Oracle (ORCL) has been an under-the-radar high-flyer stock in 2024 and has just caught the attention of Wall Street. Shares are up 61% year-to-date, and the stock is still selling at a reasonable price. The company is emerging as an AI winner after it posted a beat and raise in the most recent quarter, driven by strong performance in its AI-related business.

Oracle is a well-run legacy business, known for its database software products that are popular among businesses worldwide. Companies use Oracle’s software products to organize and manage their data more efficiently. Think software for Enterprise Resource Planning, Customer Relationship Management, and Human Capital Management, among other types of software. Oracle does it all, and much more.

I am bullish on Oracle because of strength in its AI-related business, its strong cash generation capabilities, and its current valuation even after the surge in its stock price.

Oracle’s Latest Quarterly Results Hint at Its AI Potential

Oracle’s recent beat and raise for FQ1 2025 is key to my bull case for the stock, as they clearly show how it’s gaining traction in the AI investment theme. The company earned $1.03 per share on revenue of $13.3 billion, up 6.86% year-over-year. While these are decent numbers, the most impressive aspect is the 21% year-over-year increase in its Cloud Services revenue, showing that hyperscalers are buying Oracle’s products.

Moreover, Oracle logged a record-high Remaining Performance Obligations (RPO) of $99 billion, up 53% year-over-year. This shows that business is booming for the software giant, and investors can look forward to this unearned revenue. As I mentioned, Oracle is gaining traction in the AI space, with the key highlight being its MultiCloud agreement with Amazon’s (AMZN) cloud business, AWS. This partnership joins others, like Microsoft (MSFT) and Alphabet (GOOGL), in leveraging Oracle’s database offerings in the cloud.

Therefore, the growth in RPOs and Oracle securing a MultiCloud deal with another large cloud services provider was well-received by investors. The stock is breaking out on the news, and I see this uptrend lasting longer as the company continues to gain popularity among CSPs for cloud implementations of its database products. For Fiscal 2025, the company is aiming for double-digit revenue growth and accelerated growth in its cloud infrastructure business.

Oracle Is Good at Cash Generation

Another reason I’m bullish on Oracle is its cash generation capabilities. In FQ1 2025, the company’s operating cash flow was $7.42 billion, up from $6.97 billion a year ago. This is why I am not too worried about its balance sheet. As of August 31, 2024, Oracle has about $75.3 billion in long-term debt versus about $23 billion in current assets. While this shouldn’t go unnoticed by investors, it doesn’t bother me because of the cash generation and strength in RPOs.

Additionally, Oracle turns its profits into free cash flow. In the most recent quarter, its net income was $2.9 billion, and its free cash flow was $5.1 billion. Looking at the trailing twelve months (TTM), Oracle’s net income was $10.9 billion, while its TTM free cash flow was $11.2 billion. This gives it a TTM FCF-to-net income ratio greater than 1. Even as it continues to ramp up CapEx to meet demand for its products from hyperscalers, I see Oracle thriving, not struggling, as long as it continues to generate strong cash flow.

Oracle Stock Is Fairly Valued Despite the Run-Up

Another thing I like about Oracle is its current price, as I believe the stock is fairly valued. It’s not cheap, but it’s not expensive either. It’s trading at 26.5 times this year’s earnings estimates, and while that’s a slight premium to its sector, I see the company at the cusp of a multi-year growth cycle driven by AI. Analysts on Wall Street expect earnings to grow by 24% this year, and I would rather pay 26.5 times earnings for 24% growth than 23.6 times earnings for 15% growth (estimates for the S&P 500).

In addition, management expects the strength in RPOs to drive growth throughout Fiscal 2025. If this momentum continues (my bet), Oracle’s sales might grow well beyond this year. Who knows, we might even see an upward revision for growth estimates. While I can’t put an exact multiple or earnings growth rate estimate on Oracle for the long term, I believe the new AI opportunity looks promising enough to justify the current P/E multiple.

Moreover, Oracle gave revenue guidance for Fiscal 2026 and Fiscal 2029 of $66 billion and $104 billion, respectively, driven by its improving cloud infrastructure business. At a market cap of $465 billion, Oracle is currently trading at 4.4 times management’s Fiscal 2029 revenue estimate. Again, I wouldn’t call it cheap, but I wouldn’t call it expensive either. What I will say is that this stock has the potential to go higher as its cloud infrastructure story plays out similarly to what management and investors are expecting.

Analysts’ Take on Oracle Stock

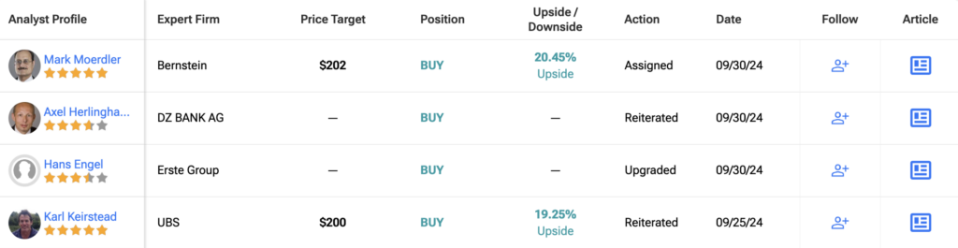

On the Street, Oracle stock sports a consensus Moderate Buy rating based on 17 Buy and 11 Hold recommendations. The average ORCL price target of $178.50 represents an upside of 6.4% from current levels.

The Bottom Line

Oracle is a well-run software business with improving fundamentals. The company’s cloud infrastructure business is going to propel it to new highs as more cloud services providers turn to it for cloud implementations of its database products. With its AI story just getting started, the stock’s current valuation does not suggest that it’s overpriced. Instead, it reflects a fair price for a company with improving fundamentals and a multi-year growth opportunity. I remain bullish on Oracle for the long term, but I would wait for a slight pullback before buying it.