Netflix (NasdaqGS:NFLX) is currently experiencing a period of significant growth and strategic innovation, highlighted by a 67.1% increase in earnings over the past year. However, the company faces challenges such as rising costs and intense competition in the entertainment sector. In the discussion that follows, we will explore Netflix’s financial performance, strategic initiatives, potential growth opportunities, and the risks that could impact its future success.

Click here to discover the nuances of Netflix with our detailed analytical report.

Innovative Factors Supporting Netflix

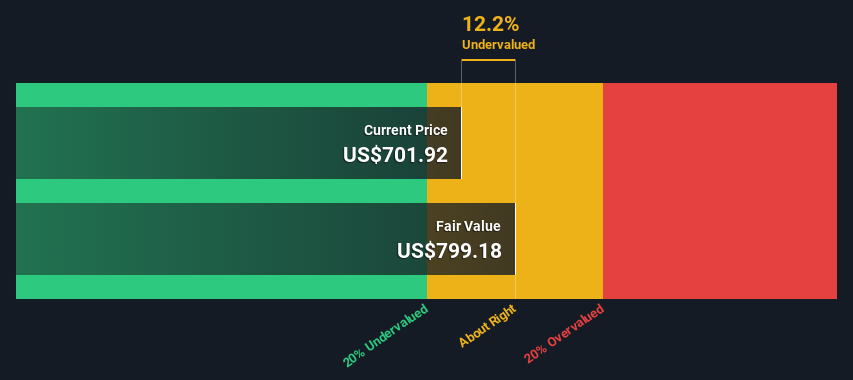

Netflix has demonstrated strong financial health, with a significant focus on revenue and profit growth. The company reported a 67.1% increase in earnings over the past year, significantly outpacing the Entertainment industry’s 3.8% growth. This performance is reflected in its high-quality earnings and improved net profit margins, now at 19.5% compared to 13.2% last year. The management team, with an average tenure of 4.5 years, and a seasoned board of directors, averaging 11.2 years, contribute to strategic stability and execution. Furthermore, Netflix’s strategic alliances, such as the partnership with Kingsmen Xperience to bring “Squid Game” to life, enhance its market position. Despite trading below its estimated fair value of $799.18, Netflix’s Price-To-Earnings Ratio of 42.5x remains favorable compared to peers but is higher than the industry average.

Strategic Gaps That Could Affect Netflix

While Netflix’s valuation is favorable compared to peers, it is considered expensive relative to the US Entertainment industry average. The company faces challenges in managing costs, with expenses up 7% year-to-date, projected to exceed $28 billion for the year. Ad revenue growth is also slower than anticipated, stemming from a relatively small base. Additionally, Netflix’s debt-to-equity ratio of 63.2% highlights its reliance on higher-risk external borrowing. These factors, coupled with the absence of a dividend yield, may impact investor sentiment.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound for Netflix, particularly in expanding its footprint in India and enhancing its advertising capabilities. The company’s revenue is forecast to grow at 10% annually, outpacing the US market’s 8.8% growth. Strategic initiatives, like integrating generative AI to improve recommendations, and gaming ventures, are poised to drive engagement and revenue. Netflix’s recent production partnership with Pritish Nandy Communications for “The Royals” exemplifies its commitment to captivating global audiences, further solidifying its competitive advantage.

Key Risks and Challenges That Could Impact Netflix’s Success

Netflix faces intense competition in the entertainment sector, vying for viewer attention against numerous rivals. Economic factors and regulatory risks present additional challenges, with advertisers demanding more features. The company’s strategic focus on content spending, as highlighted by Co-CEO Ted Sarandos, underscores the need to outpace competitors in programming quality. These external pressures, coupled with potential churn from paid sharing, pose significant threats to Netflix’s market share and growth trajectory.

To gain deeper insights into Netflix’s historical performance, explore our detailed analysis of past performance.To dive deeper into how Netflix’s valuation metrics are shaping its market position, check out our detailed analysis of Netflix’s Valuation.

Conclusion

Netflix’s impressive financial performance, marked by a 67.1% increase in earnings and improved net profit margins, underscores its ability to outpace industry growth, reflecting strategic stability from its experienced management and board. However, the company’s high Price-To-Earnings Ratio of 42.5x, although more favorable than peers, suggests a premium relative to the broader US Entertainment industry, potentially impacting investor sentiment. Strategic initiatives in international expansion and technology integration present significant growth opportunities, yet rising costs and competitive pressures could challenge Netflix’s market share and profitability. Trading below its estimated fair value of $799.18, Netflix’s current market position suggests potential for appreciation, contingent on effectively navigating its strategic gaps and leveraging its competitive strengths.

Seize The Opportunity

Is Netflix part of your asset mix? Tap into the analytical power of Simply Wall St’s portfolio to get a 360-degree view on how they’re shaping up. Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.