(Bloomberg) — Oracle Corp.’s quarterly sales jumped 18%, buoyed by the software maker’s transition to cloud computing and the acquisition of health records provider Cerner.

Most Read from Bloomberg

Sales were $11.4 billion in the fiscal first quarter, meeting analysts’ average estimate, according to data compiled by Bloomberg. Profit, excluding some items, was $1.03 a share. Oracle said currency fluctuations reduced the earnings by 8 cents a share. Analysts projected $1.06 a share.

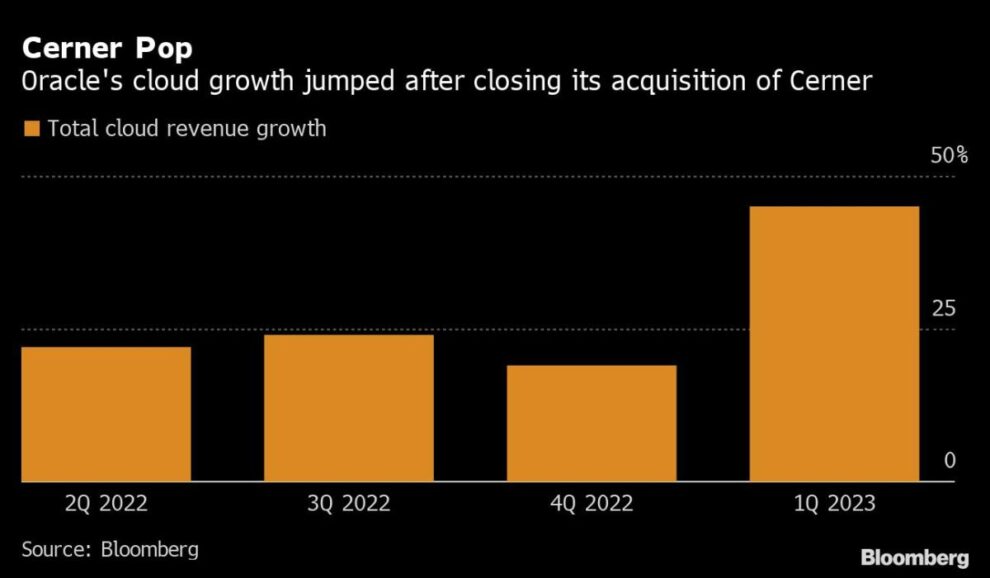

Cloud revenue — the highly watched segment that Oracle has been trying to expand — rose 45% to $3.6 billion in the period ended Aug. 31, the Austin, Texas-based company said Monday in a statement. Growth was 19% last quarter, before the Cerner deal closed.

The company, known for its database technology, sells business software applications that can be used over the internet as well as offering customers the ability to store and compute information through Oracle’s servers, called cloud infrastructure. Amazon.com Inc. and Microsoft Corp., the leaders in that market, are far ahead of Oracle. Executives say the $28.3 billion Cerner acquisition will give the company inroads in the health care industry, which has been comparatively slow to adopt cloud technology.

“The company’s application and infrastructure cloud businesses now account for over 30% of total revenue,” Chief Executive Officer Safra Catz said in the statement. “As our cloud businesses become a larger-and-larger percentage of our overall business, we expect our constant currency organic revenue growth rate to hit double-digits with a corresponding increase in earnings per share.”

Oracle completed its purchase of Cerner in June. The digital medical records provider generated $1.4 billion in sales in the period, which Catz called its best revenue quarter ever.

“We expect Cerner to do even better in the coming quarters as we develop an all-new suite of health care cloud services,” she said.

Oracle’s strong sales growth — even after removing the Cerner contribution — “bodes well for the software sector,” wrote Bloomberg Intelligence analyst Anurag Rana. “Though we were expecting application growth to stay strong, we were particularly surprised by Oracle’s infrastructure strength despite worsening economic conditions.”

Catz said sales in the current quarter will gain 15% to 17% and cloud revenue, including Cerner’s contribution, will be increase as much as 46% compared with the period a year earlier. Excluding Cerner, Oracle’s cloud sales will jump about 30% in the fiscal year, she said on a conference call after the results.

In the fiscal first quarter, sales of the Fusion application for managing corporate finances rose 33%, compared with 20% the previous period. Revenue from NetSuite’s enterprise planning tools, targeted to small- and mid-sized businesses, increased 27%, the same as the previous quarter.

In June, TikTok announced that all US traffic is being moved to Oracle’s cloud servers. The popular short-video platform, owned by China-based ByteDance Ltd., is working to convince US regulators that user data can’t be accessed by Chinese authorities.

Oracle shares gained about 1.5% in extended trading after closing at $77.08 in New York. The stock has slipped 12% this year.

(Updates with forecast in the ninth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.