Bloomberg News/Landov

Bloomberg News/Landov How fragile are American consumers?

Despite all odds, some economists think it’s time to stop fretting about consumers. In the face of conditions that have pundits wringing their hands, Americans remain resilient.

In August, amid a stock-market SPX, +0.00% sell-off and worsening trade tensions between the U.S. and China, the well-regarded University of Michigan consumer sentiment survey saw its biggest monthly decline since 2012, when the “fiscal cliff” of higher taxes and lower government spending occupied headlines for weeks.

“The recent decline is due to negative references to tariffs, which were spontaneously mentioned by one-in-three consumers,” wrote Richard Curtin, the survey’s director.

“Unlike concerns about the fiscal cliff, which were promptly resolved, Trump’s tariff policies have been subject to repeated reversals amid threats of higher future tariffs,” Curtin added. “Such tactics may have some merit in negotiations with China, but they act to increase uncertainty and diminish consumer spending at home. Unlike the repeated tariff reversals, negative trends in consumer sentiment cannot be easily reversed.”

You wouldn’t know it now. Barely four months later, the 2019 holiday shopping season looks to have set a fresh record. And it’s not just Baby Yodas and backpacks: Americans are out in force applying for mortgages and viewing homes — hardly the kind of purchase you make if your confidence is “diminished.” And that’s even as the stock market gyrated through the early fall, trade tensions remained high, and Donald Trump became only the third president in American history to be impeached. So what gives?

“The winds have shifted in favor of the consumer when you have an economy at full employment,” said Jim Glassman, head economist for JPMorgan Chase Commercial Banking.

“I think the political uncertainty story is overplayed,” said Neil Dutta, head of economics for Renaissance Macro Research.

There may be good reason to fear an economic slowdown if trade tensions remain high, Dutta noted. Not knowing what policies and regulations are going to be, how much tariffs are going to cost, or where supply chains are going to be disrupted, has caused businesses to slow their capital spending dramatically.

See: Third-quarter GDP left at 2.1% — stronger consumer spending offset by weaker business investment

At some point, a steep enough slowdown could cause layoffs, but Dutta has a somewhat cynical view about why that may not happen. “Politicians” are causing the uncertain conditions, he noted. “And if you start firing people, you push (politicians) closer to a deal. If people get fired, you get a deal, tariffs go away, and you don’t have the people you need to meet demand, which is pretty solid otherwise.”

For now, Consumers respond to “employment, gasoline prices, and the value of assets,” Dutta said.

Employment growth has slowed, but economists almost universally agree that’s to be expected, not necessarily something to worry about. What’s less universal is agreement on whether we’re actually at full employment, as JPMorgan’s Glassman believes, or still have some capacity to add people to the payrolls, up wages, increase the number of hours worked, or some combination of those.

Also less certain: the impact of wobbly markets. “The typical American consumer knows stock price volatility can presage an economic slowdown,” wrote Nicholas Colas, Co-founder of DataTrek Research, in September.

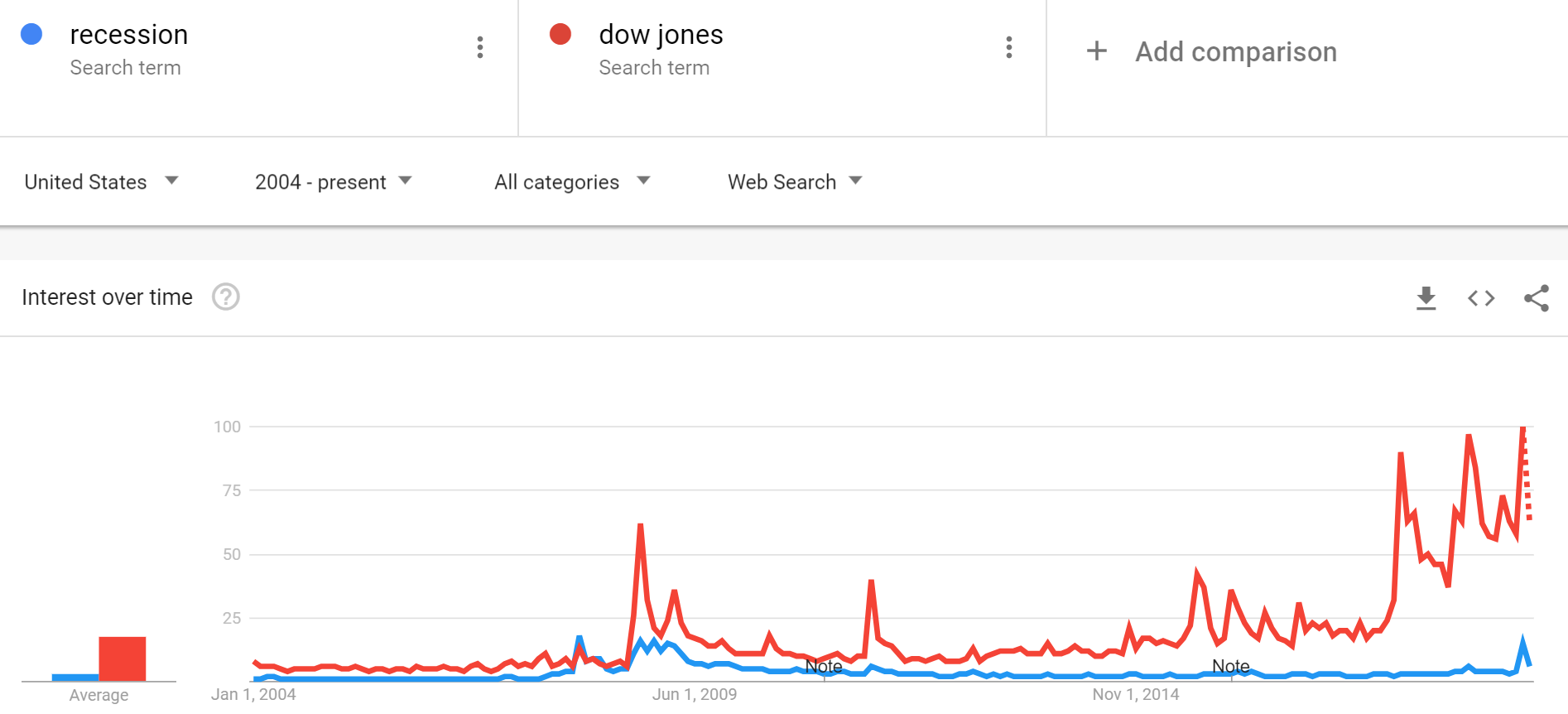

“When they see U.S. equity markets take a drop, they google ‘dow jones’ to learn more,” Colas added.

“Stock market volatility generates far more Google search interest than ‘recession,’” Colas wrote, pointing to how the October 2008 equity market meltdown saw four times the number of “dow jones” DJIA, +0.08% searches relative to “recession.”

The search ratio was 7:1 during the month of August 2019, when the University of Michigan’s consumer confidence index dropped to its lowest level since October 2016, just ahead of the U.S. presidential election, according to DataTrek.

Colas also noted that a lot would hinge on equity markets keeping calm over the often volatile year-end period, which could dampen U.S. consumer confidence. “The Google Trend data shows ever-higher levels of concern whenever stock markets swoon. So far, that has not bled over to consumer spending most likely because markets have consistently recovered. That works, of course, until it doesn’t.”

But for now, it IS working. And Dutta thinks the inverse of DataTrek’s thesis is also true. When Americans hear on the news that stock markets are at all-time highs, he said, it’s a “signaling mechanism” that times are good. “That sentiment is going to affect everything.”

See: It’s green shoots for the housing market, home builders say

So why are we so focused on every little wiggle in consumer behavior, from sentiment to sales?

“We are afraid of our own shadow” in the wake of the last downturn, Glassman said. It wasn’t just that the long recession was so difficult — though it was — but also that it was precipitated, in his words, by a “financial debacle.”

The pundit class might do well to stop fretting and make peace with the new normal of low, slow growth, in an economic cycle that may well be longer than normal, precisely because the downturn was so severe, he told MarketWatch.

What could change?

Believe it or not, “the trade war is still a risk,” said Peter Berezin, chief global strategist for BCA Research. “It’s just a cease-fire. We haven’t established anything permanent yet.”

The coming U.S. presidential election could pose some challenges for markets, if not the economy, if a Democratic candidate like Bernie Sanders were to grab the nomination, Berezin said. But Neil Dutta is quick to point out that such considerations rarely trickle through to consumers. “Consumption is as strong in election years as off-years,” he told MarketWatch.

For now, with consumers powering about two-thirds of the American economy, it’s “still the right time to be bullish on global equities,” Berezin said. He does expect stocks from countries outside the U.S. to perform better in the coming year, but that’s because valuations are lower.

On Friday, U.S. stocks extended their record-setting rally, with the major indexes edged closer to their best annual performance in two decades. Yields on haven U.S. Treasurys dipped, with the rate on the 2-year Treasury slumping to its lowest level in three weeks.

In commodities, gold prices settled Friday near a three month high, bolstered by investor caution about how far the record rally for stocks can extend into 2020, while oil prices also edged higher to a near three-month peak.

The coming shortened holiday week will bring more insights into the state of the U.S. economy, with the final Chicago Purchasing Manager Index, or PMI, of the year released on Monday, as well as November’s home-contract signings data.

Tuesday brings December’s consumer confidence index report and the Case-Shiller home price index for October.

Related: No slowdown in sight: Investors are swapping defensive stocks for cyclicals

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>