Google Cloud and Waymo look undervalued within Alphabet.

After winning its antitrust case against Alphabet (GOOGL -4.02%) (GOOG -4.08%), the U.S. government said it will consider asking the judge to break the company up. While such an extreme remedy appears unlikely, anything is possible when it comes to the law.

My prediction, though, is that Alphabet would be worth more broken up than it currently trades at as a combined company. Let’s examine its different businesses to see why this could be the case.

Alphabet’s largest business is Google Search, which represented about 57% of its revenue last quarter. Google is the dominant player in search, and nothing the government does will likely change that.

In fact, during the court proceedings, Apple said there was no price that Microsoft could pay to have it load Bing within its Safari browser. Two of the main reasons the company cites were Bing’s “inferior” search results and its “horrible” ad monetization. These two reasons are why no matter what remedies the government implements, it is very unlikely to impact Google’s dominance.

While some investors worry about the impact of artificial intelligence (AI) on search, Google is still likely to be the winner, given its long history of search data, scale, and ability to monetize its ads. In fact, AI should give it the opportunity to monetize a large portion of the search results it currently does not serve ads for, which is around 80%, as it introduces new ad formats to profit from AI.

Upstarts like OpenAI’s SearchGPT and Perplexity AI, meanwhile, just don’t have the same scale and decades of search history to build upon. At the same time, they don’t have the reach to profitably serve ads to a vast number of users. Thus, they both lose a lot of money. None of that will likely change even with any government remedies.

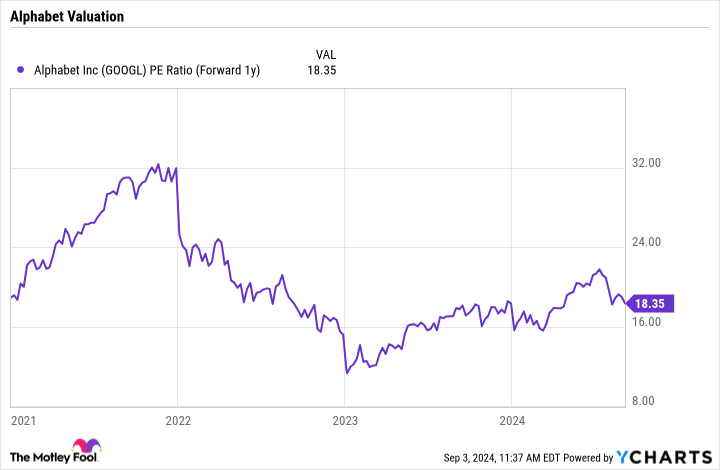

As such, Google as a stand-alone company should probably carry a similar forward earnings (P/E) multiple as Alphabet does today, given its growth and dominant market position.

GOOGL PE Ratio (Forward 1y) data by YCharts

YouTube

YouTube has become one of the most successful video platforms on the planet. Alphabet reported nearly $8.7 billion in ad revenue from the platform in Q2, up 13%. However, YouTube also generates revenue from subscriptions, which is included in a line item called “Google subscriptions, platforms, and devices.” Not all of this revenue, which was $9.3 billion in Q2, comes from YouTube, as some comes from the sale of its Pixel smartphone devices.

Unlike other streaming platforms, YouTube doesn’t have large up-front content costs, which have quickly helped make it profitable. Instead, it uses a revenue-sharing model with its creators. The financial details are business secrets, but it is believed that YouTube keeps about 45% of its ad revenue while 55% goes to creators. That should give it similar margins to Netflix, which were just close to 42% through the first half of this year.

However, more recently, YouTube has invested in content such as sports rights. It paid $14 billion for the rights to the NFL Sunday Ticket over the next seven years, although the NFL losing an antitrust suit does put the deal at some risk.

Nonetheless, YouTube has shown to be a great business. When looking at valuation, Netflix currently trades at a large premium to Alphabet, with a forward P/E of more than 29 versus more than 18 for Alphabet. As such, it would not be surprising that a stand-alone YouTube could trade at a higher valuation than Alphabet.

GOOGL PE Ratio (Forward 1y) data by YCharts

Google Cloud

Google Cloud is Alphabet’s fastest-growing business, as it benefits from customers looking to build out their AI capabilities on its platform. Its revenue soared 29% to more than $10.3 billion in Q2, while its operating income went from $395 million to nearly $1.2 billion.

This is a high fixed-cost business that has recently reached the scale to see profitability start to soar. Currently, there are no stand-alone cloud computing stocks, but this business would undoubtedly receive a very big multiple if it were to be separated out given its growth. In addition, as a stand-alone entity, it would be the only pure-play way to invest in the cloud computing sector.

Altogether, this is a business that I believe should trade substantially higher than Alphabet’s current forward P/E multiple of 18.

Image source: Getty Images.

Waymo

Alphabet’s bet on self-driving cars and robotaxis, Waymo, has gone out to a huge lead on the competition as the only company currently offering robotaxi services in the U.S. The company recently increased its number of paid riders per week from 50,000 to 100,000.

With questions surrounding Tesla’s technology given its poor history of self-driving safety and General Motors’ Cruise dealing with a major safety incident last year, Waymo has a nice first-movers advantage in the space. Alphabet, meanwhile, has said it will make an additional $5 billion investment in the unit.

As a money-losing business, Waymo doesn’t appear to account for much value at all within a combined Alphabet, which is one of the cheapest megacap tech stocks out there.

However, a stand-alone Waymo would likely get a pretty nice valuation. It was last valued at $30 billion in 2020, when it took on some outside investors. However, that valuation has likely gone up in recent years, especially now that it is the only robotaxi company operating in the country. Google is estimated to own over 80% of the company.

Alphabet looks like a buy

Outside its ad network business, which has seen revenue decline in recent quarters, I believe most of Alphabet’s other businesses would command higher multiples than the one Alphabet currently commands. This is especially true of its Cloud Computing and Waymo businesses.

As such, I think Alphabet stock remains a great buy at current levels.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, Microsoft, Netflix, and Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.