This article first appeared on Simply Wall St News.

NVIDIA Corporation’s (NASDAQ: NVDA) external environment is shifting in 2022, as confirmed per the latest earnings. The company achieved unprecedented growth as the stock became a 100-bagger in less than a decade. Yet, beyond the typical problems of 2022 (like supply chain issues), an inflationary environment that impacts the discretionary income combined with an Ethereum switch from mining (proof-of-work) – external pressure is rising.

See our latest analysis for NVIDIA.

NVDA Second Quarter Results

-

EPS: US$0.26 (down from US$0.95 in 2Q 2022).

-

Revenue: US$6.70b (up 3.0% from 2Q 2022).

-

Net income: US$656.0m (down 72% from 2Q 2022).

-

Profit margin: 9.8% (down from 37% in 2Q 2022). The decrease in margin was driven by higher expenses.

Following the earnings, the average price target decreased from US$236 to US$216, based on the estimate by 40 analysts.

Looking at the gains over the last few years, the 57% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It is common to see investors become enamored with a business, after a few years of solid progress.

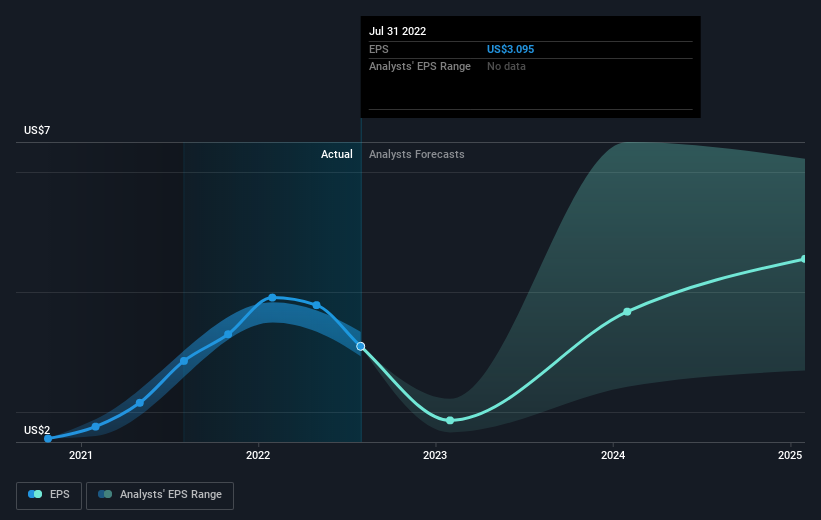

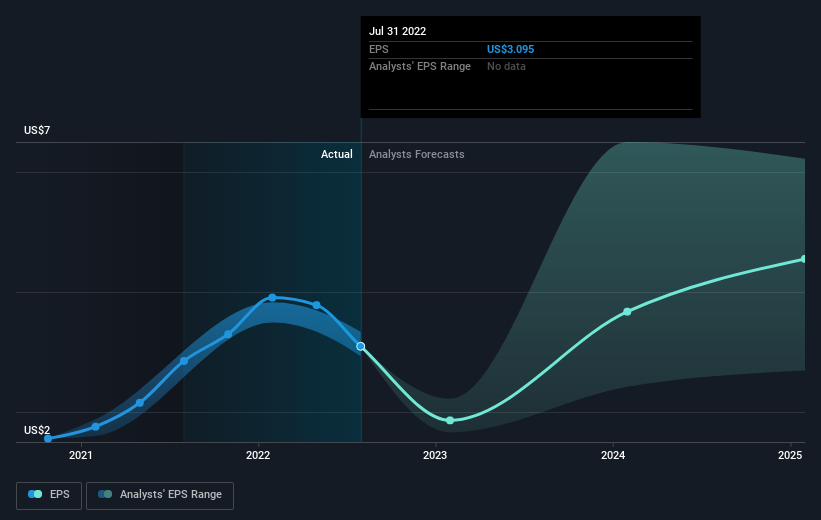

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that NVIDIA has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

Are Institutions Overlooking Guidance?

Year-over-year, NVDA’s gross margin dropped significantly – by over 20 points, to 45.9%. Meanwhile, operating expenses rose by 40% in contrast to a lethargic 3% revenue growth.

Furthermore, the company is guiding 15% below the consensus for Q3, or US$1b lower, at US$5.9b expected. This is largely due to the second most popular currency, Ethereum, switching away from GPU-based mining. Graphic cards are the main NVDA segment, and this market that drove their MSRP prices over 2x during much of the last two years is now gone. According to Nvidia CFO Colette Kress, even the company is unable to accurately quantify the extent of reduced cryptocurrency mining in demand for graphics cards.

However, some institutions remain optimistic despite the obvious headwinds, as Atif Malik of Citi noted that gaming growth should return with the release of new products later this year. Malik expects the GTC conference on September 20 to be the catalyst. He has a buy rating albeit with a lowered price target (from US$285 to US$248 per share).

NVDA declined on the latest results yet still trades at a Price-to-Sales ratio of 13.7x. If you’re looking for companies with more attractive fundamentals, take a look at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note that the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here