This isn’t the first time Nvidia has been on a run like this.

Those who are amazed by Nvidia‘s (NVDA -0.36%) meteoric rise are likely unaware of its history. Although the stock is up around 750% since the start of 2023, it also accomplished a similar feat from the start of 2019 until the end of November 2021, when the stock was up 880%.

Unfortunately for shareholders, the stock responded by dropping more than 50% until the start of 2023. So, the current rise isn’t exactly untested waters for Nvidia. But what happens over the next few years might be.

Will history repeat itself? Or is this time different?

What caused the last crash?

Nvidia’s primary products are graphics processing units (GPUs). Originally, these hardware pieces were created to process gaming graphics more efficiently than central processing units (CPUs) because of their ability to compute in parallel. This feature was found to be incredibly useful in other areas as well, so GPUs quickly expanded beyond gaming to other uses like engineering simulation and drug discovery.

GPUs are necessary to create artificial intelligence (AI) models because of their superior computing power and the previously mentioned ability to compute in parallel. And Nvidia is excelling because the demand for the sheer quantity of GPUs has never been higher. The more GPUs you have, the more horsepower you have to accurately and quickly create top-tier AI models.

The demand wave we’re seeing now is not dissimilar to what Nvidia experienced in 2019 through late 2021, except it was on a much smaller scale. That wave was triggered by cryptocurrency miners increasing their computing power to mine more coins. The more GPUs miners had, the more coins they could produce.

So, many miners continued to scale up because the profit margins stayed level; the bigger you got, the more money you made.

But mining became unprofitable when the cryptocurrency market crashed in late 2021 and throughout 2022. This created a twofold effect. First, miners weren’t buying any new GPUs, which hurt Nvidia’s sales. Second, miners sold their GPUs on the open market for pennies on the dollar, creating an attractive secondhand market. As a result, anyone building a gaming PC probably didn’t buy their GPUs from Nvidia, they bought them used.

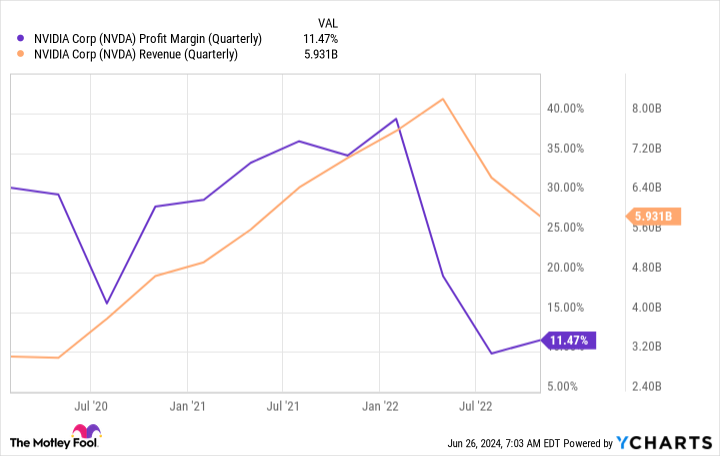

This caused Nvidia’s sales to collapse, turning it from a highly profitable company with strong sales to one that was only a shadow of its former self.

NVDA profit margin (quarterly); data by YCharts.

But starting in the fiscal 2024 first quarter (ending April 30, 2023), Nvidia’s management spoke of a new wave that was coming that would drive unprecedented growth: AI.

The rest is history. The stock has been on an absolute tear until now. But will history repeat itself?

This time might be different

There’s an old saying that history doesn’t repeat itself but often rhymes. I think that holds true here as well. Do I think Nvidia will crash 50%? No. Do I think Nvidia’s stock will have a down period over the next year or so? Yes.

Nvidia is trading at an expensive 74 times trailing earnings and 47 times forward earnings.

NVDA PE ratio; data by YCharts. PE = price to earnings.

This means that the market already baked in at least 59% earnings growth over the next year, even though Nvidia is starting to face difficult comparisons. Furthermore, it’s unknown when the appetite for more GPUs will be satisfied as eventually, companies will have built out the infrastructure they need to satisfy demand. Then, Nvidia’s revenue will come from replacing these GPUs when their life cycle ends.

With GPU life spans ranging from three to seven years, this is still a lucrative business that investors shouldn’t write off. Plus, the AI arms race has far more staying power than the cryptocurrency mining boom. So I wouldn’t expect a massive drop-off in demand, because sales aren’t tied to what a secondary product is doing.

I don’t think history will repeat itself, but Nvidia is a cyclical company. Eventually, it will have to face a demand slowdown, but whether that’s next quarter or five years from now is unknown.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.