Nvidia recently announced a 10-for-1 stock split, and this AI-focused software company could be next.

Nvidia (NVDA -0.79%) reported blockbuster results for the first quarter. Revenue more than tripled due to unprecedented demand for its accelerated computing chips and systems, especially those related to generative artificial intelligence (AI). Meanwhile, adjusted earnings increased more than fivefold.

Just as exciting, Nvidia also announced a 10-for-1-stock split — its second split in less than three years — that will take place after the market closes on Friday, June 7, 2024. Shareholders will receive nine new shares for each share they own at the time. The stock will begin trading on a split-adjusted basis when the market opens on Monday, June 10, 2024.

Investors should understand that the stock split will not impact what Nvidia is worth, nor will it impact an investment position. For instance, if a shareholder owns one share worth $1,000 before the split, they will own 10 shares worth $100 after the split. Their stake in the company will remain unchanged. But stock splits can still create value for investors.

Specifically, stock splits generally follow substantial share price appreciation, and that rarely happens by accident. Instead, price appreciation often points to a competitively advantaged company with excellent growth prospects. Nvidia certainly fits that mold, as does ServiceNow (NOW 2.12%), an AI-focused software company that could split its stock next.

Here’s what investors should know.

Nvidia has a strong competitive position in a quickly growing market

Nvidia graphics processing units (GPUs) are synonymous with cutting-edge graphics in multimedia and accelerated computing in data centers, particularly where artificial intelligence (AI) is concerned. The company commands more than 95% market share in workstation graphics processors and more than 90% market share in data center GPUs.

Additionally, The Wall Street Journal recently reported that “Nvidia’s chips underpin all of the most advanced AI systems, giving the company a market share estimated at more than 80%.” That bodes well for Nvidia and its shareholders because AI spending across hardware, software, and services is forecasted to grow at 36% annually through 2030, according to Grand View Research.

One reason Nvidia has been so successful is its ecosystem of supporting software. Chief among those products is CUDA, a programming model that lets GPUs accelerate all manner of tasks. But Nvidia also offers subscription software and cloud services that support the development and deployment of AI applications across various use cases. The company has further extended its presence in data centers by branching into networking hardware and central processing units (CPUs), both of which have become booming product lines.

In short, Nvidia provides full-stack accelerated computing systems — comprising hardware, software, and services — for AI applications and other data center workloads. That strategy, coupled with its unmatched technological prowess, affords the company a material competitive advantage that has supported strong financial results on a relatively consistent basis.

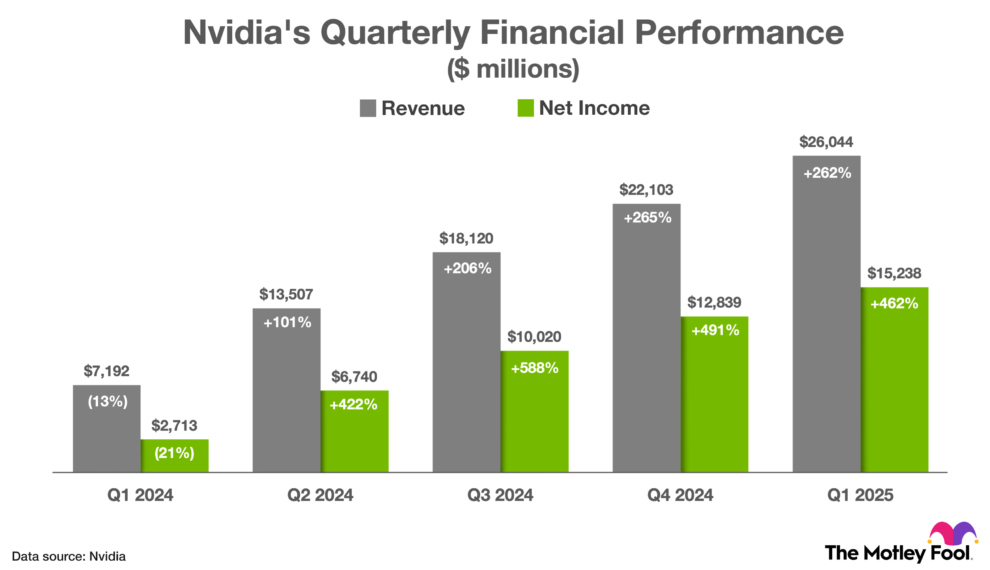

The chart below shows Nvidia’s revenue and non-GAAP net income growth during the last five quarters.

Nvidia has reported robust revenue and non-GAAP net income growth during the last four quarters.

ServiceNow could be the next artificial intelligence company to split its stock

ServiceNow stock soared 1,130% over the last decade and 145% over the last five years, outperforming the S&P 500 (^GSPC 0.80%) in both cases. That share price appreciation qualifies the company as a stock-split candidate but, more importantly, it spotlights ServiceNow as a competitively advantaged company with excellent growth prospects, much like Nvidia.

ServiceNow’s platform helps businesses digitize and automate work across different departments. The company is best known for its IT software products. Specifically, ServiceNow is the market leader in IT service management, IT operations management, and AI for IT operations software. However, the company also has a strong market presence in adjacent software verticals like customer service, digital process automation, and low-code development.

ServiceNow has integrated AI into its products for years, such as intelligent document processing, sentiment analysis, and AI-powered search. Naturally, the company was quick to incorporate generative AI capabilities into its products. Now Assist is a generative AI assistant that brings automation to IT service, customer service, human resources, and developer workflows. ServiceNow sees itself as “uniquely positioned to bring the full potential of generative AI to the enterprise.”

ServiceNow reported solid financial results in the first quarter. Revenue increased 24% to $2.6 billion and non-GAAP net income jumped 44% to $3.41 per diluted share. The stock slipped following the report due to light guidance that narrowly missed Wall Street’s expectations, but the company maintained its medium-term financial targets at its analyst day in May. Specifically, management still expects its addressable market to grow at 17% annually to reach $275 billion by 2026, and the company still believes revenue will grow at 20% annually during the same period.

With that in mind, Wall Street expects the company to grow earnings per share at 30% annually over the next three to five years. That consensus estimate makes its current valuation of 68.8 times earnings (and 54.5 times adjusted earnings) seem quite tolerable. In fact, ServiceNow shares have never been cheaper. Investors should capitalize on that opportunity and buy a small position.