(Bloomberg) — Netflix Inc. shares are on course to lose about $40 billion in value Wednesday after the streaming giant reported its first customer decline in more than a decade.

Most Read from Bloomberg

Shares in the company fell as much as 26% premarket trading, extending its plunge this year to 57%. If the losses hold, Netflix is poised to become the worst-performing stock this year in both the benchmark S&P 500 and tech-heavy Nasdaq 100 indexes.

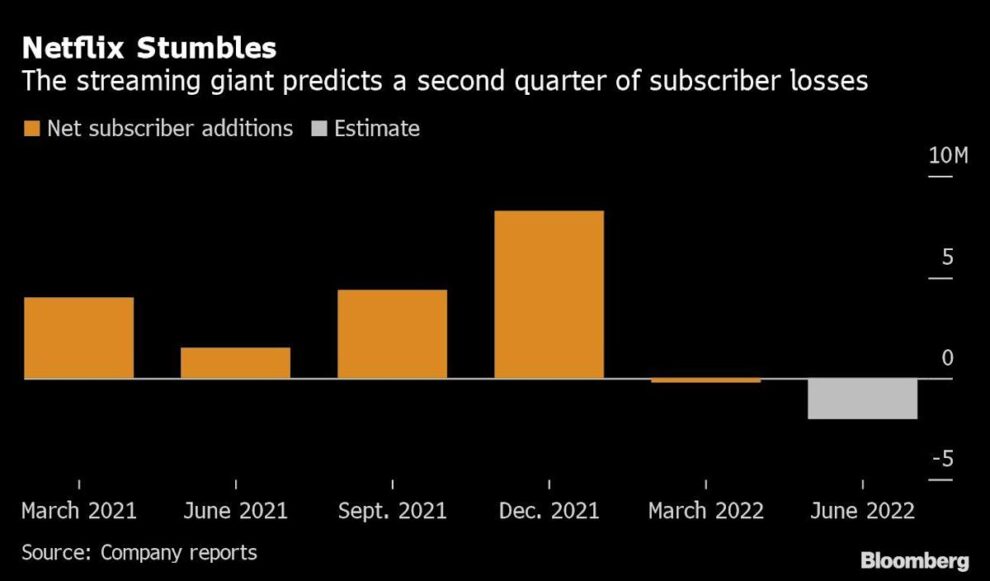

The streaming service shocked Wall Street by losing 200,000 customers in the first quarter, the first time it has shed subscribers since 2011. It also projected it will shrink by another 2 million customers in the second quarter.

“A big problem with Netflix is that it’s too easy to leave the service,” said Russ Mould, investment director at AJ Bell. Consumers feeling the pinch from inflation will be looking hard at their expenses and streaming services are a quick way to save money.

Netflix’s stock has suffered this year as the pandemic-era surge in user sign-ups faded and investors turned impatient due to rising bond yields. In comparison, the S&P 500 is down 6.4%, while the Nasdaq 100 has declined almost 13%.

Fellow stay-at-home stocks, including Etsy Inc., Zoom Video Communications Inc. and DocuSign Inc. have also been hit by deep losses, down by 33% to 47% in 2022, as these businesses struggle to leverage the inroads they made during lockdowns.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.