(Bloomberg) — Nvidia Corp. jumped in late trading after giving a bullish revenue outlook for the current quarter, suggesting that a push into artificial intelligence processors is helping offset sluggish demand for personal computer chips.

Most Read from Bloomberg

Sales in the three months ending in April will be about $6.5 billion, the company said in a statement Wednesday. That compares with an average of analysts’ estimates of $6.35 billion, according to data complied by Bloomberg.

The forecast signals that Nvidia’s push into AI computing chips is paying off. Under Chief Executive Officer and co-founder Jensen Huang, the company has parlayed its dominance of graphics processors into a strong position in the growing market for AI hardware. Its chips excel at the kind of parallel processing that allows computers to make sense of large amounts of data and train software to make decisions.

Nvidia also announced its own AI cloud service on Wednesday. The company is teaming up with Oracle Corp., Microsoft Corp. and Alphabet Inc.’s Google to offer the ability to use Nvidia GTX machines to do AI processing via simple browser access, Huang said. The new service, which will be carried by other cloud service providers, will help companies that don’t have the technical expertise to build their own infrastructure.

The shares climbed as much as 9.1% after the report was released. They had earlier closed at $207.54 in New York.

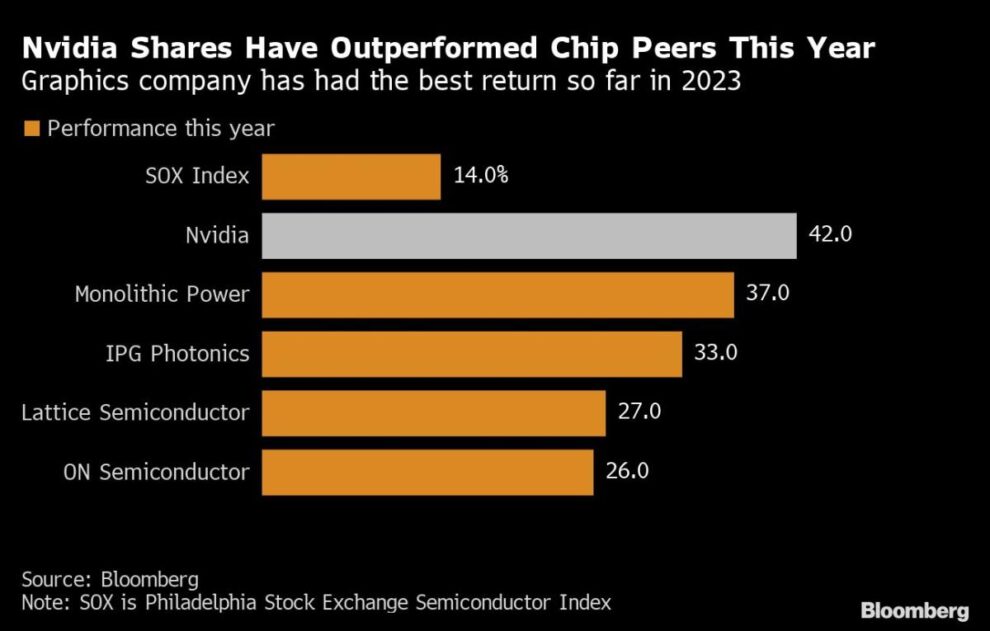

The shares have already been the best performer in the Philadelphia Stock Exchange Semiconductor Index this year, gaining 42%. Investors have piled into Nvidia — making it the world’s most valuable chipmaker again — as they bet that demand for AI systems such as ChatGPT will boost orders for the Santa Clara, California-based company’s products.

Nvidia’s dependence on the PC market for a large chunk of sales still dragged on its results last quarter, though not as much as feared. Computer makers have been slashing chip orders in an attempt to work through stockpiles of unused inventory.

The company’s gaming business — heavily reliant on the PC industry — had revenue of $1.83 billion last quarter, a decline of 46%. Still, it topped the average estimate of $1.6 billion.

Data-center sales grew 11% to $3.62 billion, coming in short of an average prediction of $3.86 billion.

Overall revenue fell 21% to $6.05 billion, marking Nvidia’s second decline in 13 quarters. Profit was 88 cents a share, minus certain items. On that basis, analysts had predicted a profit of 81 cents on sales of about $6 billion.

(Updates with AI cloud service starting in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.