Beyond Meat had a wild first year as a public company. After pricing its IPO at $25, the stock rose to around $235 in just three months. Earlier this year, the stock dropped to a low of around $54. It jumped 26% on Wednesday after beating consensus earnings expectations for its first quarter and now trades around $126.

Given the stock BYND, +8.84% now trades nearly three times higher than its 52-week low, investors must ask themselves whether Beyond Meat can justify the expectations baked into its stock price. Or are those buying the stock simply falling for the hype and ignoring significant issues facing the maker of plant-based meats?

I believe Beyond Meat’s valuation is beyond expensive. The future profit growth baked into the current stock price assumes the company faces no competition and will achieve 150% market share of the entire meat substitute market while also increasing margins.

Profitability is headed in the right direction

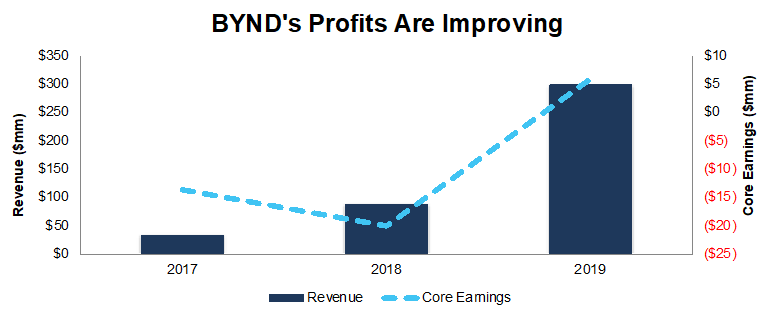

Most know that Beyond Meat has had massive revenue growth (one reason the stock soared post-IPO). Since 2017, the company has grown revenue by 202% compounded annually. More importantly to any bull argument, the company’s core earnings improved from a loss of $14 million in 2017 to a profit of $6 million in 2019. The firm’s core earnings margin improved from -42% to 2% over the same time. However, improved profitability has not slowed the firm’s cash burn. Free cash flow (FCF) was -$107 million in 2019 after -$72 million in 2018.

Figure 1: Beyond Meat’s core earnings and revenue since 2017

Competition is plentiful and has competitive advantages

Despite Beyond Meat’s early success, the alternative meat industry is quickly filling with competitors. Tyson Foods TSN, +5.46%, the largest meat producer in the U.S., sold its stake in Beyond Meat in April 2019 and just a few months later announced the launch of its plant-based food brand Raised & Rooted. Some of the largest consumer food brands have followed suit.

Below is just a short list of some of Beyond Meat’s competitors:

• Incogmeato by Morningstar Farms, owned by Kellogg K, +1.57%

• Simply Plant-Based Meatless Burger, a Sysco SYY, +1.93% exclusive product

• Simple Truth plant-based meat, owned by Kroger KR, +2.02%

•Sweet Earth Brand, owned by Nestlé NSRGY, +1.59% NESN, +1.17%

•Gardein, owned by Conagra Brands CAG, +1.05%

• Happy Little Plants, owned by Hormel Foods HRL, +1.39%

• Boca Foods, owned by Kraft Heinz KHC, +2.53%

• Impossible Foods, privately owned

This list isn’t exhaustive, and doesn’t include the many meat-based products that Beyond Meat competes against for consumer dollars.

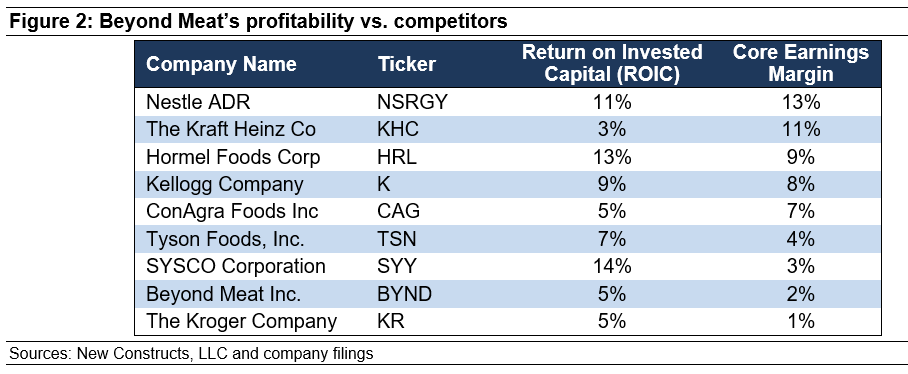

More importantly than just the number of competitors, Beyond Meat’s profitability ranks near the bottom of this group. Per Figure 2, Beyond Meat’s core earnings margin is only higher than Kroger’s and a fraction of many of its direct competitors.

Low margins in an increasingly competitive industry leave Beyond Meat with less flexibility to compete on price. Furthermore, many of the firms in Figure 2 have other key advantages — multiyear relationships and existing distribution networks with grocery stores or, in the case of Kroger, control of distribution and the end-consumer relationship.

As Kroger invests further in its Simple Truth brand, we’d expect the firm to allocate more shelf space to its own in house brands, rather than a competitor such as Beyond Meat. This competitive disadvantage only makes Beyond Meat’s path to sustainable profitability that much more difficult.

Beyond Meat represents poor risk/reward

The biggest question facing the company, and any competitors, over the next few years is whether its products will gain mainstream acceptance as a form of meat, or if they will always be treated as a niche, alternative product.

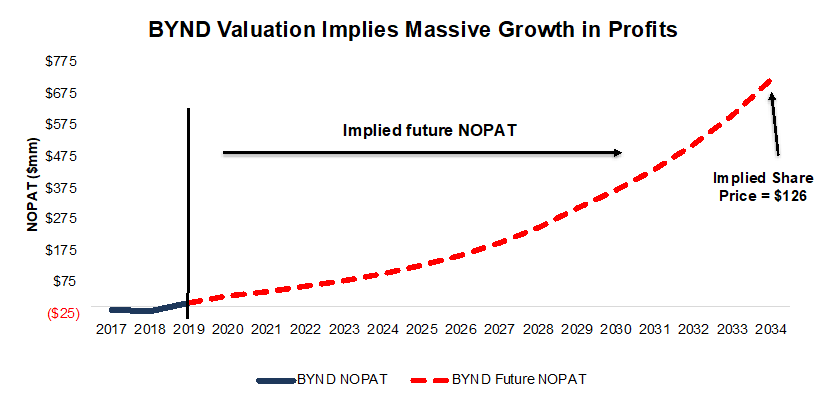

Below, we use our reverse discounted cash flow (DCF) model to quantify the cash flow expectations baked into its current stock price. This analysis reveals that the stock is already priced for perfection, and anything less than mainstream acceptance leaves investors with significant downside risk.

To justify its current share price of $126, Beyond Meat must immediately improve its net operating profit after tax (NOPAT) margin to 6% (double its current NOPAT margin and equal to the highest margin in Tyson Foods’ history) and grow revenue by 28% compounded annually for the next 15 years. See the math behind this reverse DCF scenario.

In this scenario, Beyond Meat would earn over $12 billion in revenue in 2034, which is greater than Conagra’s trailing 12 month (TTM) revenue and just below Kellogg’s TTM revenue. For reference, Allied Market Research projects the entire meat substitute market will be worth $8.1 billion in 2026.

Figure 3 compares the stock’s implied future NOPAT to the firm’s historical NOPAT.

Figure 3: Beyond Meat’s implied profit growth

Sources: New Constructs and company filings

Even if we assume that Beyond Meat executives focus on profitability rather than revenue growth and can achieve an 8% NOPAT margin (higher than Tyson) and grow revenue by 24% compounded annually for the next decade, the stock is worth just $43 today — a 66% downside to the current stock price. See the math behind this reverse DCF scenario.

Each of these scenarios also assumes Beyond Meat is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, the company’s invested capital grew by an average of $84 million a year in 2018 and 2019.

Of course, there’s also a potential scenario where Beyond Meat’s products fail to gain mainstream acceptance, or get squeezed out by their competition, and the firm never generates consistent profits. As evidenced by the scenario above, the stock is already priced for perfection and the downside risk is significant.

David Trainer is the CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and model economic earnings. Kyle Guske II and Matt Shuler are investment analysts at New Constructs. They receive no compensation to write about any specific stock, style or theme. New Constructs doesn’t perform any investment-banking functions and doesn’t operate a trading desk. Follow them on Twitter @NewConstructs.

Add Comment