Nvidia is a big fan of this high-growth AI company.

Earlier this year, Nvidia (NVDA -0.18%) revealed that it invested capital in several promising artificial intelligence (AI) companies. Management clearly believed the investments would pay off, but it also positioned the company as a direct enabler of its end markets.

After all, Nvidia isn’t an AI company itself. Rather, it supplies the AI industry with critical components like graphics processing units, or GPUs. By investing in the overall growth of AI, Nvidia can not only book a potential investment profit, but also spur long-term demand for its own products.

No matter how excited Nvidia management was about its capital allocation decisions, few likely predicted what would happen with one of the investments. Following Nvidia’s $3.7 million investment in February, SoundHound AI (SOUN -1.07%) saw its valuation soar by 165%. And there could be even more upside to go.

Nvidia has already made millions on this small AI stock

Within weeks after Nvidia disclosed its investment in SoundHound, the two companies revealed a partnership that will see their respective products packaged together, including an in-vehicle voice assistant that “uses a large language model (LLM) completely on the edge while running on the Nvidia Drive platform,” SoundHound announced in May.

In a nutshell, vehicles that run Nvidia’s Drive platform will be able to tap into SoundHound’s voice recognition platform to provide the driver and passengers with AI capabilities even without an internet connection. The use cases are exciting. You can pull up a song playlist from your favorite streaming provider, ask about the news or current events, or even chat with your car about its maintenance history and potential repair needs in the future. With SoundHound, you car essentially becomes an AI agent, able to converse and consider almost anything you throw at it — with everything running locally, no connection needed.

SoundHound has acquired a reputation for services like this. All, unsurprisingly, deal with the intersection of AI and sound.

Several fast-food restaurants are testing its products for drive-thru windows — a clever way to potentially increase order efficiencies and reduce operating costs. Tech companies have integrated its software into their applications, allowing users to better interact with their services through natural voice commands. And a host of other businesses — from Block to Oracle — are already using SoundHound to operate their customer service lines.

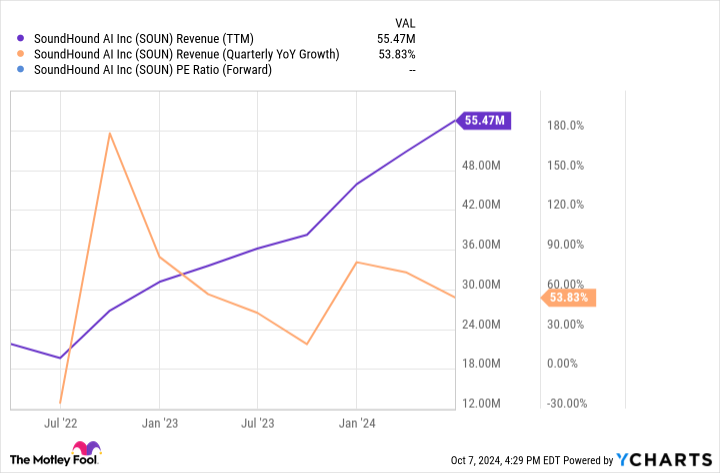

There’s no doubt that Nvidia’s investment spurred a spike in SoundHound’s valuation. It’s a strong vote of confidence, and a promising sign that SoundHound will continue to be able to source the critical components necessary to operate and improve its technology. Wall Street analysts expect the company to grow sales by roughly 84% over the next year, from $83 million to more than $150 million.

SOUN Revenue (TTM) data by YCharts

Should you buy shares of SoundHound today?

There’s a lot to like about SoundHound. It operates in the AI space — arguably the biggest growth opportunity in a generation — and has the backing of major industry suppliers like Nvidia, who put their money where their mouth is. But should you join Nvidia and buy SoundHound shares for your portfolio?

According to data from Grand View Research, the voice AI market is projected to grow by nearly 30% annually from 2024 to 2030. Thus far, SoundHound has actually been able to outpace those growth estimates. But now trading at 23 times sales, these high growth rates have arguably already been priced into the stock. That’s especially true considering the company will face mounting competitive pressures from global tech giants, nearly all of which are investing billions into their own voice AI platforms. For comparison, SoundHound’s total research and development budget is only around $56 million.

SoundHound is off to a promising start, but Nvidia’s investment put it on the map for many growth investors. If it can fend off rising competition, an investment case could be made for this exciting AI company.

But the steep valuation should cause most investors to look elsewhere. Only if you are a huge fan of SoundHound’s specific technologies, and are willing to remain invested through years of potential volatility, should you initiate a position alongside Nvidia.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Block, Nvidia, and Oracle. The Motley Fool has a disclosure policy.