In lieu of a big stock-market selloff on global economic growth slowdown and trade jitters, the market seems to still be expecting the “Art of the Deal” from Donald Trump on China and/or the Federal Reserve cutting interest rates 0.75 percentage points this year — which ever comes first.

The S&P 500 index SPX, +0.00% is up 5% after falling 6.6% in May, putting it less than 2% from April highs (despite a very tight $1 range last week). During that time, however, trade wars and tariff threats have escalated, tankers have been torpedoed, and safe-haven plays of Treasurys TMUBMUSD10Y, +1.80% gold GC00, -0.18% and the U.S. dollar DXY, -0.19% have been strongly bid. So why are equities seemingly not afraid?

Big picture: Market participants want to believe this is 1995 — when the Fed cut rates the same day in July as the stock market set a record. Those cuts kept the whole shebang going in the 1990s until it went BANG!

In January 2001, “the Fed announced a surprise cut that sent the Nasdaq up 14% in a single day, which remains the index’s largest move since its creation in 1971. .. Following that day, the Nasdaq would fall 57% before hitting bottom..” @WSJheard

Another consideration, for the short term: Markets had an emotional reaction to Jerome Powell’s Pause and are now a tad ahead of themselves.

Odds of a rate cut on Fed Wednesday are near 30% now — and seemingly on the rise every day. In years past, the market knew pretty well what the Fed was going to announce. But times are different for sure: The mystery behind announcements by this Fed, the about-faces by this Fed, the political drama from the White House against this Fed and (let’s not forget) the likelihood of selloffs after news conferences as a result of “stepping in it” by this Fed… all of this Fed action creates a lot of volatility!

Read: The Fed may break a lot of stock-market investors’ hearts this week

And: Caroline Baum says a surprise interest-rate cut by the Federal Reserve could be its best decision

Treasury volatility

The Merrill Option Volatility Estimate, or Move, aims to track the implied volatility of U.S. Treasurys over the coming month, based on prices in their derivatives markets. It is the bond market equivalent of the Cboe’s VIX volatility index, considered the stock market’s fear gauge.

Back on March 20, I posted the $MOVE Index Bond Volatility chart on Twitter and wrote “Brace for Impact!”.

On March 27 I wrote: “Treasury Volatility caused the 10-year yields to crash which further inverted the yield curve” because “those who got caught selling volatility had to hedge by effectively going long Treasurys.” Basically, I judged from this $MOVE chart that we weren’t done.

Fast forward to today. MOVE has risen almost 100% from 42.53 on 20 March to over 80.

Inversion and the R-word

The rally in haven assets such as Treasurys, gold and the dollar reflect raising worries that the economy is in trouble but stocks don’t know how badly yet. Will we sell off in a more pronounced correction that puts at risk the equity bull market’s 10-year run? My thinking: Sideways-to-lower into 2020 election (or a trade deal — whichever comes first).

Headline GDP and unemployment figures give a false sense of calm. The global and domestic economic slowdown are combined with risks not yet priced into stocks — including but not limited to the trade war. Cam Harvey, the economist who first linked an inverted yield curve to economic declines, pinpoints the 3-month/5-year curve as a key recession indicator once it inverts for a full quarter. Well, it has officially finished a full quarter of being inverted. H/T @Reganonymous.

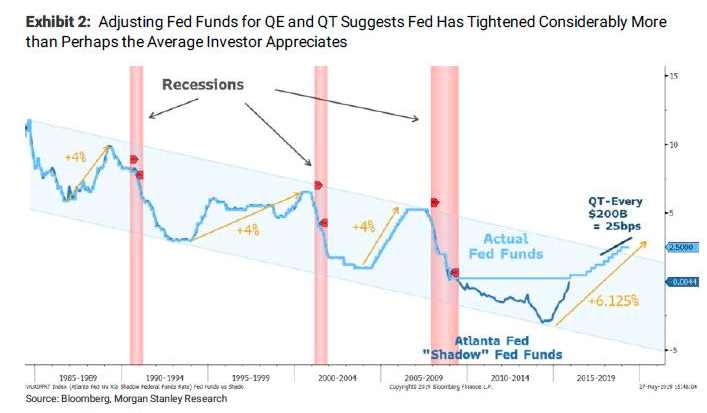

Most don’t expect that if Fed cuts the 10-year yields go UP, not down, as the market prices in “better economy” — steepening the yield curve. And … Here’s a friendly reminder of what can happen AFTER the Fed cuts: Recession. And judging from the “over-tightening” implied (see chart below) compared to prior cycles, that may be why the bond market is aggressively leading the anticipated rate cut AND why both gold and the dollar are interpreting it as recessionary.

This dramatic fall in yields doesn’t look done — either from the above Treasury Volatility MOVE chart (breaking up) or the bond market intonating 10-year rates are going lower to 2.0% this summer. It wouldn’t surprise me to see 1.75% by end of year.

The last time the U.S. 10-year government bond yield was at 2.25%, keep in mind, was the third quarter of 2017 when the fed-funds rate was 1.25%. And this is the disconnect — between what the market judges to be the appropriate interest rate and what the Fed judges to be the appropriate level — that is really helping to cause the dreaded yield curve inversion.

Fed cuts offer diminishing returns

The Fed will likely cut and soon. If the Fed doesn’t ease policy dramatically, the chances of the dollar approaching escape velocity are great. And that is exactly what the long-DXY crowd is betting on. And since a higher dollar will help suppress yields, bonds will continue their ascent as well. Think of it: long bonds and long dollar. Neither is bullish for equities.

So why are equities not falling?

Since the Jan. 26, 2018, peak in the MSCI World Index:

SPX………………………+0.58%

MSCI Eurozone………-19.04%

China large-caps…..-25.15%

MSCI Japan……………-36.82%

Where is the outlier? Yes, the U.S. is the best performer. We have the higher-yielding rates and strongest currency which has directly facilitated these results. But now with the trade war/s, we are putting this performance to the test. Since yields have diverged strongly from the dollar, traders must accept that deteriorating fundamentals have led yields lower even if in the short term, these same falling yields have supported sentiment-driven equities. This is not sustainable.

Traders may be sadly disappointed once they realize that even when the Fed cuts — whether June, July or September — this will only embolden President Trump to ratchet up his trade war and tariffs. I’m not sure which dangerous childhood game to compare it to: the Cinnamon Challenge, Chubby Bunny or straight-on Sack Tapping! But I am amazed the Fed wants to play.

For the market, Fed cuts can be negated by trade tariffs, supply-chain disruptions, revenue/profit contraction, reduced capex spending, unemployment. The immediate effects from trade wars — both in the economy and on the psyche — will be felt faster than the easing affect of rate cuts in the system. And for these reasons, the climb higher in asset prices will be that much harder. As global, domestic and earnings growth slows, consumers will start to get squeezed — slowly at first and then all at once.

Read: Trump to investors: Vote for me or else!

The path Trump has put the U.S. on to isolationism is not easily navigated and holds many dangers that the Fed is not mandated, let alone capable, to resolve. And yet it seems no one — not Congress, not his constituents nor party, not Chinese President Xi Jinping nor other world leaders — have any sway in convincing Trump that trade wars aren’t easy to win and will do significant damage to our economy, even potentially pulling forward a global recession. No one, except maybe the Fed.

Now read: Risks of global recession grow as Trump and Xi refuse to blink, Roubini says

Samantha LaDuc is a strategic technical analyst and trader at her own firm, LaDuc Trading. Follow her on Twitter @SamanthaLaDuc.