NVIDIA Corporation NVDA is boosting its initiatives to empower artificial intelligence (AI) technology for building autonomous vehicles or AVs. At its ongoing virtual GPU Technology Conference (GTC) 2022, the company revealed that it started the production of its highly advanced software-defined platform, NVIDIA DRIVE Orin, for autonomous vehicles.

NVIDIA DRIVE Orin is a system-on-a-chip (SoC) that powers autonomous driving capabilities, confidence views, digital clusters and AI cockpits. It is designed to handle several applications and deep neural networks that run simultaneously in autonomous vehicles and robots while achieving systematic safety standards.

NVIDIA DRIVE Orin SoC consists of 17 billion transistors and delivers 254 trillion operations per second. It enables developers to build, scale and leverage one development investment across the entire fleet, from Level 2+ systems to Level 5 entirely driverless vehicles.

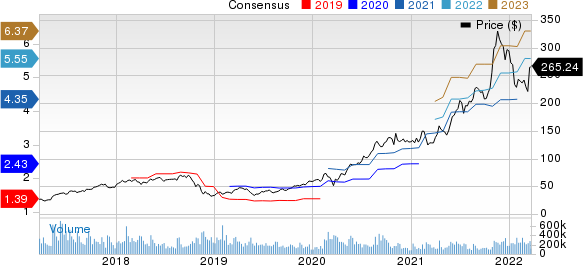

NVIDIA Corporation Price and Consensus

NVIDIA Corporation price-consensus-chart | NVIDIA Corporation Quote

NVIDIA Eyes Huge Opportunity in AV Space

The company’s foray into autonomous vehicles and other automotive electronics space is positive. NVDA is working with more than 320 automakers, tier-one suppliers, automotive research institutions, high-definition mapping companies and start-ups to develop and deploy AI systems for self-driving vehicles.

At its GTC 2022, the company revealed that BYD and Lucid Group adopted the NVIDIA DRIVE platform for their next-generation fleets. While BYD is planning to roll out its next-generation electric vehicles based on the NVIDIA DRIVE platform, Lucid has built its DreamDrive Pro advanced driver-assistance system on DRIVE.

NVIDIA’s focus on incorporating AI into the cockpit for infotainment systems is enabling it to grow its autonomous driving revenues. The company expects its automotive total addressable market to be $30 billion by 2025, which comprises $25 billion for driving, $3 billion for the training/development of deep neural networks and $2 billion for validation and testing.

At its GTC 2022, the company stated that 20 out of the top 30 passenger electric vehicle makers adopted the NVIDIA DRIVE Orin platform. NVDA also revealed that its total automotive design win increased to $11 billion from $8 billion in April 2021.

With a continued focus on developing new and more advanced AI technology for self-driving cars, the company is well-poised to become a leading provider of technology for autonomous vehicles. In the AV space, the company is already a market leader, outpacing other competitors, such as Intel and Advanced Micro Devices, in terms of growth.

Zacks Rank & Other Stocks to Consider

NVIDIA currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks from the broader technology sector worth considering are Advanced Micro Devices AMD, ON Semiconductor ON and Micron Technology MU.

Advanced Micro Devices currently sports a Zacks Rank #1. The Zacks Consensus Estimate for first-quarter 2022 earnings has been revised upward by 33.8% to 91 cents per share over the past 60 days. For 2022, earnings estimates have moved upward by 70 cents to $3.99 per share over the past 60 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 17%. Shares of AMD have declined 20.2% year to date (YTD).

ON Semiconductor sports a Zacks Rank #1. The Zacks Consensus Estimate for ON Semiconductor’s first-quarter 2022 earnings has been revised upward to $1.04 per share from 82 cents 60 days ago. For 2022, earnings estimates have been revised upward by 26.8% to $4.16 per share in the past 60 days.

ON Semiconductor’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 16.3%. Shares of ON have declined 8.4% YTD.

Micron currently carries a Zacks Rank #2. The Zacks Consensus Estimate for second-quarter fiscal 2022 earnings has remained unchanged over the past 60 days at $1.95 per share. For fiscal 2022, earnings estimates have moved upward by 4 cents to $8.95 per share in the past 60 days.

Micron’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 5%. MU stock has lost 15% of its market value so far in the year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

To read this article on Zacks.com click here.