As a result of shifts in shopping behavior due to the COVID-19 outbreak, brands and retailers are rethinking online marketing strategies while also accelerating digitalization efforts.

These are efforts driven by robust growth in online sales as well as shoppers embracing retailers such as Walmart and Target, where they can purchase essentials and household staples along with apparel, home goods and consumer electronics.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="More from WWD” data-reactid=”21″>More from WWD

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Here, Greg Malen, vice president of solutions at SimilarWeb, discusses these retail trends, and how successful brands are winning in today’s market.” data-reactid=”28″>Here, Greg Malen, vice president of solutions at SimilarWeb, discusses these retail trends, and how successful brands are winning in today’s market.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="WWD: We all know COVID-19 has changed the way consumers shop, are there fashion brands that have done well during the pandemic?” data-reactid=”29″>WWD: We all know COVID-19 has changed the way consumers shop, are there fashion brands that have done well during the pandemic?

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Greg Malen: A lot of the focus has been centered around fashion retailers with sizable brick-and-mortar locations that suffered during the lockdown. Obviously, a number of retailers and brands filed for bankruptcy over the last few months, but these were retailers who were late to adopt digital as a growth platform.” data-reactid=”30″>Greg Malen: A lot of the focus has been centered around fashion retailers with sizable brick-and-mortar locations that suffered during the lockdown. Obviously, a number of retailers and brands filed for bankruptcy over the last few months, but these were retailers who were late to adopt digital as a growth platform.

The brands we see succeeding in the COVID-19 world are ones that have maintained a digital-first or strong omnichannel shopping experience. The two best examples are Nike and Lululemon. Nike online growth is over 30 percent and Lululmeon is nearly 50 percent year-over-year.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="WWD: What are some of the strategies these brands/retailers have leveraged to find success?” data-reactid=”32″>WWD: What are some of the strategies these brands/retailers have leveraged to find success?

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="G.M.: This will sound very simplistic, but product fit and brand recognition. Obviously, consumers are wearing more casual attire or ath-leisure, since more people are stuck around the house. As a result, it’s not surprising that brands like Nike and Lululemon are thriving.” data-reactid=”33″>G.M.: This will sound very simplistic, but product fit and brand recognition. Obviously, consumers are wearing more casual attire or ath-leisure, since more people are stuck around the house. As a result, it’s not surprising that brands like Nike and Lululemon are thriving.

We see this backed up in marketing channels where 75 to 80 percent of traffic is coming in directly to the site or through organic search. A lot of brands and retailers cut back on their paid acquisition in March and April. We’re seeing some spending return, but it is a slow climb back.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="WWD: How have giants like Amazon and Walmart factored into the fashion and apparel landscape?” data-reactid=”35″>WWD: How have giants like Amazon and Walmart factored into the fashion and apparel landscape?

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="G.M.: Obviously, Walmart and Amazon have experienced increased demand during COVID-19. Walmart posted 97 percent year-over-year growth in e-commerce in the second quarter, where Amazon was up 40 percent. This is driven by consumers purchasing household staples: cleaning supplies, groceries, etc.; the visits and transactions on Walmart’s clothing category have doubled since March.” data-reactid=”36″>G.M.: Obviously, Walmart and Amazon have experienced increased demand during COVID-19. Walmart posted 97 percent year-over-year growth in e-commerce in the second quarter, where Amazon was up 40 percent. This is driven by consumers purchasing household staples: cleaning supplies, groceries, etc.; the visits and transactions on Walmart’s clothing category have doubled since March.

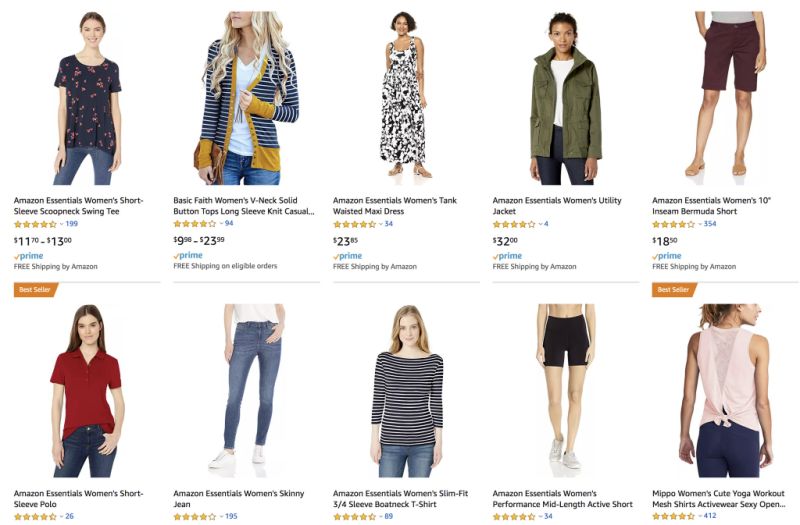

Amazon has also grown, purchases have increased 15 percent year-over-year in the category. I think this growth highlights the “one-stop shop” mentality, where if you are purchasing items on the site, you might be more willing to explore “new” categories. What really gets my attention about clothing on Amazon is that Amazon Essentials is the most popular brand.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="WWD: What about brands like Nike that are not officially sold on Amazon?” data-reactid=”38″>WWD: What about brands like Nike that are not officially sold on Amazon?

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="G.M.: I eluded to this a bit in the last answer, but Amazon Essentials prominence within the clothing category should be on everyone’s mind. The brand is supplementing lower-cost staples (e.g. workout shirts, shorts) that have less brand cache as let’s say the latest “Air Jordans.”” data-reactid=”39″>G.M.: I eluded to this a bit in the last answer, but Amazon Essentials prominence within the clothing category should be on everyone’s mind. The brand is supplementing lower-cost staples (e.g. workout shirts, shorts) that have less brand cache as let’s say the latest “Air Jordans.”

When you look at the top 10 brands within the fashion category on Amazon, I would say five are athletic apparel, it might prompt brands to evaluate Nike’s decision more closely. Despite the withdrawal from Amazon, Nike is still a top 10 brand on the site, with a quarter of a million transactions every month and sales are only down 35 percent year-over-year.

At SimilarWeb, we are about to launch a new product that provides a deep dive into Amazon, and it’s been fascinating to see the growing prominence of Amazon-branded products and low-cost alternatives.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="WWD: Fast-forward 12 months from now, what will the digital landscape look like for fashion and apparel brands/retailers?” data-reactid=”42″>WWD: Fast-forward 12 months from now, what will the digital landscape look like for fashion and apparel brands/retailers?

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="G.M.: I normally say we see three trends in retail: 1. consolidation at the top by large marketplaces (e.g. Amazon) 2. fast-fashion and low-cost retailers (e.g. Marshalls) 3. niche, luxury or experience-based buying.” data-reactid=”43″>G.M.: I normally say we see three trends in retail: 1. consolidation at the top by large marketplaces (e.g. Amazon) 2. fast-fashion and low-cost retailers (e.g. Marshalls) 3. niche, luxury or experience-based buying.

I’d say COVID-19 has impacted each category differently, but the one that appears most impacted is number two. I think low-cost players, like T.J. Maxx, have tried to accelerate their digital adoption; it will be difficult to catch up. Low-cost is reliant on the in-store shopping experience.

As a result, we will see consolidation at the top by retailers like Amazon and Walmart offering a mix of affordable clothing and fragmentation around d-t-c brands that can provide customers a unique experience. The latter is what makes Walmart’s collaboration with Shopify fascinating to follow for the fashion and apparel space.