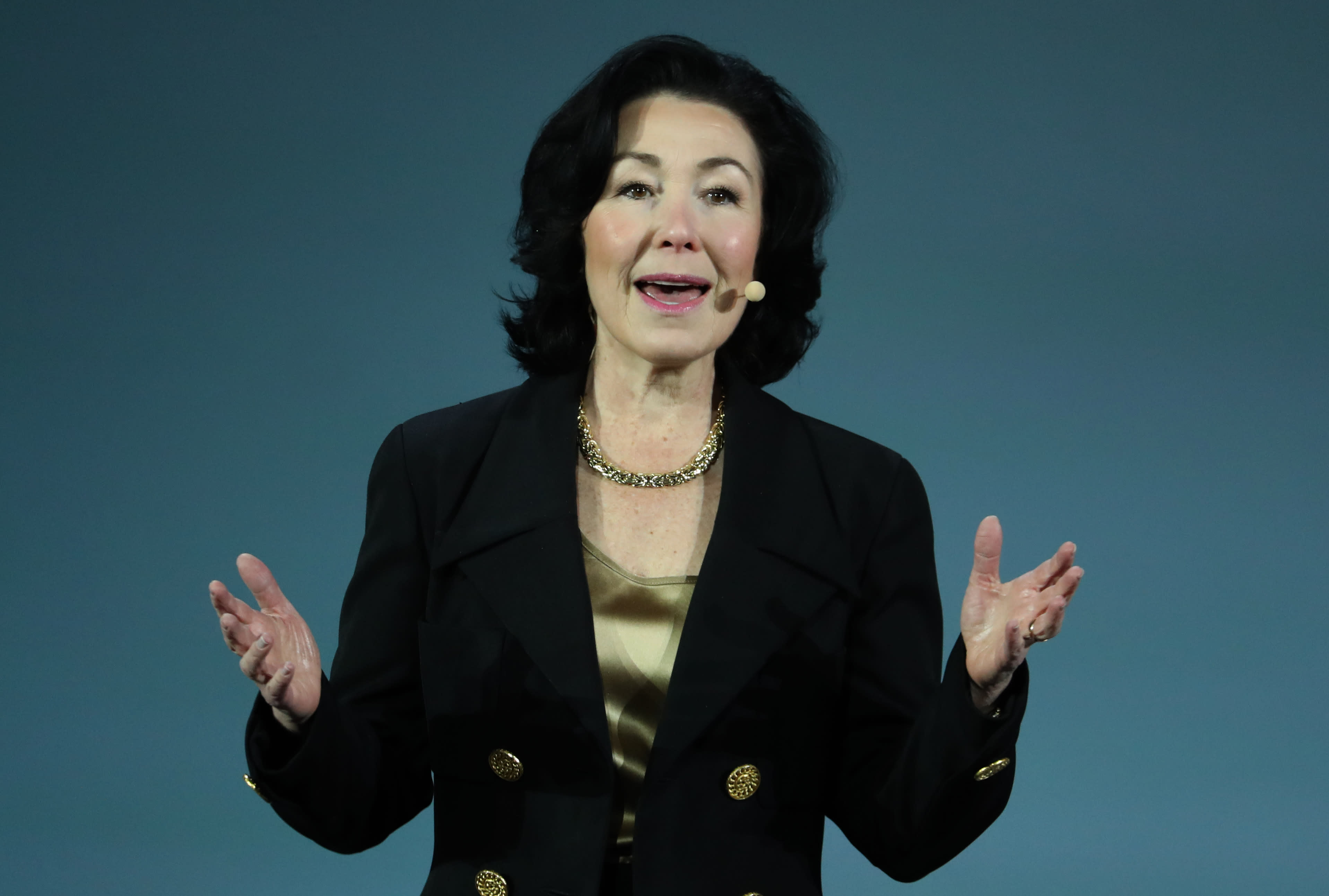

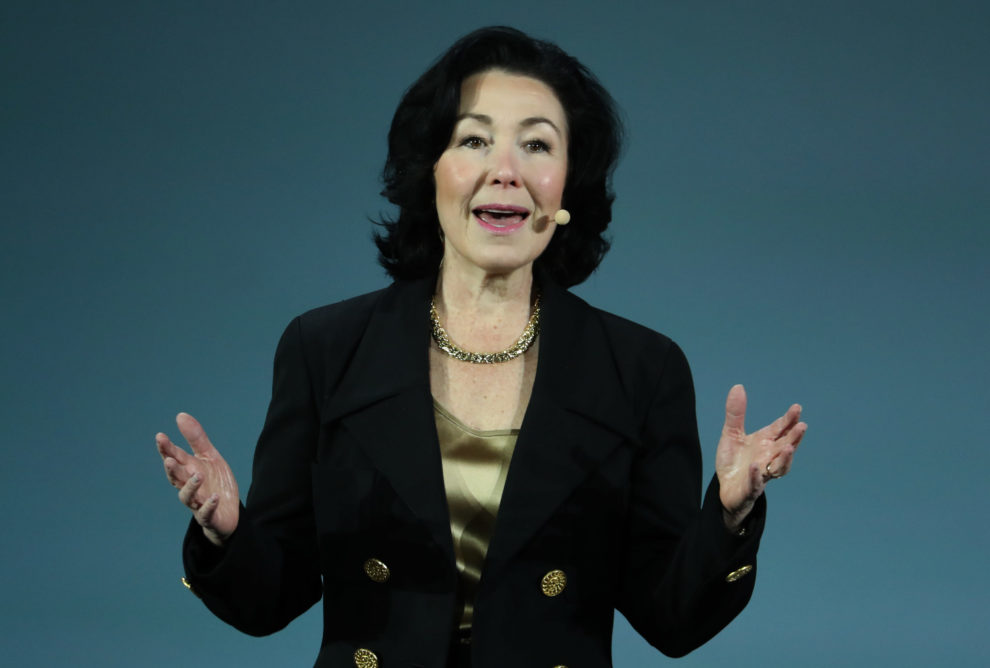

Oracle CEO Safra Catz delivers a keynote address during the 2019 Oracle OpenWorld on September 17, 2019 in San Francisco, California. Oracle CEO Safra Catz kicked off day two of the 2019 Oracle OpenWorld with a keynote address. The annual convention runs through September 19.

Justin Sullivan | Getty Images

Oracle shares rose as much as 5% and later lost much of their gains Thursday after hours, following an 11% drop during the day’s trading session, as the company reported fiscal third-quarter earnings and quarterly earnings guidance that were better than analysts had expected.

Here’s how the company did:

- Earnings: 97 cents per share, adjusted, vs. 96 cents per share as expected by analysts polled by Refinitiv.

- Revenue: $9.80 billion, vs. $9.75 billion as expected by analysts polled by Refinitiv.

The company’s revenue grew 2% on an annualized basis in the quarter, which ended on February 29, according to a statement.

Revenue from Oracle’s top business segment, cloud services and license support, totaled $6.93 billion, growing 4% year over year and coming in above the FactSet consensus estimate of $6.90 billion.

The cloud license and on-premises license segment contributed $1.23 billion in revenue, which is down 2% and more than the $1.19 billion FactSet consensus estimate.

The company’s hardware and services divisions missed expectations. Hardware had $857 million in revenue, down 6% in the quarter, while the FactSet consensus was $878 million. The company had $778 million in services revenue, down 1%; the FactSet consensus was $781 million consensus.

With respect to guidance, Oracle CEO Safra Catz told analysts on a Thursday conference call that she expects $1.20 to $1.28 in adjusted fiscal fourth-quarter earnings per share. The midrange of $1.24 is just over the $1.23 per share expected by analysts polled by Refinitiv. The company expects a range of a 2% revenue decline to 2% revenue growth in the fiscal fourth quarter. Analysts polled by Refinitiv had expected $11.31 in revenue, which would imply 1.5% revenue growth. Catz said the revenue guidance range was much wider than usual because of the current uncertainty in the business climate.

“There’s no question we can support our dividends with ease, okay, and any kind of increased dividend, we could support that also,” Catz said. “I mean our business is very strong, it generates very large amounts of cash.”

Oracle stock was up 1% after the call ended.

The company’s board boosted Oracle’s share buyback authorization by $15 billion.

In the quarter Oracle announced the availability of a Cloud Data Science Platform service and said former Infosys CEO Vishal Sikka was joining its board.

Societe Generale analysts led by Richard Nguyen upgraded its rating on Oracle stock to buy from hold in a note distributed to clients on March 4.

“In our view, Oracle’s execution capacity ranks among the best in the sector,” the analysts wrote. “In the past two recessions, the group successfully increased its margins thanks to its ability to cut costs rapidly.” They estimated that two-thirds of the company’s revenue comes in on a recurring basis, including through maintenance.

Oracle stock hit a 52-week low of $39.71 during Thursday’s session amid a wider market selloff as coronavirus continued to impact the economy. The stock had not traded at that level since January 2017. Notwithstanding the after-hours move, Oracle shares are now down 23% since the beginning of the year.

WATCH: IBM is analogous to Oracle’s infrastructure business: Bernstein’s Toni Sacconaghi

Add Comment