Chip stocks Nvidia (NVDA), Taiwan Semiconductor Manufacturing (TSM), and ASML (ASML) have all soared this year thanks to investor bets on the artificial intelligence boom. On Wednesday, their momentum came to a screeching halt.

The three stocks slid for reasons ranging from investor concern over export restrictions to a broader rotation out of tech stocks.

One headwind that emerged was the potential for tighter restrictions on exports of semiconductor technology to China.

Bloomberg reported the Biden administration is considering implementing a more severe curb involving controls on foreign-manufactured products that use even the smallest amount of American technology.

Current restrictions have already impacted US-based companies’ ability to sell to China. Nvidia sales to China decreased as a percentage of total data center revenue from 19% in fiscal year 2023 to 14% in fiscal year 2024.

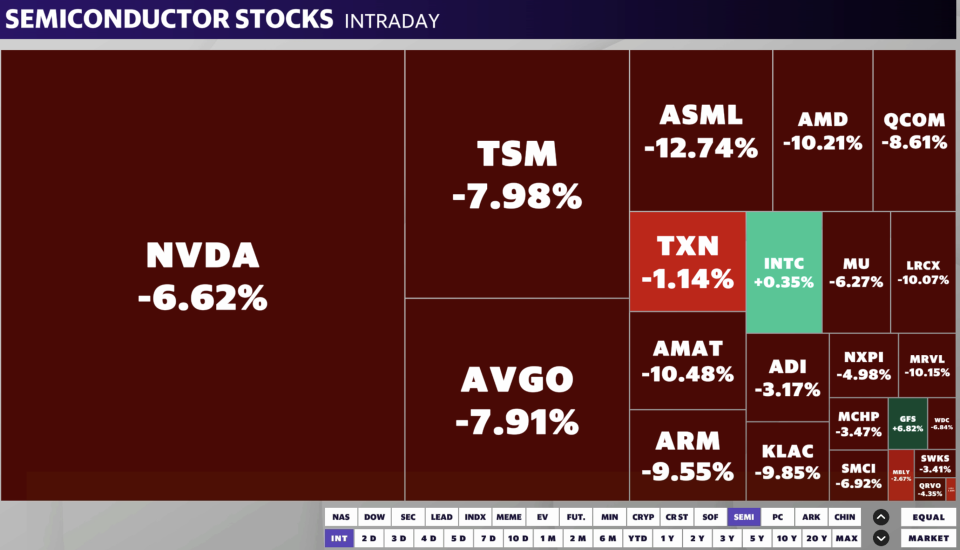

ASML stock saw the steepest decline on Wednesday, falling more than 12%. Shares of the Netherlands-based chip equipment maker were also pressured following its third quarter guidance.

While ASML beat its second quarter top- and bottom-line expectations, its revenue forecast for the current quarter came in shy of the consensus analyst estimate.

The company also said it expects quarterly gross margin in the range of 50% to 51% versus Wall Street expectations of 51.1%.

Also dragging down chip stocks were comments from former president Donald Trump, who said Taiwan “should pay” the US for protection against any aggression from China.

“You know, we’re no different than an insurance company. Taiwan doesn’t give us anything,” Trump told Bloomberg Businessweek in an interview published on Tuesday.

He also said Taiwan took “about 100%” of the US chip business.

Trump’s comments sent shares of chip manufacturing and design giant TSMC plummeting more than 7% on Wednesday.

Many chipmakers, including Nvidia, depend on Taiwan for manufacturing. The island located east of China is a major semiconductor hub with roughly 92% of the world’s most advanced chipmaking capacity, according to the US International Trade Commission.

It’s worth noting shares of semiconductor companies Intel (INTC) and GlobalFoundries (GFS) were up during the session. Both companies are seen beneficiaries of the Biden administration’s push to onshore chip production to the US.

The semis sell-off comes as investors have recently rotated out of big-cap names into small-cap stocks.

The rotation out technology began last week after the latest inflation print gave investors more optimism that the Federal Reserve would start cutting rates in September.

The Russell 2000 (^RUT) outperformed large-cap stocks on the Nasdaq 100 (^NDX) over a five-session streak.

On Wednesday the small-cap index fell roughly 1% while the tech-heavy Nasdaq 100 dropped almost 3%.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance