“ Crises offer companies unique opportunities to distinguish themselves against rivals. ”

The World Health Organization declared the global COVID-19 outbreak a pandemic on March 11, 2020. Three years later, what can companies and managers take away from this crisis to do better in the next one?

Answering this question is particularly pertinent now, as other crises unfold. Crises offer companies unique opportunities to distinguish themselves against rivals. Our assessment of the performance of more than 1,000 large companies around the COVID shock shows that, in the 18 months before the pandemic hit, the average gap in total shareholder return (TSR) between the 25th and 75th percentile performers across industries measured 75 percentage points, while 18 months after the shock, the gap had increased to 105 percentage points.

Looking at how businesses fared during the COVID crisis shows corporate leaders how to enhance their organization’s resilience and offers investors a way to identify resilient companies that can thrive through future crises.

What does the COVID pandemic tell us about resilience?

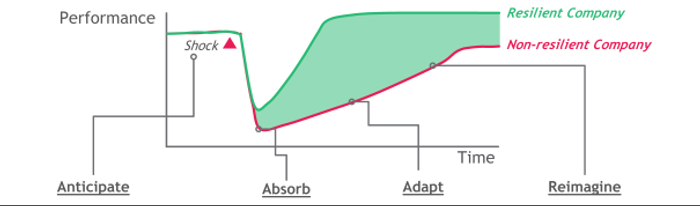

At its core, resilience describes the capacity to absorb stress, recover critical functionality, and thrive in altered circumstances. As such, the value of resilience is not just in damage mitigation, but also in innovation and seizing opportunity.

Resilient businesses can better anticipate and absorb the immediate impact of an external shock. They are better at preparing for hiatus and have built up an advantage in the form of operational redundancy, portfolio diversity or financial buffers.

Moreover, resilient companies adapt better than their peers to shifting circumstances, by more rapidly mobilizing in response to opportunities emerging from the crisis and so more quickly recovering their original position.

“ Resilient businesses are more likely to thrive in the new circumstances after a crisis.”

Finally, resilient businesses are more likely to thrive in the new circumstances after a crisis, due to their ability to reimagine their business for the “new normal” and to shape industry dynamics in the post-shock environment to their advantage.

Our historical analysis of almost 1,800 large companies indicates that between 1995 and 2020, outperformance during crises was primarily driven by withstanding the immediate impact of a shock.

During COVID, this trend reversed: For the 12 months after the COVID shock, 9% of the outperformance of new winners was driven by lower shock impact, 27% by faster recovery speed, and 64% by greater recovery extent.

For instance, companies with a keen understanding of the long-term shift to online and digital business models, and were already taking advantage of this trend, were much better positioned to succeed when the COVID pandemic accelerated this adoption. They subsequently left their rivals behind.

U.S. retail giant Kroger KR, -0.74% is a good example: Much of Kroger’s focus in recent years has been on preparedness for long-term trends in e-commerce. Its omnichannel investments, initiated years before the pandemic, meant that the company could offer home delivery and pickup to more than 95% of U.S. households in 2019.

When customers were apprehensive about in-person contact as the pandemic began, Kroger was ready to offer a robust digital alternative. The company doubled its online sales in the first quarter of 2020, cushioning the immediate impact of the COVID shock. Thanks to its investments in e-commerce, Kroger ranked among the top 10 overall online retail companies across all categories in the U.S. in 2022.

How can companies build resilience?

Building resilience requires a mindset shift away from a sole focus on maximizing short-run efficiency and returns, towards long-term competitive advantage: Our analysis indicates that resilience is key to this because crises separate the wheat from the chaff. Although crises occur in only about 10% of quarters, relative TSR during these times accounts for about 30% of a company’s long-run relative TSR.

In other words, performance during crisis periods has almost three times the impact of performance during more stable periods and two-thirds of long-term high performers, had strong crisis performance.

In our research, we have identified seven critical factors for making resilience an intergral quality of a company:

- Prudence: Enhancing the ability to anticipate and prepare for crises, e.g., by developing early warning systems and contingency plans.

- Redundancy: Building up absorptive capacity in the form of buffers (e.g., cash) or functionalities (e.g., suppliers, manufacturing) to buffer against shocks.

- Diversity: Creating different types of capabilities, revenue sources, or means of production to avoid correlated responses across the business.

- Modularity: Organizing in loosely linked modules (e.g., subsidiaries, plants, teams) to isolate crisis impact and avoid domino effects.

- Embeddedness: Connecting with the broader business ecosystem and aligning with shifting social norms in order to cushion shocks through collaboration and adjust to shifting needs and priorities. It is important to remember that resilience is a characteristic of connected systems, not only individual parts of those systems.

- Adaptiveness: Building the capability to respond quickly to changes in circumstances and to shape the new competitive environment (e.g., by practicing experimentation, selection, and scaling up winners).

- Imagination: Beyond adaptation, building the capability to systematically harness imagination in order to shape the new normal, rather than being the victim of change.

Our research indicates that although each crisis is unique, some businesses can achieve general resilience: In our 25-year study period, we found that 15% of companies outperformed their industries in at least 80% of the crisis quarters they faced. An example is Berkshire Hathaway BRK.A, -2.76% BRK.B, -2.81% : From 1995 to 2020 it has outperformed the diversified financials industry on TSR by about 2 percentage points year — with this outperformance being achieved almost entirely in crisis quarters (TSR outperformance in 15 of the 17 crisis quarters it faced). This is no doubt driven by Berkshire Chairman Warren Buffett’s mindset of treating crises as opportunities, with a mantra of “be greedy when others are fearful.”

What are the lessons for investors?

Instead of a single shock, we are currently witnessing several crises unfolding simultaneously, on different timelines and scales — ranging from COVID to Russia’s invasion of Ukraine to climate change

As crisis mode turns from a transient phenomenon to a permanent feature, the value of resilience will only increase. Investors need to become better at identifying companies equipped to absorb shocks, recover, and shape as well as thrive in the new environment.

This entails assessing the presence of the resilient qualities in companies. Are companies building up modular or redundant supply chains, a robust ecosystem, and the capability to shift quickly in response to external changes? This can be complemented by quantifying a company’s resilience track record: For example, what was the recovery rate of a company relative to its competitors in recent crises? How much of the share of its industry upswing did it capture following a crisis period?

Investors also can incorporate forward-looking metrics into their assessments — such as our vitality index, which estimates the potential for long-term growth of a company — in order to ensure they do not overvalue the short-run efficiency-focused metrics that often dominate financial analysis. These same perspectives can also be applied to investors themselves, as well as their investment targets.

Martin Reeves is a managing director and senior partner at Boston Consulting Group and the chairman of the BCG Henderson Institute. He is the co-author, with Jack Fuller, of The Imagination Machine: How To Spark New Ideas and Create Your Company’s Future. (Harvard Business Review Press, June 2021.)

Adam Job is director of the Strategy Lab at the BCG Henderson Institute. He can be reached at [email protected].

More: 8 key strategies that business leaders say your company needs to succeed in this economy

Also read: Women are missing from leadership ranks — even in female-dominated industries