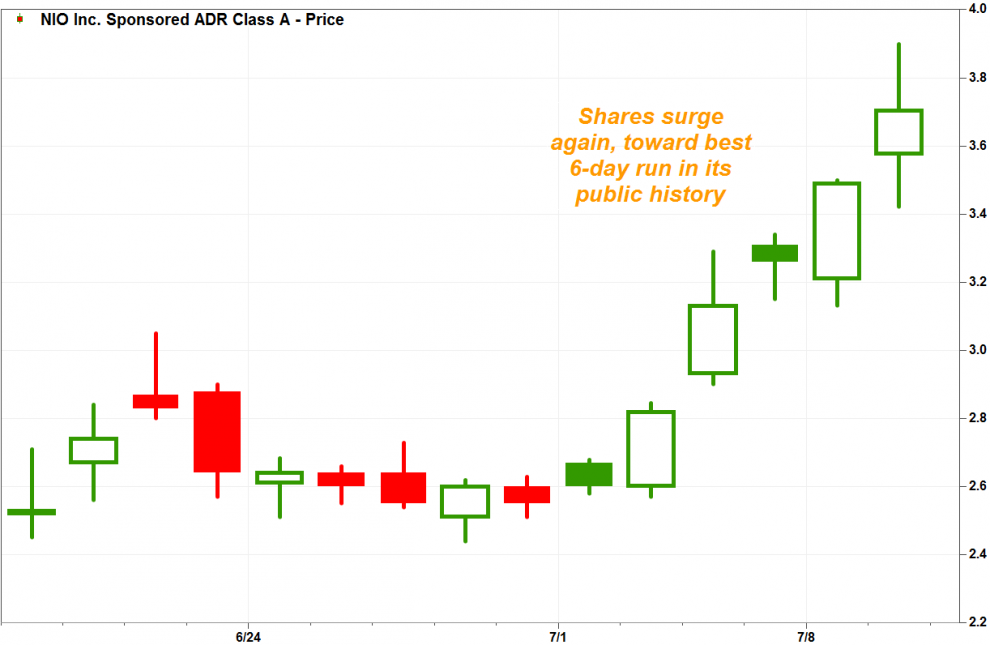

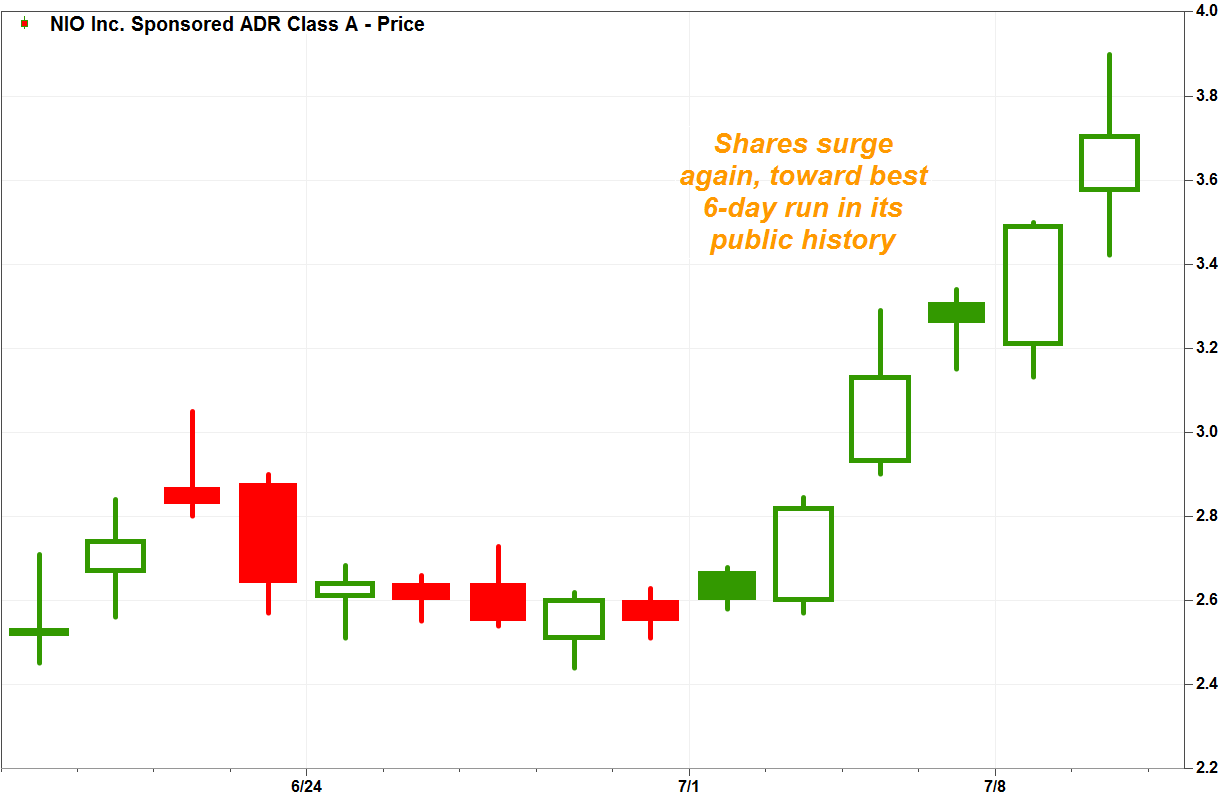

Shares of Nio Inc. surged in active trading Tuesday as the China-based electric car maker sped toward its biggest six-day rally since going public.

The stock NIO, +5.73% shot up 5.7% to a sixth-straight gain, and the highest close since May 28. Volume swelled to over 87.4 million shares, enough to make the stock the most actively traded on major U.S. exchanges, and more than double the full-day average of 38.8 million shares.

The stock has now rocketed 44.7% during its win streak, which is the biggest six-day gain since Nio went public on Sept. 12, 2018.

The company did not immediately respond to a request for information and comment.

Nio’s share gains come as data out overnight showed that June retail sales of passenger cars in China rose 4.9% from a year ago, the first increase in 13 months, according to a report in The Wall Street Journal, citing the China Passenger Car Association.

The rally also comes in the wake of upbeat deliveries data from electric car maker Tesla Inc. TSLA, -0.12% last week, with Nio often called the Tesla of China.

In Nio’s last vehicle delivery report, released June 4, the company said it delivered 1,089 ES8 vehicles in May, down from 1,124 deliveries in April. Chief Executive William Li said at the time that he expected full second-quarter deliveries to be “near the top of, or to exceed” its previous guidance range of 2,800 to 3,200 deliveries.

Analyst Robert Cowell at 86Research said Nio’s second production vehicle, the ES6, which began delivery in June, has been receiving largely favorable press and reviews.

FactSet, MarketWatch

FactSet, MarketWatch

The last time Nio’s stock fell was on June 28, when it slumped 1.9% after the company disclosed that it was recalling 4,803 vehicles following some “battery safety incidents” that occurred in Shanghai and other locations in China. The recall, of vehicles produced between April 2 and Oct. 19 of last year will be to replace battery packs, which under “extreme cases” could short circuit, and created a safety issue.

Despite the recent rally, the stock was still down 27.1% over the past three months. The stock has underperformed shares of rival Tesla, which have lost 15.6% the past three months, as well as the iShares MSCI China exchange-traded fund MCHI, -0.25% , which has declined 9.3%. In comparison, the S&P 500 index SPX, +0.12% has gained 3.4% over the same time.

Since Nio shares closed its first day trading on the NYSE at $6.60, which was 5.4% above its $6.26 initial public offering price, the stock has lost 43.8%.

Over the same time, Tesla shares have shed 20.9% and the S&P 500 has advanced 3.0%.