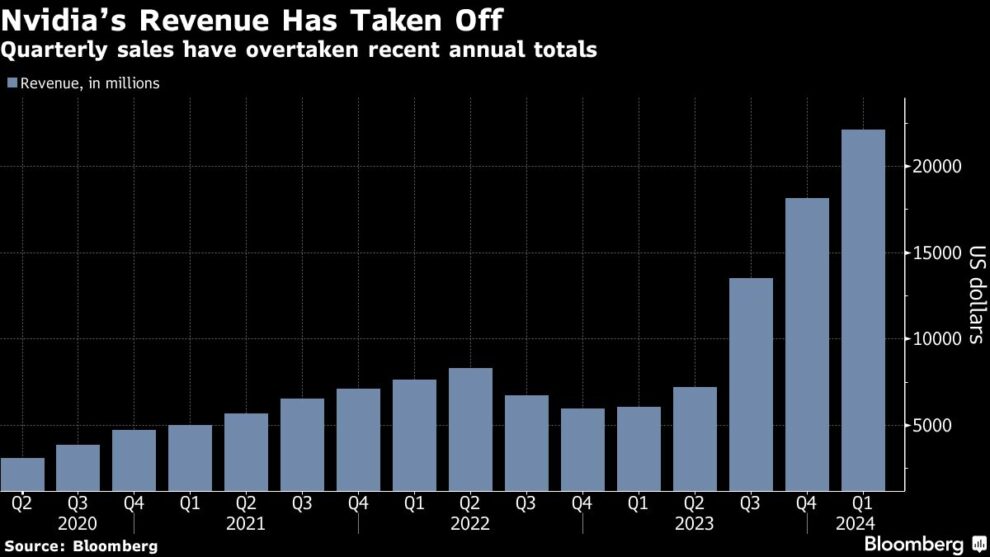

(Bloomberg) — US equity futures rallied following upbeat earnings from Nvidia Corp. released after the New York close, which reinforced optimism for the global artificial-intelligence boom.

Most Read from Bloomberg

The chipmaker said second-quarter revenue will be about $28 billion, beating analysts’ estimates. The company also announced a 10-for-1 stock split and boosted its quarterly dividend by 150% to 10 cents a share. S&P 500 and Nasdaq 100 futures both rose after Nvidia’s results sent its shares as much as 7% higher in after-hours trading. The dollar was little changed in Asia, after rising for three straight days.

A gauge of semiconductor manufacturers in Asia climbed to its highest since February 2021, taking its lead from Nvidia’s earnings.

“Even in the face of huge expectations, the company once again stepped up and delivered,” said Ryan Detrick at Carson Group, who highlighted strong data center revenue.

Asian shares were mixed. Stock benchmarks declined in Australia, China and Hong Kong, while those for Japan gained. South Korean stocks reversed early losses after central bank Governor Rhee Chang Yong said the potential for an interest-rate hike is limited at the moment. The Bank of Korea left its key interest rate unchanged following its policy meeting.

Chinese stocks were the biggest drag on the region with technology names leading the decline. A gauge of tech shares listed in Hong Kong slid amid a brewing price war between Alibaba Group Holding Ltd. and Tencent Holdings Ltd. over cloud services.

Read more: Nvidia Clears the Way for AI Stocks to Keep Powering Higher

Treasuries were little changed in Asia after dropping on Wednesday. Policy-sensitive two-year yields had climbed four basis points in New York after Federal Reserve minutes showed officials remained in no rush to cut rates.

“Many” Fed officials expressed uncertainty over the degree to which policy is restraining the economy — but the minutes also noted policy “was seen as restrictive.”

“I felt the signals from FOMC reinforcing the likelihood of rates higher for longer is negative for most Asian currencies and thus capital markets,” said Abrdn investment director Xin-Yao Ng. “It’s the currency effect.”

In currencies, a gauge of dollar strength held a rally from Wednesday, when it touched a one-week high. The yen was little changed after falling against the greenback to the lowest level since late April. The People’s Bank of China cut its yuan fixing to the weakest level since January.

New Zealand’s dollar rose after Reserve Bank Governor Adrian Orr said the central bank doesn’t want to risk a blowout in inflation expectations.

Tech Profits

US tech earnings have been among the strongest in the first-quarter reporting season, with revisions in the sector outpacing the rest of the market. However, earnings results also suggest a broadening market, according to Solita Marcelli at UBS Global Wealth Management.

“We stay positive on the AI trend and maintain our preference for big tech given the advantageous market positions,” she said. “We forecast global tech earnings growth of 20% and 16% this year and next, respectively, led by the semiconductor sector where we see investment opportunities.”

In Asia, South Korea unveiled a $19 billion package of incentives to bolster its chip sector, a boon to Samsung Electronics Co. and SK Hynix Inc. as they race to stay ahead in an increasingly competitive industry.

Gold fell for a second day after dropping 1.7% Wednesday following the Fed minutes. West Texas Intermediate also slipped, on track for its fourth daily decline. Copper prices fell on signs of weakening demand.

Key events this week:

-

Eurozone S&P Global services and manufacturing PMIs, consumer confidence, Thursday

-

G-7 finance meeting, May 23-25

-

US new home sales, initial jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

US durable goods, consumer sentiment, Friday

-

Fed’s Christopher Waller speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.6% as of 12:08 p.m. Tokyo time

-

Nasdaq 100 futures rose 0.9%

-

Japan’s Topix rose 0.4%

-

Australia’s S&P/ASX 200 fell 0.5%

-

Hong Kong’s Hang Seng fell 1.4%

-

The Shanghai Composite fell 0.8%

-

Euro Stoxx 50 futures rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0829

-

The Japanese yen was little changed at 156.77 per dollar

-

The offshore yuan was little changed at 7.2536 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $69,434.88

-

Ether rose 0.6% to $3,769.09

Bonds

Commodities

-

West Texas Intermediate crude fell 0.6% to $77.07 a barrel

-

Spot gold fell 0.3% to $2,370.88 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Zhu Lin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.