As Nvidia (NVDA) is set to execute a 10-for-1 stock split after Friday’s market close, Bespoke Investment Group co-founder Paul Hickey joins Asking for a Trend to discuss what the move means for the chip giant.

“I don’t think the stock split is much of a big deal,” Hickey says, noting it is a psychological play allowing retail investors to buy more shares at a more attractive price. He explains that Nvidia’s recent run is “unlike anything we’ve ever seen,” as the company added $2 trillion in market cap over the span of a year.

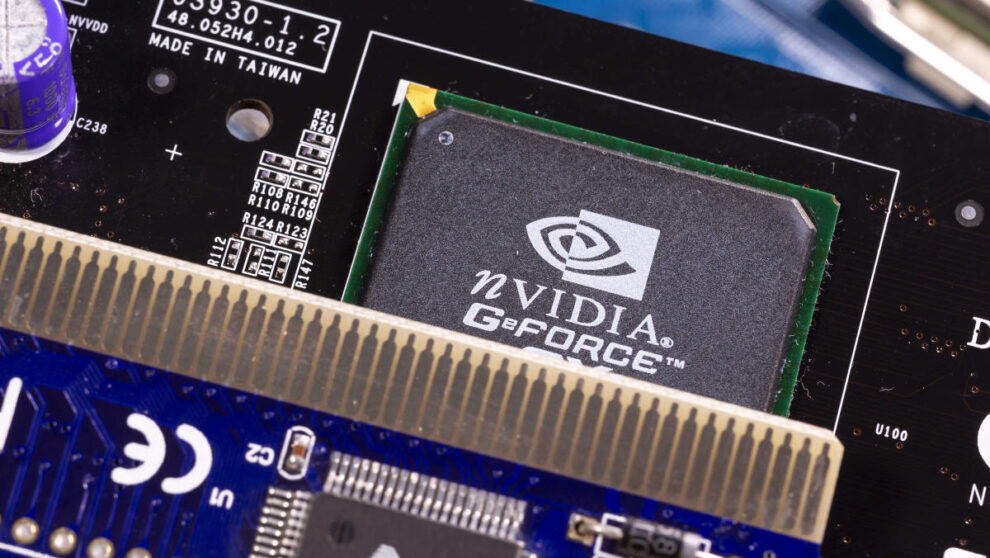

As the AI race heats up and companies like Google (GOOG, GOOGL) shift their primary focus to AI, Nvidia continues to get a boost. “Today, if you want to build out AI, you have to use Nvidia chips,” Hickey says, explaining that Nvidia has what seems like an “insurmountable lead” currently. Over time, however, he expects competition to increase.

For more expert insight and the latest market action, click here to watch this full episode.

This post was written by Melanie Riehl

Video Transcript

Nvidia executing that 10 for one stock.

But after the close today with the stock closing at about $1209.

So shares will begin trading on a split adjusted basis when the markets open back up on Monday for more on what this means to investors and the A I trade broadly or bring in Paul Hickey, co founder of Bespoke Investment group.

Hey, Paul, good to see you.

You too.

How are you doing?

I’m too.

Oh, great.

Thank you.

This has been a fun story to watch the NVIDIA story that is with the, the stock split being the latest um news there along with the earnings.

Um And I know you’ve, you’ve written a lot and thought a lot and looked a lot at the trading patterns that we have seen in NVIDIA.

So as we now factor in the stock split, what does that do to sort of your view on the, on the whole phenomenon?

You know, I, I don’t think the stock split is much of a big deal.

I mean, yes, it, it, it allows retail investors to buy shares of it.

Um You know, it’s hard, it’s a lot easier to buy $100 stock than $1000 stock.

And while brokerages have fractional shares, it never sounds good to say, hey, I bought 1/10 of a share of NVIDIA.

So I, I think in that respect, psychologically, it, it’s a good thing there.

Uh this run that we’ve seen though is just unlike anything we’ve ever seen.

You know, like you, you go back to all these comparisons just, I mean, we just think about the last year with NVIDIA, it went from one trillion to two trillion market cap in nine months and then went from two trillion to three trillion in about three months.

So in just the span of a year, it’s added two trillion in market cap, which is more than Amazon is like the entire market value of Amazon.

So that, that kind of run is just insane.

It’s up 22,000% over the last 10 years.

And if you look at all the other mega caps today uh over any 10 year period in their history.

Um Microsoft is the next closest as it went up about 13,000% in the, in the nineties.

So this is this kind of move is unlike, you know, pretty much anything you’ve seen amongst current market, current mega caps.

Uh you know, but it sort of reminds me, you know, if you remember back to the late nineties and Cisco, the run in Cisco, cisco had a uh was in a very similar position in the internet um as NVIDIA is within the A I space today.

So um that’s something to keep, keep in mind.

And when we look, when we did a comparison of Cisco following the IP O of AOL in the early nineties, you know, which was a seminal moment in the early days of the internet.

And if you compare that to how NVIDIA has done since 2016, when Google versus Sundar Pachay said that we’re now an A I first company.

So that was a seminal moment in A I.

And you compare the runs of those stuff over those periods.

They’re nearly the exact same up until this.

Here.

Here’s my question about that, Paul when Cisco had that run, what was its pe right?

So, I mean, to me, that’s been one of the most interesting things about NVIDIA is that even as the stock has skyrocketed rocketed because the earnings are kind of keeping pace here, the price to earnings ratio has not gone crazy.

Oh, no, you, you’re, you’re absolutely right.

And so I wouldn’t say that NVIDIA has to crash from here by any uh any stretch of the imagination.

But what this stock has done is it’s to keep that growth pace, growth pace going forward.

It’s just the, the, the numbers are just, you know, become too high and it’s just, just takes up, you know, all of the other market cap of um of the companies in the market.

So I think it’s just, it’s an unsustainable pace.

But the key is to remember is back in the nineties, Cisco had the monopoly on routers, there were other networking companies.

But if you really wanted to build out your network, internet infrastructure, you had to use Cisco products today.

If you want to build out A I, you have to use NVIDIA chips.

And so at both Cisco at that time, and NVIDIA now they have what seems like insurmountable leads.

But at some point, the comp you know, competition, um you know, comes into the market, success breeds more competition.

And, uh I think over time you’ll see that again.

I don’t think NVIDIA is a stock that’s gonna go crashing and burning from here by any stretch of the imagination.

But a lot of the move and the, the positive fundamentals have been priced into the stock at this point.