It’s not enough just to spot the big trends because those trends won’t benefit all businesses equally.

Imagine a glob of wet cement and a stick of butter sitting side by side in the middle of the street on a hot summer day in Florida. Both objects are experiencing the exact same thing — intense heat — but how they respond to their environment couldn’t be more different. The cement hardens. The butter melts.

Investing can be like that too, sometimes. Businesses can lean into the exact same secular tailwinds but experience widely disparate results.

Today, I want to highlight the artificial intelligence (AI) trend, but I don’t want to highlight the AI trend for its own sake. Rather, I believe there’s a deeper, hidden investing lesson that you can’t afford to miss.

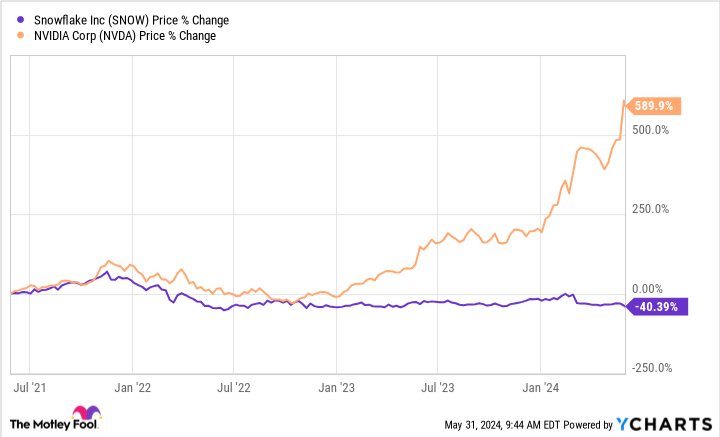

Think of the AI trend as the sun from our analogy. To play the roles of “cement” and “butter,” let’s cast Nvidia (NVDA -0.79%) and Snowflake (SNOW -3.38%). Even though both companies are dedicating their full attention to AI, shares of Nvidia have surged, while shares of Snowflake have slumped.

Data by YCharts.

As the chart shows, Nvidia stock has risen nearly 600% over the last three years as the AI trend has gained momentum. Meanwhile, Snowflake stock is down 40%. The disparity between the two is largely due to where these businesses fit into the bigger AI picture.

Like cement and butter

It’s no secret the AI trend has been kind to Nvidia. In just the last three years, its revenue has nearly quadrupled — this is what many investors focus on. But an underappreciated development is how the company has improved its gross margin, which nearly hit 80% in its most recent quarter.

In short, both revenue and gross margin are spiking for the company thanks to its sales of high-end, AI-capable graphics processing units (GPUs), as the chart below shows.

Data by YCharts.

And then, there’s Snowflake. Its product revenue growth accelerated marginally from 33% in its fiscal 2024 fourth quarter (ended Jan. 31) to 34% the next quarter. New CEO Sridhar Ramaswamy gave a lot of credit to AI for that accelerating growth, saying, “What is exciting about AI is that it can turbocharge our capabilities and growth.”

However, the company’s guidance tells a slightly different story. If the AI trend was truly a turbocharger for the business, one would expect Snowflake’s growth to at least hold fast, if not accelerate further. But management’s outlook implies a slowdown to just 19% growth for product revenue in the second half of this fiscal year. For perspective, growth has never been that slow for Snowflake since it went public in 2020.

So it seems AI isn’t quite turbocharging Snowflake’s growth after all. Moreover, it isn’t providing Snowflake with a gross margin boost like it did with Nvidia. In fact, the opposite is true. For fiscal 2025, Snowflake is forecasting a gross margin of 75% for product revenue. That’s still quite strong, but it’s a decrease from fiscal 2024’s 78% margin.

Snowflake’s management blames spending on AI infrastructure for that expected dip. But it shows that AI isn’t really boosting its business since growth is slowing. And its margins are dipping, in stark contrast to Nvidia’s.

The hidden investing lesson

In investing, just recognizing a trend of enormous significance — such as AI — isn’t enough. Each company’s business model and place in the trend must also be considered in your attempt to distinguish which have the most potential to benefit.

In Nvidia’s case, during its long history of making chips to support increasingly processing-hungry video games, it developed top-of-the-line GPUs that could deliver the performance that gamers needed. Over the years, other industries have found use cases for those GPUs beyond gaming. Now, businesses have recognized their potential to power AI applications and are scooping them up at a prodigious pace. The result: Nvidia had a head start in AI hardware before anyone even knew there was a race.

Nvidia’s GPUs are considered the best, as evidenced by the company’s reportedly 80% market share in AI GPUs. Demand is far exceeding supply, which is naturally boosting its revenue and profit margins.

In other words, Nvidia is directly fueling the AI trend with indispensable hardware. By contrast, AI companies like Snowflake are just trying not to fall behind.

Snowflake’s customers do want AI applications to help them sort through masses of data. But at that layer of the trend, AI applications are becoming the industry standard. If you want to compete, you have to spend money to steadily improve your offerings, so you can provide clients with what they need in a changing world. Snowflake’s increased AI investments won’t necessarily boost growth, but if it fails to upgrade, it risks losing business to competitors.

This is why investors should always have a sound investment thesis when buying a stock. However, an investment thesis that only considers underlying big-picture trends isn’t sufficient — that’s like recognizing the hot summer day in the earlier analogy. Investors must also think through how that trend will affect the business, so they can have a fair shot at distinguishing what will prove to be “cement” from what will turn out to be “butter.”