“I told you these were shadows of the things that have been.That they are what they are, do not blame me!” — The Ghost of Christmas Past from Charles Dickens’ “A Christmas Carol”.

I frequently hear from readers haunted by past investments. Many of you are trying to build an investment portfolio that meets your current goals, needs and ideals while trying to figure out what to do with these remnants of the past.

After reading our blog and others like it, you realize that a simple, low-cost, tax-efficient approach to investing is the best approach for most people. Choosing a few index funds, or maybe a single target-date fund, combined with an appropriate savings rate will get most readers to the secure retirement numbers they desire.

Unfortunately, for many that realization comes after years or even decades of investing. Many of us have a hodge-podge of investments accumulated over time. We were sold products by financial advisors, tried our hands at stock-picking schemes, or threw darts at the myriad selections in our 401(k).

So what do we do with these ghosts of investments past? I dealt with this problem when unwinding my past investment mistakes before I could move forward. Trying to deal with these mistakes can feel overwhelming.

Specific actions will vary depending on your circumstances. But there is a universal process that we can all follow to make the best decisions going forward. It will enable action and help avoid expensive errors as we build the portfolio we desire while unwinding past mistakes.

Step 1: Stop investing

My goal when writing is to simplify complex topics and inspire action. In this case, your actions have created the situation you’re in.

So the first step is to stop investing. There are several reasons for this if you are planning to change your investment approach.

The first reason is risk. If you are investing in a volatile asset that you may want to sell in the short term, there is substantial risk that your investment could drop in value in the interim.

I made this mistake when I put the cart before the horse and impulsively started investing large amounts into my 401(k) before developing a comprehensive investing plan, only to then reallocate the money into different investments a few months later.

The second reason to stop investment contributions applies if you are investing in taxable accounts. Short-term capital gains are taxed at a less favorable rate than long-term capital gains.

It is therefore generally wise to hold investments with substantial gains until they receive more favorable tax treatment. Not adding to these investments stops the cycle of creating new short-term gains that complicate the process of selling old investments.

Make sure you are not unintentionally adding more new money to these investments. It is generally good advice to automatically reinvest your dividends and interest. In this case, it is wise to shut off this feature so you are not adding to investments you no longer want. Contribute only to investments you plan to keep long term.

Step 1A: But keep saving!

To be clear, you should continue contributing to your investment accounts. This is particularly true if stopping contributions means you would miss out on free money from employer matches to retirement or health savings accounts. And be careful not to miss the opportunity to contribute to tax-advantaged accounts for a particular year.

Read: Choosing an HSA can save you money now and make you even more later

You can automate contributions into high-yield savings accounts, money-market or short-term bond funds where your money can earn interest for the short time until you determine where you want to direct future contributions for the long term.

This allows you to maintain the habit of automating savings while avoiding short-term market risk.

Read: Save $1,000 a year. Retire with millions

Step 2: Develop a plan

Once you have stopped throwing good money after bad, it’s time to establish a plan to guide you moving forward. I wrote out an investment policy statement. Taking this action was incredibly helpful to start and stay the course when managing our investments.

It’s easy to get caught in paralysis by analysis. Set a deadline to finish your plan and start implementing it. This should be a month to several months, not years!

I’ve reviewed the four resources that have had the most impact on my investment philosophy:

• “The Little Book of Common Sense Investing”

• “The Intelligent Asset Allocator”

• “All About Asset Allocation”

After developing a basic plan for controlling fees, taxes and behavior, the most important decision to make is determining an asset allocation appropriate for you needs and risk tolerance. Once you know where you want to be going forward, you will need to determine how old investments fit into this portfolio.

My wife and I started with a sizable portfolio of actively managed mutual funds split between taxable, tax-deferred and Roth accounts as well as inside of a variable annuity. We’d have liked to have gotten rid of all of those funds and start over, but considerations that I’ll outline below meant that it made sense to make this transition slowly.

We looked up each of the funds we held and saw where they fit in the Morningstar Style Box. We then considered the old funds as part of our target allocation in the most closely correlated asset class. Gradually, we sold them and bought the actual funds we wanted in that asset class.

Step 3: Start making new contributions

Once you see where you are and where you want to be, start buying new investments in alignment with your investment plans. You can start by buying assets that are short of your desired allocation.

Any cash you’ve saved while figuring out your investment plan can now be allocated. As new money becomes available, you can dollar cost average into the asset classes.

Dealing with the ghosts

Emotions can run high when you consider your past investment mistakes. I experienced anger at the poor advice I received and regret over the opportunity costs of my mistakes. Learning from those mistakes is part of the price you pay to invest. Accept it and move on.

Emotions and investing can be a lethal combination. It is crucial to separate emotion from your decisions to avoid acting rashly and making more mistakes. If this is difficult or impossible for you, hiring a financial adviser may be beneficial.

We decided to manage our own investments. We developed a plan to address our past mistakes in a way that allowed us to move on systematically without incurring unnecessary fees or taxes that would worsen our situation.

Step 4: Address tax-advantaged accounts

Start rebuilding your investment portfolio in tax advantaged accounts. You avoid taxation in the year you make a contribution and pay the taxes when the funds are withdrawn with tax deferred accounts. With Roth accounts, you pay income taxes up front, and you never pay taxes again.

In either case, you don’t pay taxes on capital gains on a year-to-year basis. This means you can sell any investments held inside these accounts without worrying about tax consequences.

You do want to check that your specific account doesn’t have rules that limit trading. Check that the investments inside the accounts are not held within a structure like an annuity that may come with surrender charges.

You can roll over retirement accounts from former employers to an IRA at a brokerage of your choice. If you’re still working, you may also have the option to roll them into your current retirement plan. Either provide options to control fees and simplify your portfolio by consolidating it.

Assuming you hold simple investments with no onerous trading or surrender fees, you can sell everything inside a tax-advantaged account at once without worrying about tax consequences. You can then immediately reinvest the money according to your desired asset allocation and move on with your life.

Read: The Roth strategy we wish we’d built for early retirement

Step 5: Address taxable accounts

Switching investments in taxable accounts is more complex. When you sell investments in a taxable account, it creates a taxable event.

Step 5A: Understand capital-gains taxes

You will owe taxes on any increase in value over the initial investment amount. For example, assume you invest $100 and your investment is now worth $150. You will owe taxes on the $50 capital gain if you sell the investment. You owe no tax on the $100 you invested, known as the cost basis.

It is generally unwise to make investment decisions solely based on tax consequences. You want to make money on investments, which results in taxation of those gains. However, you do want to be aware of the tax consequences of your investment decisions.

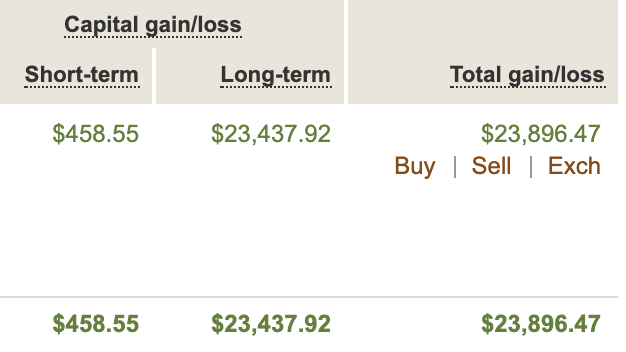

If you haven’t kept great records of your investments, the brokerage where you hold your investments should provide information as to how much gain or loss your investments have accumulated. They should also be able to tell whether these are short or long-term gains or losses. See the screenshot below as an example from one particular fund held at Vanguard.

Example of capital gains displayed in a brokerage account

Step 5B: Understand the impacts of creating capital gains

There are a few things to consider before selling investments in a taxable account:

1. Understand the difference between the taxation of short-term and long-term capital gains. In many cases it is wise to hold an investment for at least a year to avoid paying taxes at the higher short-term rate.

2. Understand that selling taxable investments may create taxable income. This income may affect other areas of your tax planning. A few examples:

• When buying insurance on the Affordable Care Act marketplace, additional income may adversely affect your premium tax credit. In worst-case scenarios, one additional dollar of income can push you over the subsidy cliff and cost thousands of dollars in additional health insurance premiums.

• There are income limits that disqualify you from using certain tax-advantaged accounts once the limit is exceeded. For example, in 2020, singles making greater than $124,000 and married couples filing jointly making greater than $196,000 will exceed the income limits allowing them to contribute to Roth IRA accounts.

• For those collecting Social Security, your total taxable income affects how Social Security is taxed.

3. The long-term capital-gains rate is 0% for those in the lowest tax brackets. The income produced by selling off investments could push your long-term capital-gains rate to 15%. For those nearing retirement, it may make sense to hold onto investments you don’t want long term until you can gradually sell them without a tax hit once your income is lower.

Consider whether it makes sense to sell off your taxable investments after looking at your situation holistically.

Read: Here’s the formula for paying no federal income taxes on $100,000 a year

Step 5C: Selling taxable investments

If it makes sense to proceed with selling off taxable investments, you need to develop a plan. Plans will vary depending on individual circumstances.

When dealing with my own past investments, the strategy was to start selling old actively managed mutual funds. I had competing goals. My first goal was to eliminate the high fees and unnecessary and unpredictable taxable income the actively managed funds produced, and to do so as quickly as possible. My second goal was to avoid creating too much income by selling off the old investments so that my wife and I could fully contribute to our Roth IRAs each year.

I started by looking for holdings that had gone down in value and sold those first. This allowed me to harvest those losses. I then sold off the largest holdings with the smallest gains until my gains matched my losses. This allowed me to eliminate a substantial portion of my old taxable investments without any tax consequences.

Going forward, at the end of each year I considered our household income and then sold off as much of our old investments as possible without the capital gains pushing us above the Roth IRA income threshold.

It took three years to completely sell off the taxable portion of our old investment portfolio. I’ve documented the details here.

Special circumstances

What I’ve written to this point is true for simple investments including individual stocks, bonds or mutual funds. Unfortunately, many of us have to deal with even scarier ghosts in our investment pasts. There is great incentive for the financial industry to push complex and expensive financial products including whole-life insurance, equity-indexed annuities and variable annuities.

I unfortunately became somewhat of an expert on variable annuities. My wife and I realized that about a quarter of our portfolio was tied up in one. So we spent a lot of time determining the best way to get out of it. I published our step-by-step process when I was writing for Doughroller.

Thankfully, I have no direct expertise with other products. Several lessons from my experience with the variable annuity can be applied to these other investment products you may not want to keep.

• These products are complicated. If you don’t have the time or stomach to deal with them, it may be worth your while to pay a fee-only, fiduciary financial adviser to help you figure out your options and avoid getting stuck.

• Before paying an adviser, go in with realistic expectations.

• Insurance companies produce these products with teams of lawyers. “Advisors” operating under suitability rather than fiduciary standards sell the products. Don’t expect to find a loophole that will allow you to escape the contract without penalty or sue the person who sold it to you.

• Teams of actuaries design these products to assure the insurance companies will not lose money. To some degree you’re going to have to take your medicine. You’ll likely either pay high fees if you keep the product or a surrender fee if you sell it.

Now read: Why getting an annuity from your 401(k) is a terrible idea

Take action

Dealing with past investment mistakes can cause emotional distress. It also can be technically complicated for those unfamiliar with the rules that govern different investment accounts and products.

All of this can feel overwhelming. I understand. I’ve been there. Recognize that you can’t change the past, but you can take control over your future.

Start today. Leave your investing ghosts in the past where they belong.

Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. This was first published on the blog “Can I Retire Yet?”

Add Comment