issue.

If you’re unsure about the strength of Netflix’s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here