(Bloomberg) — Nvidia Corp. is in advanced talks to acquire Arm Ltd., the chip designer owned by SoftBank Group Corp., according to people familiar with the matter.

The two parties aim to reach a deal in the next few weeks, the people said, asking not to be identified because the information is private. Nvidia is the only suitor in concrete discussions with SoftBank, according to the people.

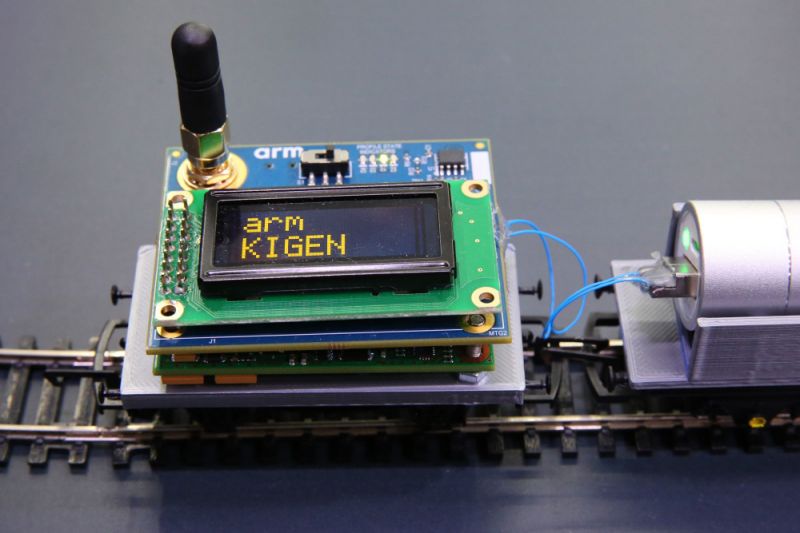

A deal for Arm could be the largest ever in the semiconductor industry, which has been consolidating in recent years as companies seek to diversify and add scale. Cambridge, England-based Arm’s technology underpins chips in products including Apple Inc. devices and connected appliances. SoftBank acquired the business for $32 billion in 2016.

No final decisions have been made, and the negotiations could drag on longer or fall apart, the people said. SoftBank may gauge interest from other suitors if it can’t reach an agreement with Nvidia, the people said. Representatives for Nvidia, SoftBank and Arm declined to comment.

Any deal with Nvidia, which is a customer of Arm, would likely trigger regulatory scrutiny as well as a wave of opposition from other users of the company’s technology. Other Arm clients could demand assurances that a new owner would continue providing equal access to Arm’s instruction set. Such concerns resulted in SoftBank, a neutral company, buying Arm the last time it was for sale.

Divestment Drive

Billionaire Masayoshi Son has been selling some of SoftBank’s trophy assets as seeks to pay down debt at the Japanese conglomerate. SoftBank has offloaded part of its stake in Chinese internet giant Alibaba Group Holding Ltd. and a chunk of its holdings in wireless carrier T-Mobile US Inc.

SoftBank has been exploring options to exit part or all of its stake in Arm through a sale or public stock listing, Bloomberg News has reported. The chip-design company could go public as soon as next year if SoftBank decides to proceed with that option, people with knowledge of the matter have said.

Arm is becoming more valuable as the company pushes for its architecture to be used in more smart cars, data centers and networking gear. The company could be worth $44 billion if it pursues an initial public offering next year, a valuation that may rise to $68 billion by 2025, according to New Street Research LLP.

Nvidia, based in Santa Clara, California, is the world’s largest graphics chipmaker. Its shares rose 1.4% in New York trading Thursday, giving the company a market value of about $261 billion. The stock has more than doubled over the past year.

(Updates with listing considerations from seventh paragraph)

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”30″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”31″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment