It may be a good time to remind everyone of an old market adage: Nobody will ring a bell when market cycles end. There won’t be a grand announcement that a top is in. There won’t be a massive reversal that will make it clear to everyone that a major top is in, a top for years to come. Wall Street won’t announce it, nor will the Fed, and any warnings will be dismissed.

Nobody can call a top in advance, tops are only clear in hindsight. Not the day after, but often only months later.

In fact tops can be very sneaky, innocuous, uneventful, subtle. Indeed there was nothing special about key market pivot points in 2000 or 2007.

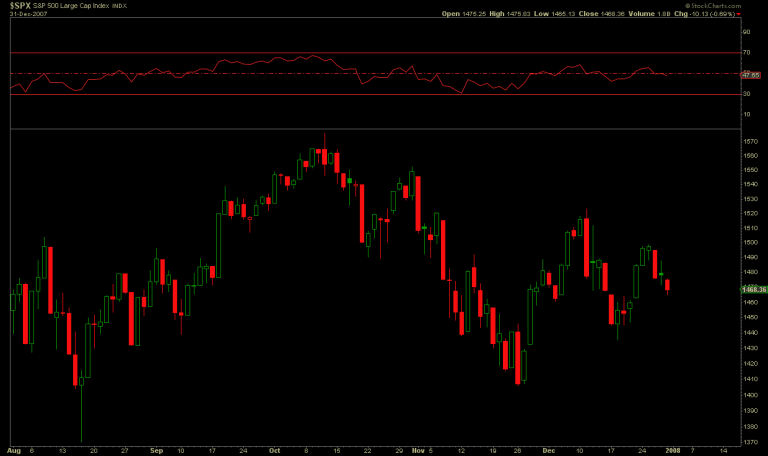

Here’s the lead up to the 2007 top in the S&P 500 SPX, +0.33% and the action right there after:

There was nothing drastic about it at the 1,570 level. The next day was an inside day, then an outside day and a couple slightly lower days following that. Nothing there suggested markets would embark on a journey toward 666 by March 2009.

Again: Nobody will ring a bell and nobody can call it, it’ll only be clear in hindsight. Heck even in December of 2007 one could’ve argued new highs would come again. They obviously didn’t, but the action was just chop and a lot of back and forth. Tops are processes. And at every single one of them Wall Street will have higher targets.

Case in point: At the end of 2007 these were the 2008 targets:

Yet 2008 ended with the S&P at 900.

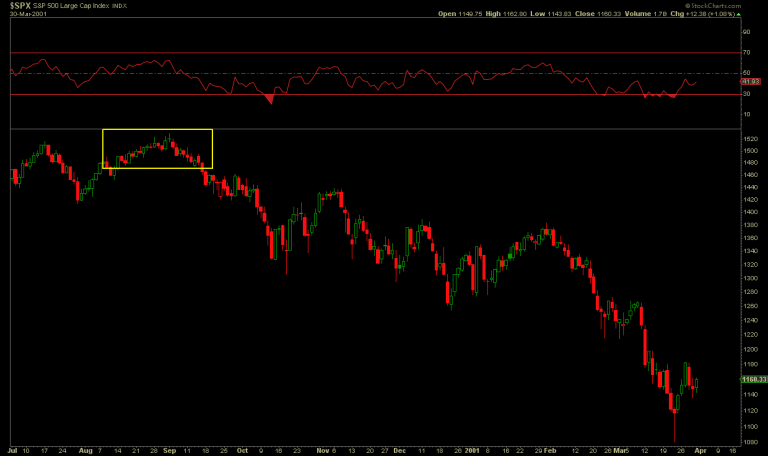

It was no different in 2000: While the S&P peaked in March, it had another big rally into the summer to near the all-time highs:

Nothing dramatic happened the day after either, or any of the 10 to 20 days after, just slow drip. But it was the beginning of a long journey down.

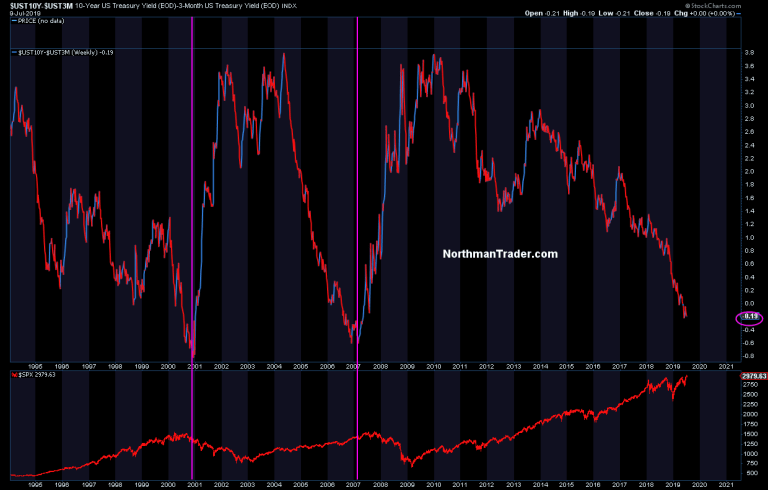

Both of these events happened in conjunction of an inverted yield curve:

…with weakening internals and participation and slowing growth. It’s the same backdrop we have now.

The only difference in my mind is how low rates are already, the massive amounts of debt that has been accumulated and the desperation with which they (the Fed, Fed Chairman Jerome Powell, Treasury Secretary Steven Mnuchin, White House National Economic Council Director Larry Kudlow, President Donald Trump etc.) try to sweet-talk markets every single day while unemployment is at a cycle low and bond markets are screaming caution with equities still drifting higher:

As passive investing has become all the rage investors have embraced a fantasy, that markets will rise forever and ever and central banks will keep all corrections contained and minimized in duration.

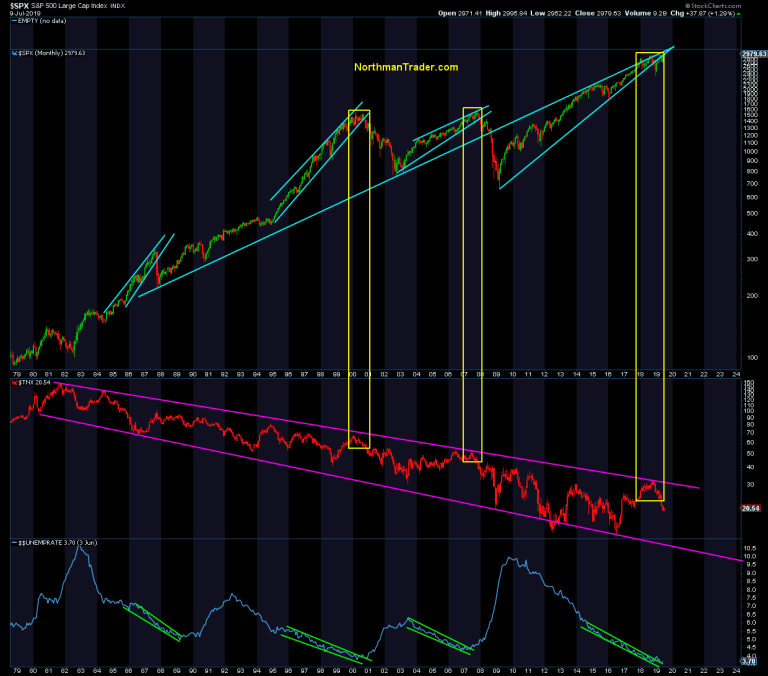

And I can’t blame investors for believing this. They have been trained to believe it:

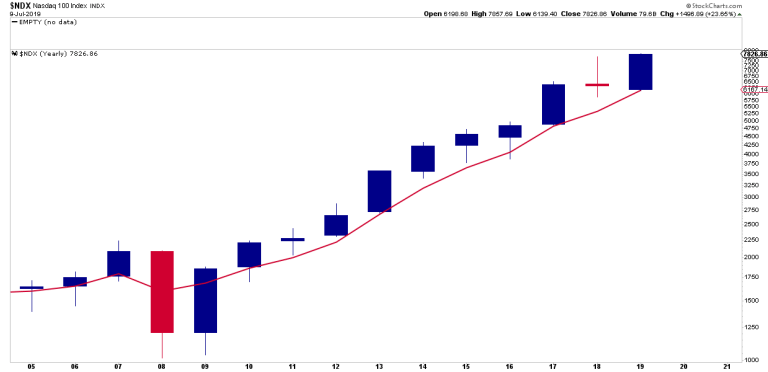

Here’s a yearly chart of the Nasdaq-100 index NDX, +0.68% :

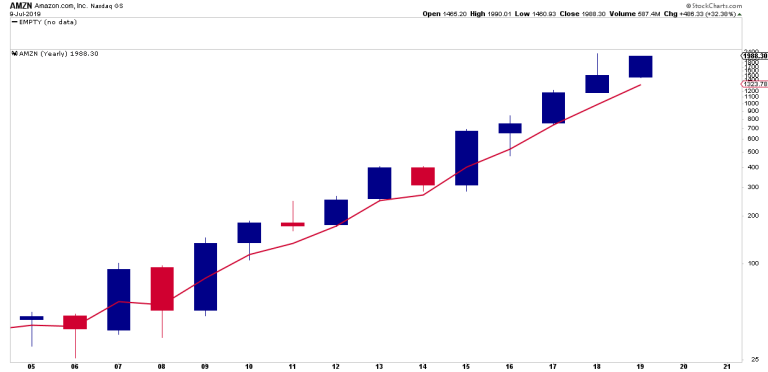

And of Amazon.com AMZN, +1.32% yearly:

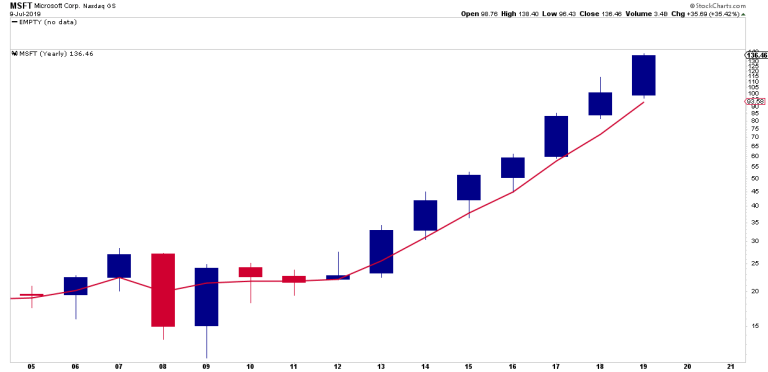

And of Microsoft MSFT, +0.83% yearly:

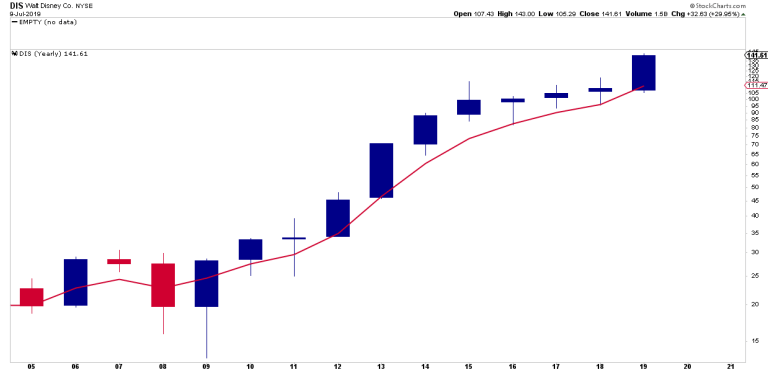

Here’s Walt Disney Co. DIS, +0.45% yearly:

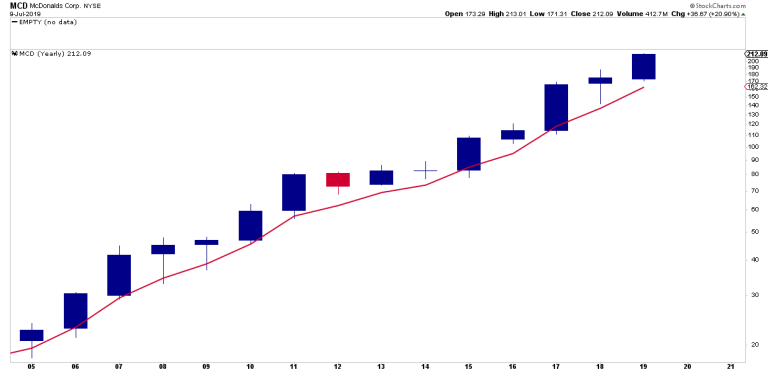

And McDonald’s MCD, +0.35% yearly:

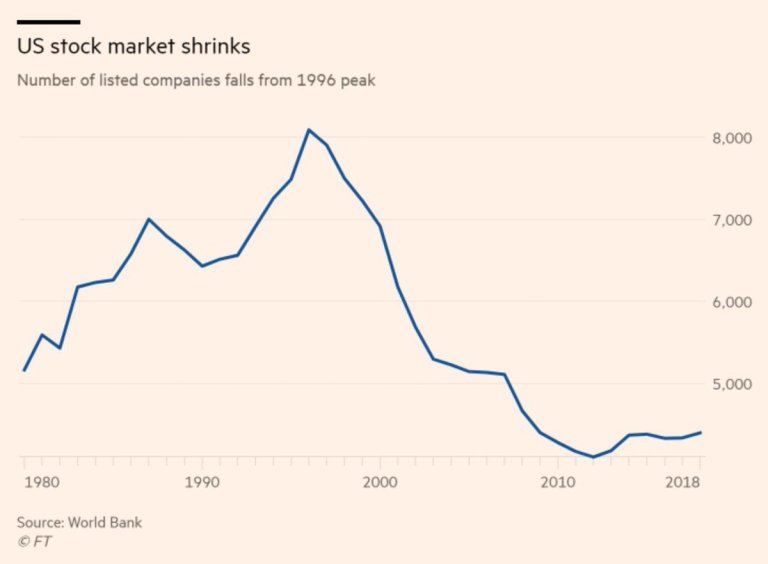

Stocks and indexes that haven’t corrected in meaningful ways in a decade, but remain on a steady ascent as the size of the investible universe is shrinking.

There are fewer companies to invest in:

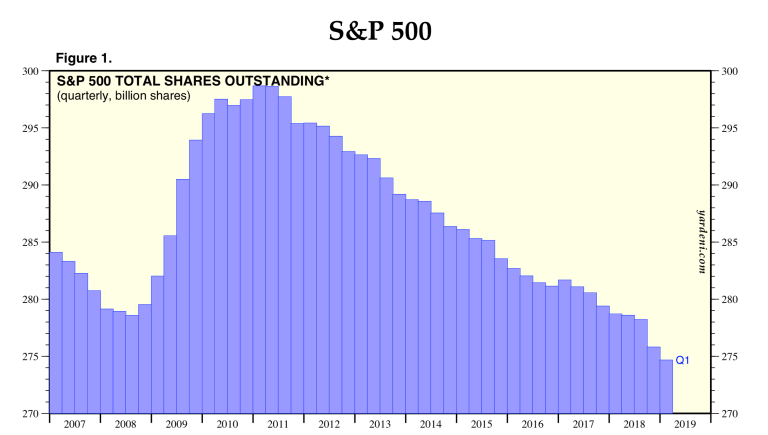

with ever fewer shares to buy as the outstanding float keeps shrinking courtesy buybacks and splits:

Ever more passive investment money is buying into an ever-shrinking universe of stocks all covered by an expanding universe of ETFs tracking the fewer available investible shares.

Permanent levitation. Infinite growth in a no-yield, low-growth world. Believe it to be true if you wish, just know nobody will ring a bell if it’s not.

Now we may still grind higher (Sell Zone) or we may not. After all, we have entered the sell zone twice and both times the stock market then reversed. But be sure Jerome Powell will do his best to keep the fantasy of ever-rising stock prices alive. In 2007 the final high came on the heels of the Fed’s first rate cut — 50 basis points under Ben Bernanke, the same Fed chair who said subprime was contained. Markets peaked two weeks later.

And nobody rang a bell. Not the Fed, not Wall Street. And investors were left holding the bag.

Now read: Live blog and video of Jerome Powell testimony to House committee on economy, interest rates

Sven Henrich is founder and the lead market strategist of NorthmanTrader.com. He’s well-known for his technical, directional and macro analysis of global equity markets. Follow him on Twitter at @NorthmanTrader.