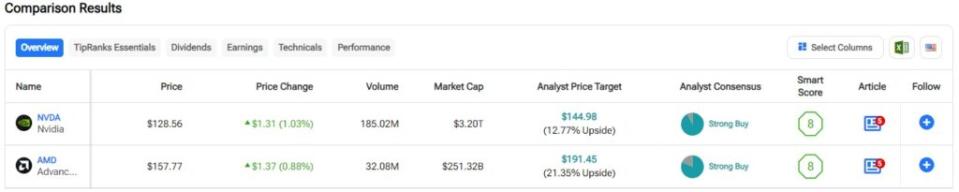

In this piece, I evaluated two semiconductor stocks: Nvidia (NVDA) and Advanced Micro Devices (AMD). A closer look suggests a long-term bullish view of Nvidia and a neutral view of AMD.

While both companies make semiconductors, Nvidia focuses on artificial intelligence, gaming, cryptocurrency, electric vehicles, robotics, and other uses. AMD is also trying to get into the AI game but also targets servers, gaming, the embedded-chip market, healthcare, laptops, and desktop computers.

Shares of Nvidia have soared 149% year-to-date and 162% over the past year. Meanwhile, AMD stock is up 3% year-to-date and 38% over the last year.

With Nvidia up so much year-to-date and AMD climbing so little, it may be a bit surprising that NVDA’s valuation is a fraction of AMD’s. We compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

For comparison, the semiconductor industry is trading at a P/E of 63.3x, versus the three-year average of 36.3x.

Nvidia

At a P/E of 75.2x, Nvidia is trading at a premium to its industry, but it’s well deserved due to the massive growth the company has been putting up. The forward P/E of 42.5x looks even more attractive, calling for a long-term bullish view on Nvidia.

There’s no doubt that Nvidia is way ahead of AMD in AI, and its current multiples and long-term share-price growth just make it too cheap to ignore. The company’s stock has been trading towards the middle to low end of its normalized P/E range of 37x to 107x since November 2019, which excludes the spike between March and September 2023.

Nvidia’s five-year stock return of 3,080% and a 10-year return of nearly 26,800% also make this stock one to buy and hold for the long term.

One word of caution for investors: Nvidia’s Q2 earnings report is coming up next week, and if it disappoints, it could kick off some volatility in the shares. However, it would present a nice buy-the-dip opportunity to add to a position or establish a new one.

In the last quarter, Nvidia reported explosive year-over-year growth of over 260% in revenue and 628% in net income, so the bar is set quite high. However, if the stock skyrockets after the Q2 earnings report, investors may miss the boat on this stock — until the next dip, anyway.

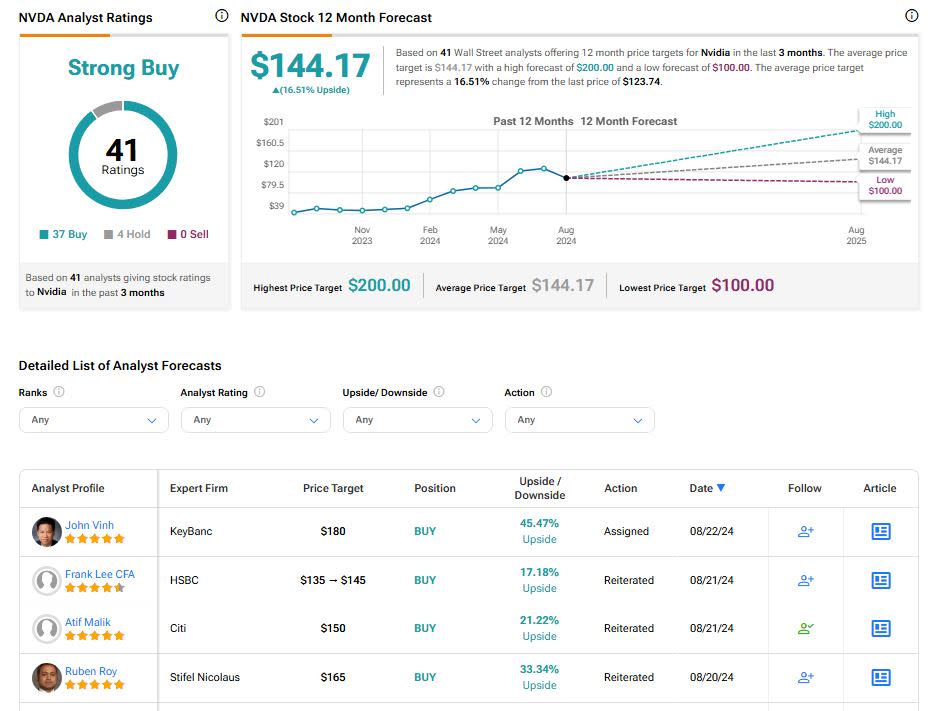

What Is the Price Target for NVDA Stock?

Nvidia has a Strong Buy consensus rating based on 37 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $144.17, the average NVDA stock price target implies upside potential of 16.51%.

Advanced Micro Devices

At a P/E of 189.9x, Advanced Micro Devices is trading at a sizable premium to its industry and Nvidia, even though it has fallen behind in AI. While the company is catching up, growing concerns suggest it might be too little, too late. AMD’s forward P/E of 35.9x is attractive, but there’s no guarantee the company will put up the results required to achieve that. Thus, a neutral view seems appropriate until we see some actual results on this front.

First, AMD reported a mere 9% year-over-year growth rate in revenue for its latest quarter, which is minuscule compared to Nvidia’s growth. Net income exploded by 881% but remained tiny at $265 million, despite the multi-billion-dollar sales.

Although AMD reported record growth in its Data Center segment and accelerating AI sales, these gains have yet to positively impact the bottom line. The company launched new AI chips in June, making next quarter’s results crucial. However, I’d like to see more concrete outcomes before taking a more positive stance on this stock.

A key concern is the growing discussion about the potential for AI investments to take years before generating a return on invested capital. If this narrative continues to pick up, AMD may end up being too late to the party. For instance, Goldman Sachs recently reported that tech giants are expected to spend over $1 trillion on AI capital expenditures in the coming years.

While that could benefit AMD in the near term if it turns out to be true, experts like Daron Acemoglu from the Massachusetts Institute of Technology (MIT) and Jim Covello from Goldman Sachs are skeptical about whether all those invested dollars will pay off.

Additionally, AMD’s focus on data centers could be problematic, as highlighted by a recent Ernst & Young (EY) AI Pulse survey. The survey showed that while executives are pouring money into AI, they’re not investing in the necessary infrastructure to support it—precisely what AMD is currently offering.

Although some Goldman Sachs analysts are more optimistic about the potential returns from AI investments, there could still be concerns for AMD stock if it arrives too late to capitalize on the trend. However, there is likely room for two major AI players in the semiconductor industry, so AMD isn’t necessarily doomed in the long run. The stock just appears to be overpriced at its current valuation.

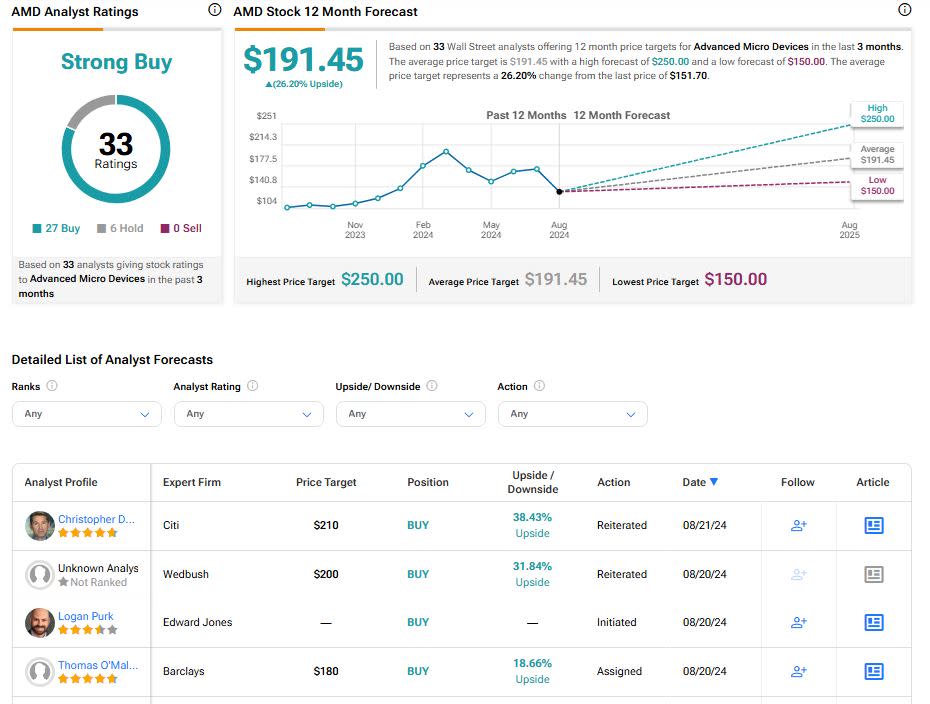

What Is the Price Target for AMD Stock?

Advanced Micro Devices has a Strong Buy consensus rating based on 27 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $191.45, the average AMD stock price target implies upside potential of 26.20%.

Conclusion: Bullish on NVDA, Neutral on AMD

Nvidia and Advanced Micro Devices have been facing off in the semiconductor space for many years, with one surging ahead of the other at different times. This time, it’s Nvidia’s time to shine, but its valuation isn’t necessarily full at current levels. On the other hand, I would take a wait-and-see approach with AMD to see how its AI chips perform compared to Nvidia’s.