NVIDIA Corporation NVDA was the top performer on the S&P 500 in 2023 and continued its upward movement this year due to its sheer dominance in the artificial intelligence (AI) chip market.

However, NVIDIA stock breezed past $1,000 in early 2024, making it inaccessible for many investors. So, a stock split was initiated in early June. Let’s examine NVIDIA’s performance following the split to determine its present investment potential.

NVIDIA Stock Performance – Positive After Stock Split

In May, NVIDIA declared its intention to split its stock in a 10-for-1 ratio. Immediately after the announcement, the stock climbed from around $900 to more than $1,000. Between the announcement and the split date (Friday, June 7), NVIDIA stock soared about 30%. Post-split, it opened on June 10 at about $120, now trading at around $123, marking a more than 2% increase.

NVIDIA stock, historically, has gained two out of three times in the three months following a stock split. A Statista report using Bank of America Corporation’s BAC data found that companies that split their stocks had an average return of more than 25% in the 12 months post-split, double the S&P 500’s average return in the same period.

Fed Rate Cuts Boost NVIDIA Stock

After the split, NVIDIA stock got a boost from the Federal Reserve’s interest rate cuts. The Fed trimmed interest rates by 50 basis points to support economic growth. The Fed eased its monetary policy for the first time in four years.

Lower interest rates are expected to reduce NVIDIA’s borrowing costs and boost profit margins. Lower interest rates also don’t affect NVIDIA’s cash flows necessary for growth initiatives.

Going back to the 1990s, the NVIDIA stock gained, on average, 20.7% in the 12 months following an interest rate cut, while the S&P 500 jumped only 2.9%, according to Dow Jones Market Data.

Key Tailwinds for NVIDIA Stock

Dominance in the graphic processing unit (GPU) market, shipment of the most sought-after Blackwell chips by year-end and significant growth in the AI market also boosted NVIDIA stock.

The widespread use of NVIDIA’s CUDA software platform over Advanced Micro Devices, Inc.’s AMD ROCm software platform has given it the bulk share in the GPU market, which is projected to reach $1,414.39 billion by 2034 from $75.77 billion in 2024, according to Precedence Research.

CEO Jensen Huang, meanwhile, assured that the high-end Blackwell chips will be available soon to cater to high demand. This is because the Blackwell chips have more AI throughput than the current Hopper chips.

A recent report by Bain Technology showed that the AI hardware and software market is estimated to grow to $990 billion by 2027 from around $185 billion in the current year, crushing any concerns that the big cloud companies are contemplating spending big on AI.

NVIDIA benefits from the AI boom as a key hardware and technology provider for AI applications. It expects revenues of $10 billion for 2024 from the government’s sovereign AI investments, a significant increase from zero last year, per the Bain Technology report.

Strong Fundamentals to Drive NVIDIA Stock

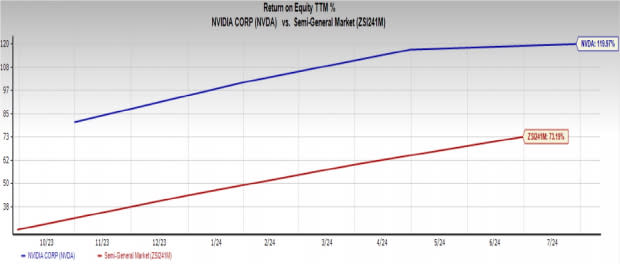

NVIDIA’s ability to generate profits proficiently and manage costs efficiently is likely to drive up its future share price based on its return on equity (ROE) and net profit margin.

NVIDIA’s ROE is 120%, surpassing the Semiconductor – General industry’s 73.2%. Any reading above 100% indicates the company’s net income is exceeding its equity.

Image Source: Zacks Investment Research

NVIDIA’s net profit margin is 55%, more than the industry’s 47.6%. Any reading above the 20% threshold indicates a high margin (read more: NVIDIA & 2 Other S&P 500 Stocks Show Strong Earnings Growth).

Image Source: Zacks Investment Research

Here’s How to Trade NVIDIA Stock

NVIDIA’s shares rose post-split due to macro trends and continue to be a Wall Street darling based on strong fundamentals.

Prominent brokers have also increased the average short-term price target of NVDA by 23.7% from the stock’s last closing price of $120.87, while the highest price target is $200, a massive upside of 65.5%.

Image Source: Zacks Investment Research

Moreover, the NVIDIA stock is currently trading above the 50-day moving average (DMA) and the 200-DMA, indicating a near-term bullish trend.

Image Source: Zacks Investment Research

NVIDIA stakeholders, therefore, should retain their market share due to the strong price upside, making selling unlikely. However, NVIDIA stock’s meteoric rise in the past few years due to the advent of AI has made the stock expensive.

New buyers, thus, should wait for an opportune moment to invest in NVIDIA. After all, per the price/earnings, the stock is trading at 43.8X, above the peer group’s 18.2X forward earnings multiple.

Image Source: Zacks Investment Research

For now, NVIDIA stock has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.