Netflix Inc. is ending the DVD-by-mail business that first made it a household name and took down Blockbuster Video.

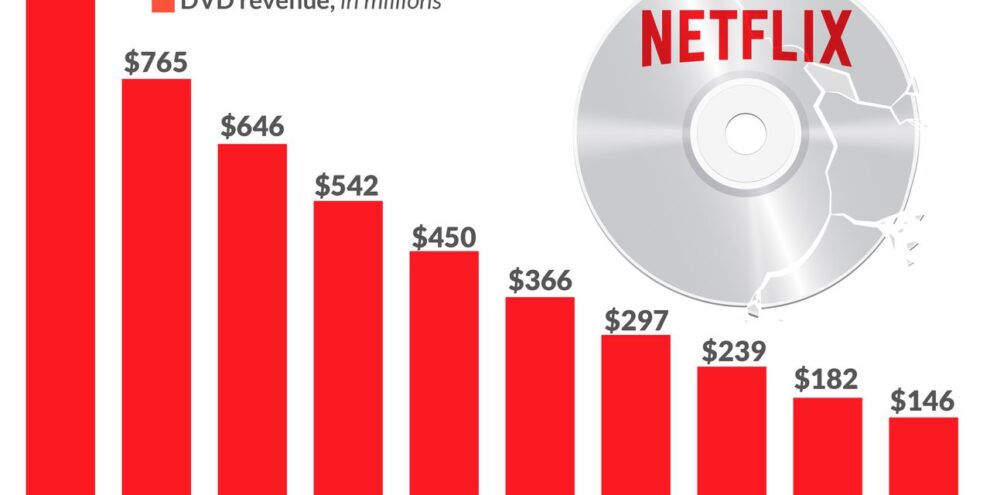

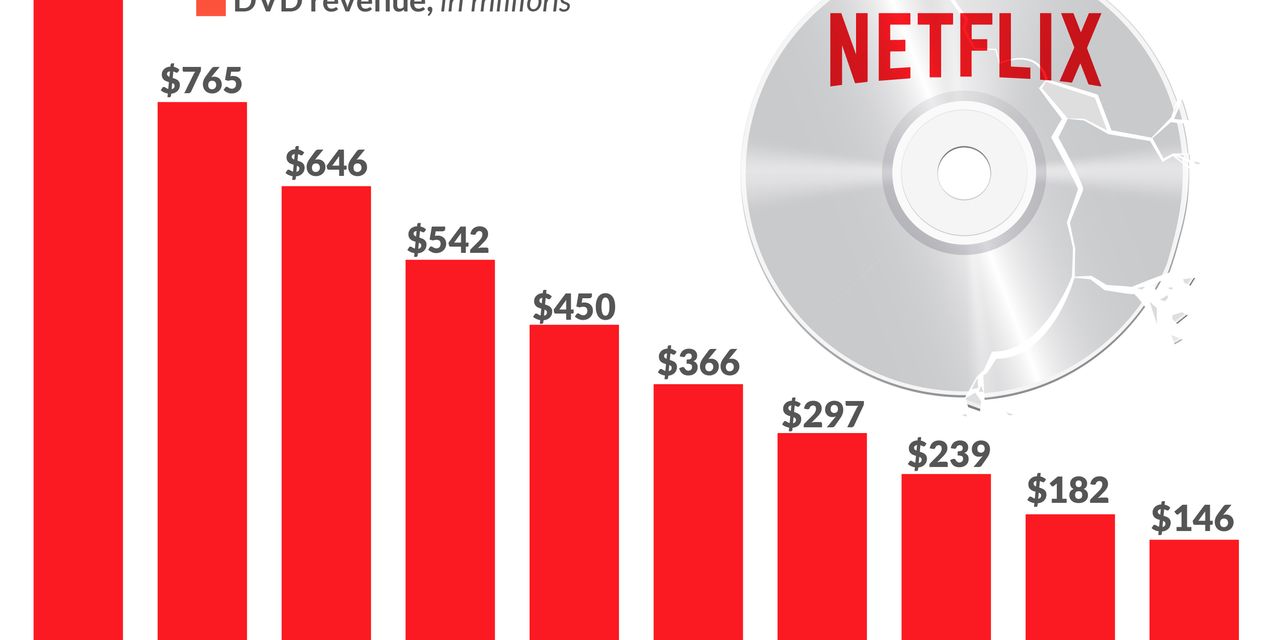

Netflix NFLX, +0.29% executives announced Tuesday afternoon that the company will ship its last red DVD envelopes on Sept. 29, after 25 years. The business has dwindled in the past decade from more than $900 million in revenue in 2013 to less than $150 million last year.

“Our goal has always been to provide the best service for our members, but as the business continues to shrink that’s going to become increasingly difficult,” co-Chief Executive Ted Sarandos said in a blog post titled “Netflix DVD — The Final Season.”

Netflix launched as a DVD-by-mail service in an era that relied on physical media such as the discs to watch television shows and movies at home. The DVD business at the time was dominated by Blockbuster, which relied on brick-and-mortar stores that rented movies for a few days and charged late fees if they were not returned on time.

Netflix offered a different approach, allowing consumers to have a certain number of DVDs mailed to their home and return them at their leisure, which eventually led to the demise of Blockbuster. Eventually, the company began focusing on streaming media directly to consumers, and first offered that service for free to DVD subscribers.

Co-founder and former Chief Executive Reed Hastings — who announced he was stepping down from that position three months ago — decided to pivot from the successful DVD business to focus on streaming, which wasn’t an easy transition. When he announced that Netflix would sever the DVD and streaming businesses in 2011, effectively doubling the monthly price for consumers who wanted both offerings, it became one of the biggest debacles in Netflix history as consumers raged and canceled their subscriptions.

While the process was not easy — remember Qwikster? — Hastings’ vision for streaming services won out, with Netflix collecting roughly $31.5 billion in streaming subscription revenue last year, as the DVD business racked up $146 million. Some of the biggest names in entertainment and tech — Walt Disney Inc. DIS, +0.63%, Apple Inc. AAPL, +0.75%, Warner Bros. Discovery’s WBD, -1.79% HBO, and many more — have followed Netflix’s path, and established streaming as one of the most dominant forms of media consumption.

For more: Netflix has changed drastically since its IPO —and is worth thousands of times more

“Those iconic red envelopes changed the way people watched shows and movies at home — and they paved the way for the shift to streaming,” Sarandos wrote in Tuesday’s announcement.

Netflix stock has also been a winner, despite a decline in late trading following earnings on Tuesday afternoon. Shares have increased more than 1,300% in the past decade, as the S&P 500 index SPX, +0.09% has grown by about 167%.