(Bloomberg) — Oracle Corp. reported better-than-expected quarterly revenue and profit in a sign that demand for information technology hasn’t been slowed by inflation and economic uncertainty. Shares jumped about 12% in extended trading.

Most Read from Bloomberg

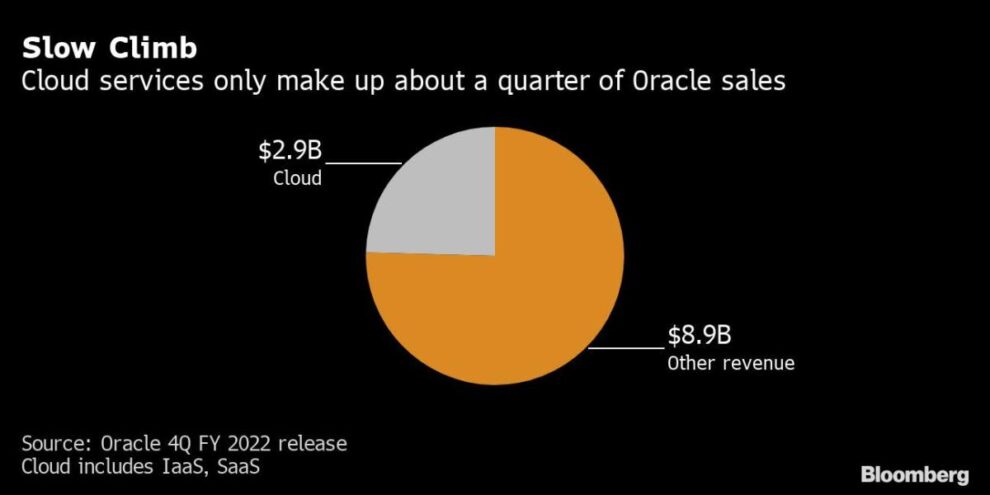

Sales increased 5.5% to $11.8 billion in the fiscal fourth quarter, topping the average analyst estimate of $11.7 billion. Profit, excluding some items, was $1.54 a share, compared with the average estimate of $1.38 a share.

Cloud revenue — the highly watched segment that Oracle has been trying to expand — rose 19% to $2.9 billion in the three months ended May 31, the Austin, Texas-based company said Monday in a statement. Cloud sales growth had been greater than 20% since Oracle, the second-biggest software maker by revenue, began disclosing it last year.

While sales of applications for management and financial operations have fueled the company’s cloud effort thus far, Oracle “experienced a major increase in demand in our infrastructure cloud business” of 36% in the quarter, Chief Executive Officer Safra Catz said in the statement.

Cloud revenue will accelerate as much as 25% in the current quarter and more than 30%, in constant currency, in the fiscal year, Catz said during a conference call after the results. That revenue could increase as much as 47% in the period ending in August including cloud sales from Cerner Corp., the newly acquired digital medical records provider, she added.

Economic headwinds like inflation and currency volatility could lead to corporate cost-cutting that may help drive cloud adoption, wrote JPMorgan’s Mark Murphy ahead of the results. The fast-growing cloud market is led by Amazon.com Inc., Microsoft Corp. and Alphabet Inc.’s Google.

Oracle is hoping its $28.3 billion acquisition of Cerner, completed last week, will build inroads in the health care industry, which has been comparatively slow to adopt cloud technology. Catz has said the deal should be “substantially accretive” to Oracle’s earnings in fiscal year 2023.

With Cerner now part of Oracle’s business, sales may increase as much as 19% in the current quarter, Catz said on the call. Profit, excluding some items, will be $1.04 to $1.08 a share in the period, she said.

With a surging US dollar, tech peers with significant overseas exposure including Salesforce Inc. and Microsoft Corp. have seen growth eaten by currency volatility. Oracle, with nearly half of its sales outside the Americas, said it suffered a 5% hit to its quarterly revenue from currency fluctuations. On Monday, the US dollar hit its highest level since April 2020 as traders bet on an increasingly-rapid round of interest rate hikes from the Federal Reserve.

Fourth-quarter sales of the Fusion application for managing corporate finances rose 20%, compared with 33% last quarter. Revenue from NetSuite’s enterprise planning tools, targeted to small- and mid-sized businesses, increased 27%, the same as in the previous period. Cloud license and on-premise license sales gained 18% to $2.5 billion, beating the average estimate of $2.2 billion.

The results marked Oracle’s eighth straight quarter of year-over-year revenue increases. “Couple a high growth rate in our cloud infrastructure business with the newly acquired Cerner applications business — and Oracle finds itself in position to deliver stellar revenue growth over the next several quarters,” Catz said in the statement.

The shares closed at $64.05 in New York, the lowest value in 16 months, and have slipped 27% this year amid a broad rout among technology companies.

(Updates with forecast for cloud growth in the fifth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment