Nvidia Corp. Chief Executive Jensen Huang spoke at length to the public about his company’s plans Tuesday for the first time since dropping his pursuit of chip designer Arm Ltd., including the introduction of the next generation of its core product.

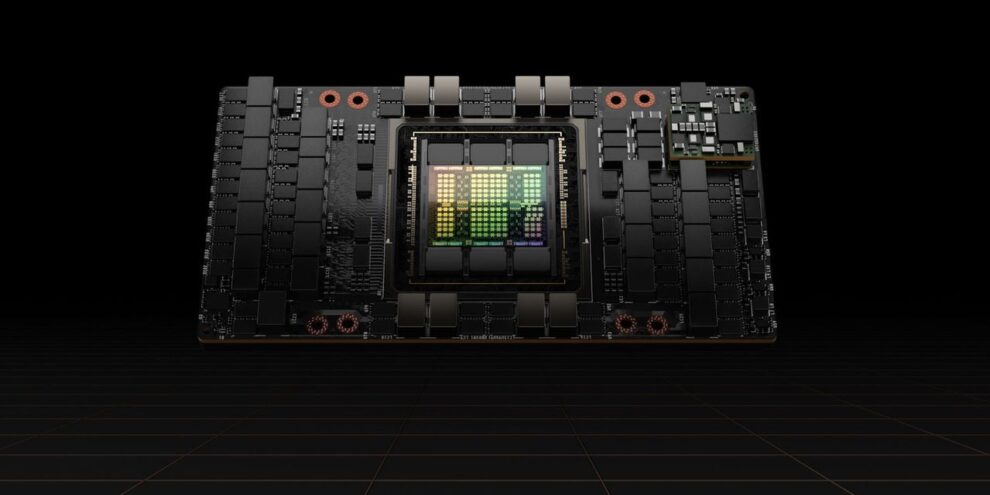

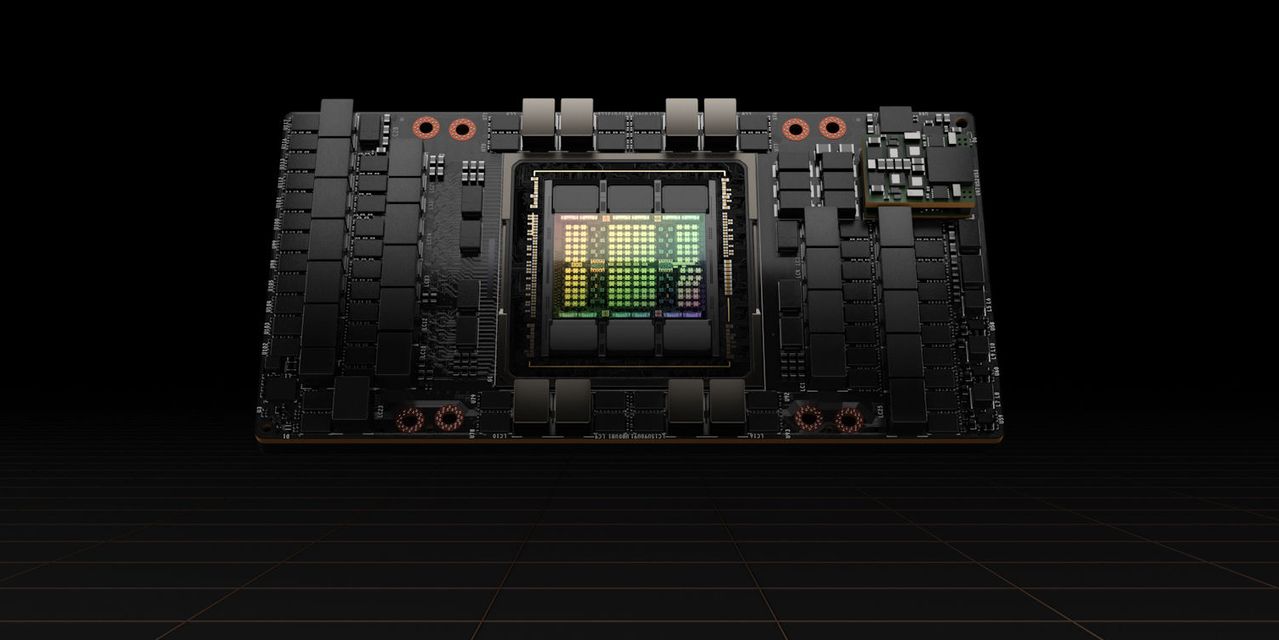

In the keynote address for Nvidia’s NVDA, -0.79% annual developer conference — the GPU Technology Conference, or GTC — Huang introduced Hopper, a new line of graphics processing units that will eventually replace Ampere, the current architecture that was originally announced at the event in 2020. As has been the company’s practice in recent years, the new architecture based on four-nanometer technology developed by Taiwan Semiconductor Manufacturing Co. Ltd. 2330, +1.20% will first land in configurations meant for servers before trickling down into other formats later, with the first chip for supercomputers and other high-intensity workloads called the H100.

“The engine of the world’s AI computing infrastructure makes a giant leap,” Huang proclaimed in a presentation streamed online for the virtual event.

It was the first major event for Nvidia since the company dropped its attempt to acquire chip designer Arm from SoftBank Group Corp. 9984, +7.22% for $40 billion after regulators worldwide questioned the deal. Nvidia’s roadmap as laid out in Tuesday’s event did not change, however, with Nvidia continuing its quest to develop its first central-processing unit for servers using Arm designs, which will challenge the standard x86 server technology used by Intel Corp. INTC, +2.11% and Advanced Micro Devices Inc. AMD, -0.98%

For more: The Arm deal is dead, but Nvidia is not expected to slow down

Huang disclosed that Nvidia has designed a new “superchip” version of its planned effort that combines two of its planned Grace CPUs into one unit, advancing plans that were first shared in the 2021 GTC keynote. The first Grace CPUs are expected to arrive in early 2023, bundled with Hopper for the data-center market in a Grace-Hopper configuration that honors the namesake of both chips, pioneering programmer Grace Hopper.

“Grace is progressing fantastically, and on track to ship next year,” Huang said.

Huang said that Hopper, which will release in the third quarter, will be used by the largest cloud providers in the U.S. and China: Amazon Web Services AMZN, +2.10%, Microsoft Azure MSFT, +1.64%, Google Cloud GOOGL, +2.77% GOOG, +2.78%, Alibaba Cloud BABA, +11.00%, Baidu AI Cloud BIDU, +5.39% and Tencent Cloud. 700, +0.26% Server manufacturers including Dell Technologies Inc. DELL, +1.28%, Hewlett-Packard Enterprise Co. HPE, +0.47% and Cisco Systems Inc. CSCO, +0.30% plan to offer servers with the H100 accelerators, according to the company.

While Nvidia has long been known and succeeded because of its chips’ use for gaming, the company has expanded in the past decade as GPUs’ ability to accelerate artificial intelligence became known and studied, with data-center representing its largest success in the effort so far. In the fiscal year that wrapped at the end of January, Nvidia reported annual server revenue of $10.6 billion, up from $6.7 billion the year before and less than $3 billion two years ago.

The chip maker is also targeting the automotive market, using its chips and software to develop autonomous-driving systems. That effort has taken longer to pay off, but Nvidia disclosed Tuesday that it has a pipeline of more than $11 billion in automotive revenue under contract, up from $8 billion announced at last year’s GTC.

Huang also announced new deals for the Nvidia Drive offering with electric-vehicle manufacturers Lucid Group Inc. LCID, +4.96% and BYD Co. Ltd. 1211, +3.68%, and said production has begun on the Nvidia Drive Orin chip that will help power autonomous driving. The company said in a news release that 25 vehicle makers have adopted the system-on-a-chip for their autonomy plans, including 20 of the top 30 passenger electric vehicle makers globally.

Nvidia reported $566 million in annual automotive revenue last month, up slightly from the previous year but down from a record $700 million two years ago, as the company ditched some of its efforts focused on older in-car entertainment systems. Analysts on average expect automotive revenue to top that record amount in the current fiscal year and top $1 billion for the first time in the next year, according to FactSet.

Earnings recap: Nvidia profit doubles, and execs see ‘accelerated growth’ ahead

While Nvidia is most known among consumers for its videogame offerings, GTC typically focuses on the AI uses for its chips. Last time Nvidia introduced a new GPU architecture in May 2020, executives revealed new gaming cards using the chips in September of that year.

Nvidia did unveil a new offering for developers who make videogames and other immersive environments, called Omniverse Cloud. The cloud-based software will allow teams working on three-dimensional virtual environments to collaborate and build.

“A new wave of work is coming that can only be done in virtual worlds,” Huang said in a news release. “Omniverse Cloud will connect tens of millions of designers and creators, and billions of future AIs and robotic systems.”

Nvidia stock has more than doubled in the past year, continuing a rise that has made it the most valuable U.S. chip maker, with a market capitalization topping $650 billion. Shares are up more than 500% in the past three years combined, as the S&P 500 index SPX, +1.13% has gained less than 60%.