Netflix Inc. (NASDAQ:NFLX) is up more than 50% over the past year, outpacing rivals in the streaming space, thanks to a mix of originality, strategic alliances and a continuous focus on subscriber acquisition.

The latest earnings confirm the company is not a spent force. Subscribers are up in the last six quarters in a row, bringing its total count to approximately 278 million by mid-2024. A lower-priced ad-supported tier has helped immensely. Netflix has grown its ad inventory and upgraded its ad solutions to become a major player in digital advertising, leading to renewed interest in the pure-play streaming stock.

Along with its redesigned advertising approach, the company’s move into live-streaming sports events is helping drive shares to levels not seen since late 2021.

However, one crucial question remains as the streaming giant expands: Is the stock overpriced? Though the company’s strategic choices have spurred amazing expansion, views on the feasibility of this increase differ. What’s more, from a valuation perspective, shares are trading at a premium, notwithstanding Netflix’s efforts to continue growing.

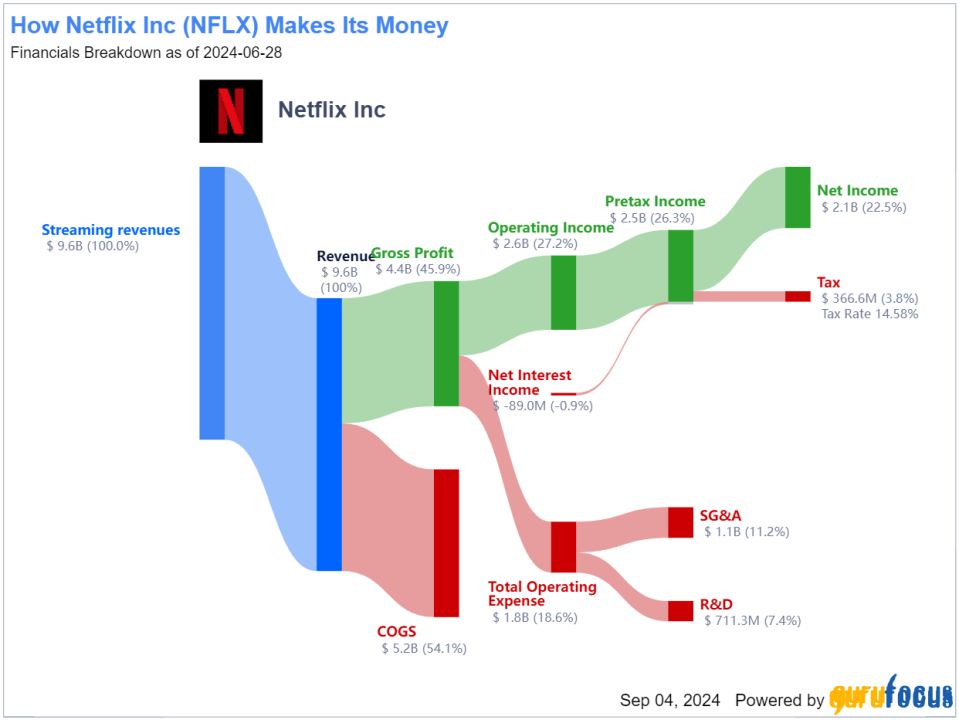

Netflix’s fiscal second-quarter 2024 results are one of the prime reasons the stock is doing well this year. While experts expected $9.53 billion in sales, the company posted $9.56 billion, a 16.4% increase year over year.

Its net income rose 44% to $2.15 billion from $1.49 billion a year ago. Netflix beat the $4.74 expectation with earnings of $4.88 per share. New subscription options, especially the ad-supported tier, drove the high earnings gain.

Worldwide membership rose by 8.05 million to 277.65 million. The year-over-year increase is 16.50%. Netflix’s ad-supported membership grew 34% quarter over quarter.

Among the major publicly listed streamers, Netflix is the only one to regain highs seen during the Covid-19 pandemic thanks to the push to limit account sharing, its cheaper ad-supported tier and expansionary efforts.

As a result, Netflix’s financials stand head and shoulders above its peers. The streaming giant effectively turns revenue into profit with a gross margin of 43.84%, compared to Amazon’s (NASDAQ:AMZN) 18.22% and Disney’s (NYSE:DIS) 35.36%. It has managed costs well in content creation and delivery due to its lean operational structure.

Thanks to a basic business model focusing on content production and distribution, which explains its large profit margin, Netflix can invest heavily in its streaming business. This is in stark contrast to Disney, which must balance its capital-intensive theme parks and television networks, or Amazon, which has numerous low-margin companies.

Netflix’s 32.54% return on equity is outstanding financial management compared to Disney’s 4.80% and Amazon’s 22.08%, which is predictable given Amazon’s extensive operations and Disney’s need to balance media, entertainment and its parks and resorts, lowering margins and returns.

The streaming company also has an 18.78% free cash flow margin, above Amazon’s 12.60% and Disney’s 8.84%. Effective cash flow generation means Netflix can expand into live events, regional content and content development without worrying investors too much.

With current figures and market performance, Netflix is the top pure-play streaming company accessible globally. Still, the primary concern for investors will be if it can continue growing in the future.

Maintaining that kind of growth will be difficult. Underpenetrated areas, including Asia-Pacific, Europe, the Middle East and Africa, might be sources of future development. Deals with businesses like Reliance Jio in India and SK Telecom (NYSE:SKM) in South Korea have helped Netflix to establish large user bases in both countries. Another calculated action is aiming to raise its profile all throughout Europe, particularly in France, by means of the Canal Plus and Netflix partnership. By including the streaming service in the Cine Series bundle, Netflix will gain access to Canal Plus’ subscribers.

Still, progress in these spheres is a double-edged sword. With 44% of its revenue coming from the North American market, Netflix’s future rests especially on this region. Still, this sector is overcrowded as 99% of American households currently have at least one streaming service subscription.

In the end, regions outside of North America may not provide Netflix the same profitability. Reflecting on the popularity of the ad-sponsored tier, for example, average revenue per user declined 1% in EMEA, Latin America and Asia-Pacific; it rose 7% to $17.17 in the U.S. and Canada in the most recent quarter.

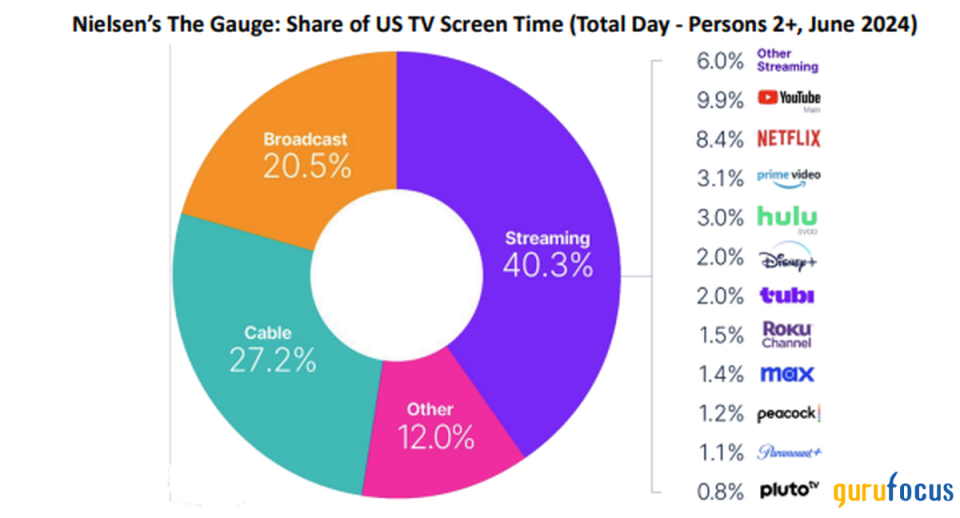

To remain ahead, Netflix also has to keep investing in content. From $12.6 billion in 2023lower owing to the Hollywood strikesNetflix aims to spend $17 billion on content in 2024. According to data from Nielsen’s The Gauge, 40.3% of U.S. TV screen time is streaming as of June. Netflix has 8.40%, but the competition is fierce, particularly from YouTube and Prime Video.

Source: Nielsen’s The Gauge June 2024 Report.

Additionally, Netflix is in the middle of changing its business model, quietly carving out a position for itself in the industry, showing a significant rise in front-of-sale advertising. The company acquired a 150% increase in upfront ad revenue commitments for 2024 compared to 2023. Expanding income from this sector will take time; hence, investors may need to be more receptive to the shift . After Netflix declared it would stop reporting subscriber growth in 2025 and concentrate on operating margin and profitability, its shares fell substantially.

At the same time, Netflix’s transition toward live sports, in the shape of its latest plan to show NFL games and WWE matches, will lead to revenue increases and obstacles. Though intriguing, the company has yet to face logistical and financial challenges in live sports. Live sports broadcasts need abilities that are different from those of on-demand streaming. It must build infrastructure for real-time content delivery, live broadcasts and pricey sports rights agreements.

Its gaming goals are in the same boat. Netflix’s first mobile gaming venture has promise, but growing it into a major revenue generator will take time. Sony (NYSE:SONY), Microsoft (NASDAQ:MSFT) and Nintendo (NTDOY) dominate the competitive gaming industry. Netflix must create compelling games to compete with these giants while improving the user experience by incorporating gaming into its platform.

Netflix has had some success with mobile games, but it remains to be seen whether it can make gaming a major revenue source in an industry dominated by giants. The company’s gaming strategy depends on its ability to provide fresh, engaging content for casual and serious gamers. Spending heavily on game development and acquisition may strain the company’s resources and deflect focus from its streaming business.

Though creative, these decisions show the company’s growing dependence on non-core sectors to maintain development, indicating its streaming method may have limitations. Netflix risks losing focus and spreading its resources in non-core areas. The company must balance these new ventures with its primary business to maintain growth without losing its status. However, these initiatives will determine if Netflix can expand and justify its high share price.

Netflix’s stock trades at a forward price-earnings ratio of 29.30. In comparison, Disney sells at 17.50 times and Amazon at 30.30 times. These lower values imply the market sees these businesses as less risky or more diverse in income sources. Disney, for instance, has a large range of stable industries outside of streaming, including theme parks and retail. Should it fail to provide the expected expansion rate, the stock price may be significantly corrected. Given the uncertainty in the global economy and the competitive scene, investors should ask themselves if they are ready for the risks connected with such a high value.

Using a 15% growth rate over 10 years in my discounted cash flow model for Netflix, I reflected its viewpoint on continuous expansion in worldwide markets and new content categories. I estimated a 4% terminal growth rate, a respectable estimate in line with long-term economic projections. Set at 7.50%, the discount rate matched Netflix’s current market situation with the natural risks in its competitive industry. With an estimated intrinsic value per share of around $443.02, my model suggests the business could be highly overvalued considering the current market conditions.

Further, the GuruFocus DCF model also shows Netflix is overpriced. It forecasts a 20% growth rate over 10 years using a higher discount rate of 10%, then a 4% growth rate in the terminal period. Though still less than the market price, the result was a fair value of $550.56 per share.

Though using distinct approaches and presumptions, both models reveal Netflix’s stock is currently overpriced, pointing to the possibility that the present market value could not be entirely justified by the underlying financial facts, notwithstanding its great growth potential.

Much of the same story persists when you take a look at the average consensus estimates for Netflix. Considering an average 12-month price target of $695.32, the upside is just 2.96%. Based on all this information, value investors will wait for dips before initiating a position in Netflix or adding to their holdings.

Netflix has to actively spend on content if it is to keep expanding and compete in new sectors such as gaming and live sports. While its ventures into these new areas deviate from streaming, consistent advancement will depend on balancing core and non-core sectors.

Since the company is extending its economic model, the real test will be whether it can justify its premium valuation or whether the market will adjust its expectations. The value of Netflix will depend on its capacity to develop and innovate. Should it overcome these obstacles, the business might take the front stage in the streaming market. Still, should it fail, a market meltdown might follow.

This article first appeared on GuruFocus.