The earnings recession is not news. What most investors don’t know is that core earnings, when adjusted for unusual gains and losses hidden in footnotes, are a lot worse than they realize.

Meanwhile, the S&P 500 index SPX, +0.22% has been on a tear this year, up nearly 25% and currently around an all-time high.

How do stocks rise when the underlying fundamentals fall?

Answer: Most investors are not aware of the more severe decline in core earnings.

Why are they not aware?

Answer: Because too few people read the footnotes.

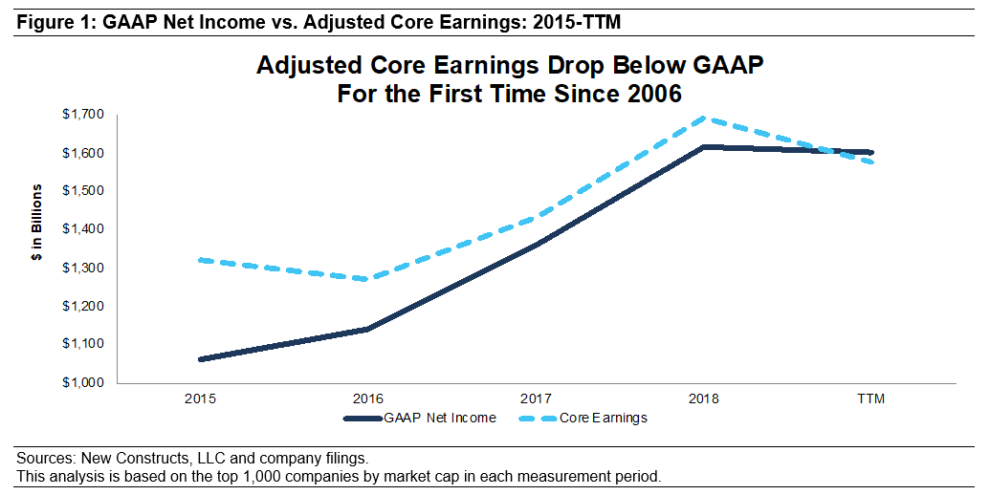

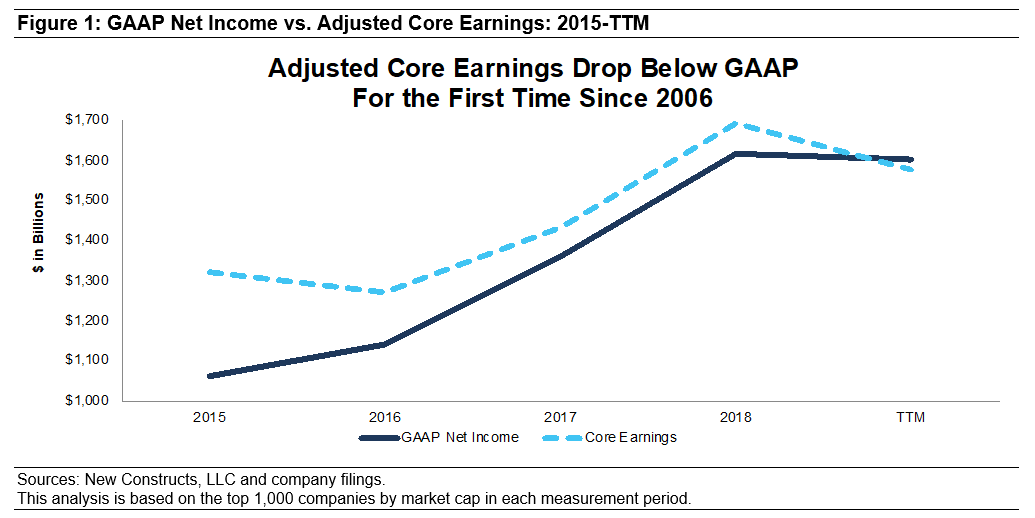

Adjusted core earnings drop below GAAP earnings for the first time since 2006

Over the trailing 12 months, GAAP earnings fell 1% while adjusted core earnings fell 6% for the largest 1,000 companies by market capitalization in each period. Most investors know that GAAP earnings are prone to distortion because they include lots of non-recurring or unusual items. Most investors are not aware that core earnings (from CompuStat or Wall Street analysts) are also distorted by unusual items. In fact, earnings for the S&P 500 were distorted by 22% on average in 2018.

Figure 1 highlights the more severe drop in core earnings when accounting for these hidden gains or losses.

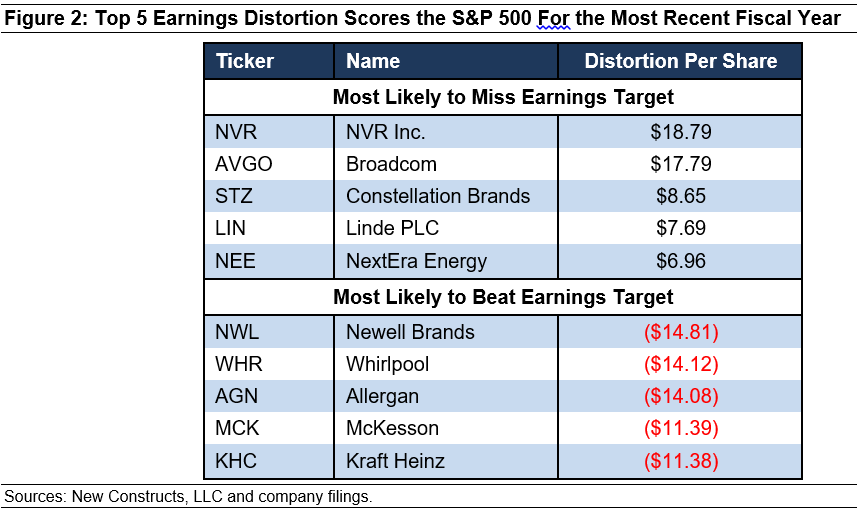

Whose earnings are most distorted?

Figure 2 shows the best and worst S&P 500 companies from our Earnings Distortion Scorecard. High levels of earnings distortion means companies are overstating their earnings; so there is a greater risk of their missing their earnings targets. Negative or lower levels of earnings distortion mean the opposite.

The companies most likely to miss earnings in Figure 2 overstated their core earnings by including a variety of unusual gains, including:

• A $7.3 billion one-time gain due to the impact of the corporate tax cut for Broadcom AVGO, -0.10%

• A $2 billion unrealized gain on securities for Constellation Brands STZ, -2.90%

• A $3.3 billion gain on sale of businesses for Linde LIN, -0.65%

On the other hand, large asset write-downs are the cause of the understated earnings for all the companies most likely to beat in Figure 2.

Why the severe drop in core earnings?

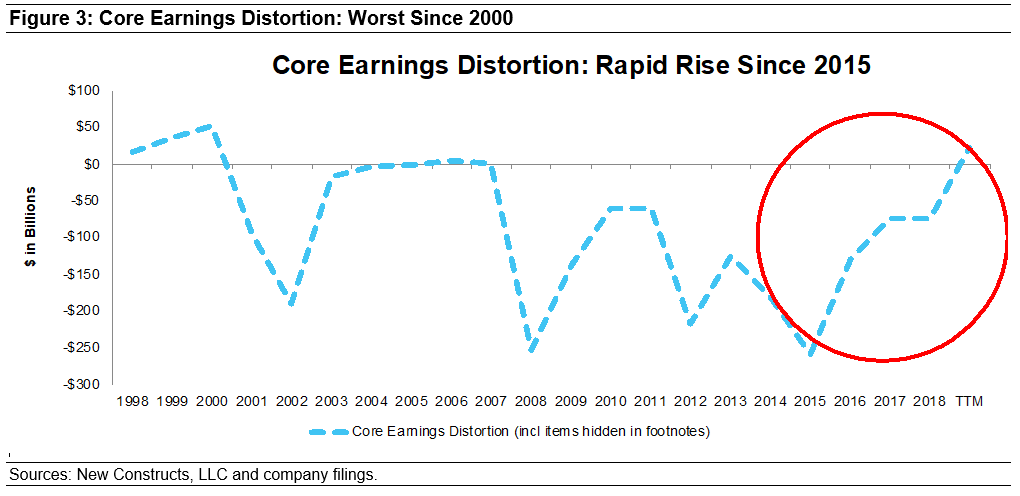

Earnings distortion from hidden gains is on a rapid rise, and core earnings from traditional sources have not been this overstated since 2000. Figure 3 shows the level of core earnings distortion from the unusual gains and losses from 2000 to the present. Note the rapid rise in the distortion from gains buried in footnotes over the last few years.

The rapid rise in earnings distortion since 2015 means that an increasing amount of corporate income is coming from unusual or one-time gains, which is not apparent to investors analyzing news releases or income statements. Corporate managers hide the one-time nature of these gain by only disclosing them in the fine print. In other words, managers are dressing up the numbers in an increasingly aggressive manner over the last few years.

Notably, earnings distortion is now positive for the first time since 2007 and is the highest it’s been since 2000. Figure 3 shows that soon after earnings distortion broke into positive territory, in 2006-07 and 1998-2000, the stock market crashed.

Catalyst for a market correction

We know that the Federal Reserve plans to leave interest rates unchanged for the near future, so there are two likely catalysts for a market correction:

1. Companies suddenly report core earnings more accurately.

2. Investors figure out the true core earnings.

The odds of the first option are lower than the second. We’re not holding our breath that investors will suddenly decide to spend hours scouring footnotes and adjusting their numbers for the hidden gains and losses that managers use to manipulate earnings. It is more likely, however, that investors would start using research that does the footnotes research for them

The only remaining question is how quickly investors adopt this research. We are not sure how to answer that question except to say that those who adopt sooner have an advantage over those that adopt later.

Earnings distortion reveals a stock to avoid

Some stocks are more risky than others.

We created the Earnings Distortion Scorecard to help investors identify stocks most at risk of an earnings miss due to accounting distortions, and Northrop Grumman NOC, +0.27% is currently near the top of the list.

We previously warned investors about Northrop Grumman in our article “Earnings Distortion Makes This Stock a Sell”. The stock is up 45% so far in 2019, and the company has beat earnings expectations in all three quarters. However, our analysis shows that these earnings beats are the product of non-operating items.

Over the trailing-12-month period, Northrop Grumman had $415 million in net unusual income adjustments that cause earnings to be overstated. Notable unusual gains include:

• $440 million ($2.61 per share) in non-operating pension gains — Page 72 of the 2018 10-K

• $82 million ($0.49 per share) in company-defined other expenses — Page 1 of the third-quarter 2019 10-Q

• $84 million ($0.49 per share) in non-recurring tax benefits — Page 62 of the 2018 10-K

Northrop Grumman’s GAAP earnings per share are up 24% over the trailing 12 months, but its core earnings per share are up just 3%.

Meanwhile, Northrop Grumman’s valuation implies that it will continue to grow profits at the rate of GAAP EPS rather than core earnings. Our reverse discounted cash flow (DCF) model more rigorously assesses the valuation of this stock by quantifying the expectations for future profit growth baked into the stock price.

When we look at the expectations implied by its valuation, the stock looks much more expensive. In order to justify its valuation of $356/share, Northrop Grumman must improve its NOPAT margin to 10% (up from 9% in 2018) and grow NOPAT by 7% compounded annually for the next 10 years. This seems ambitious for a company that has grown NOPAT by just 3% compounded annually over the past decade. See the math behind this dynamic DCF scenario.

If Northrop Grumman maintains its 2018 NOPAT margin of 9% and grows NOPAT by 3% compounded annually over the next decade, the stock is worth $224 a share today, a 37% downside to the current stock price. See the math behind this dynamic DCF scenario.

Investors who want to stay safe in an increasingly dangerous market should avoid companies with overstated earnings, like Northrop Grumman.

David Trainer is the CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and model economic earnings. Sam McBride and Kyle Guske II are investment analysts at New Constructs. They receive no compensation to write about any specific stock, style or theme. New Constructs doesn’t perform any investment-banking functions and doesn’t operate a trading desk. Follow them on Twitter @NewConstructs. This is an abridged version of “Consensus Earnings Are Wrong & How Much Is It Costing You?” that was published on the New Constructs website.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>