COVID-19 has wreaked havoc on economies across the globe and resulted in record asset write-downs. Meanwhile, the S&P 500 raced to new all-time highs as most investors were willing to look past the COVID-induced decline in earnings.

The sharp decline across all markets Thursday signals that now is the time for investors, especially fiduciaries, to reduce risk in equity portfolios as investors have pushed stock up too indiscriminately and exuberantly.

Read:Here are the biggest stock-market losers on Thursday

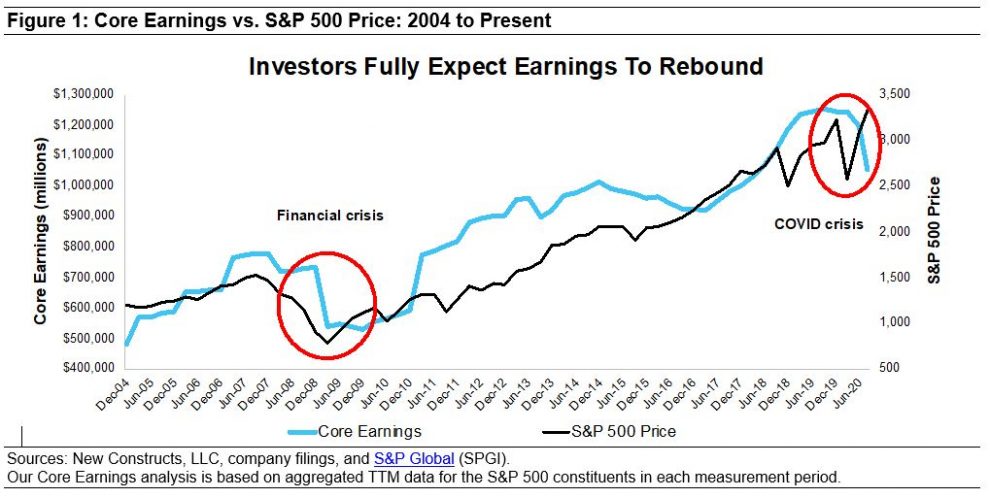

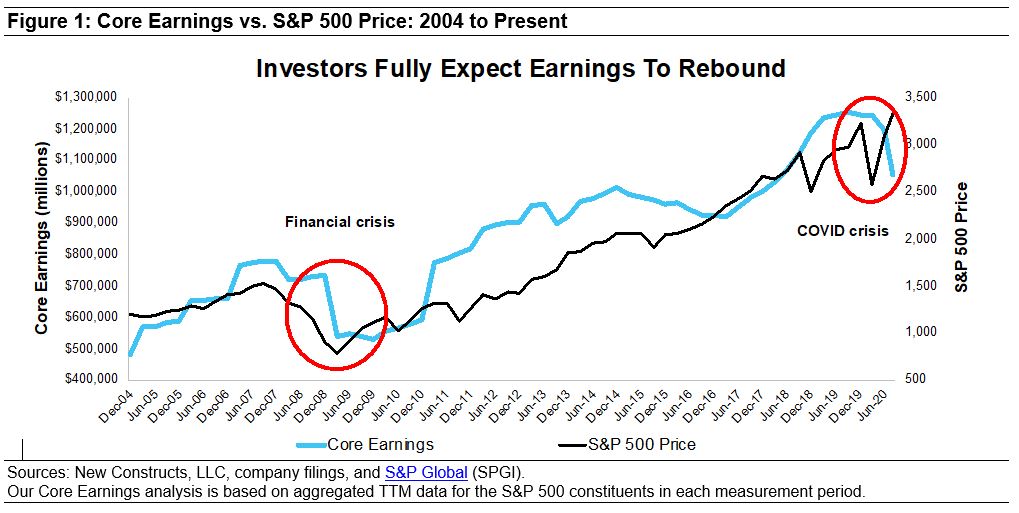

We called a market bottom in March. We’re now calling a market top in this quarter’s review of the S&P 500’s true core earnings and valuation. Figure 1 shows how the bottoming out of core earnings during the financial crisis presaged the market rebound in 2009.

Currently, Figure 1 shows that the market is anticipating a strong rebound in earnings even sooner, relative to the trend in core earnings, than during the financial crisis. Consequently, with expectations already so high, any setbacks to the recovery will hit the large-cap heavyweight stocks driving the S&P 500 hard.

While retail and momentum investors may push markets higher, those with fiduciary duties should consider pumping the brakes and lowering the risk in their portfolios by selling stocks with abnormally high valuations (see the list at the bottom).

The right measure of earnings matters — especially for fiduciaries

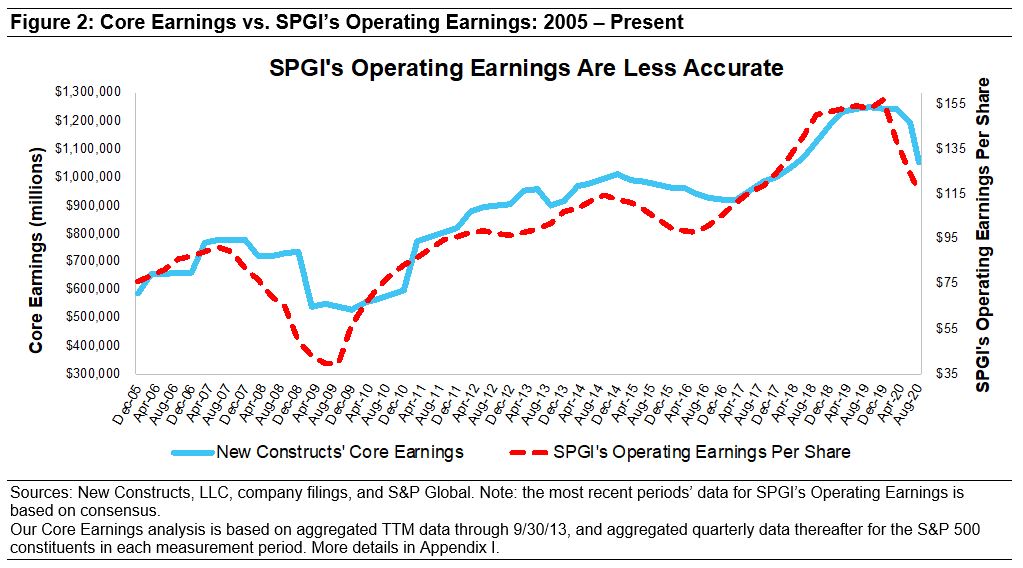

Figure 2 highlights how different our measure of core earnings is from S&P Global’s (SPGI) operating earnings. The differences are due to SPGI’s data systems not capturing the full impact of unusual gains/losses buried in footnotes as shown by this Harvard Business School & MIT Sloan study. Missing these unusual gains and losses causes earnings to be unreliable and subject to management manipulation.

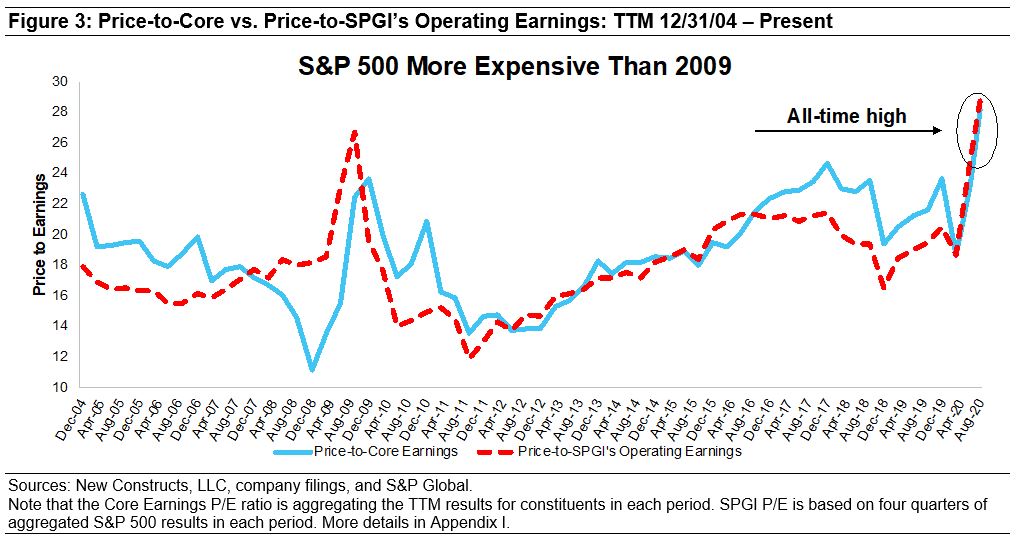

Figure 3 shows our P/Es agree with S&P Global that the market today is fully valuing a significant recovery in earnings.

As mentioned above, anything that threatens that recovery will hit stocks hard. That is all the more reason for fiduciaries to be diligent about analyzing earnings accurately at both the market level and for individual stocks.

COVID-19 erased years of earnings, but it’s not as bad as you think

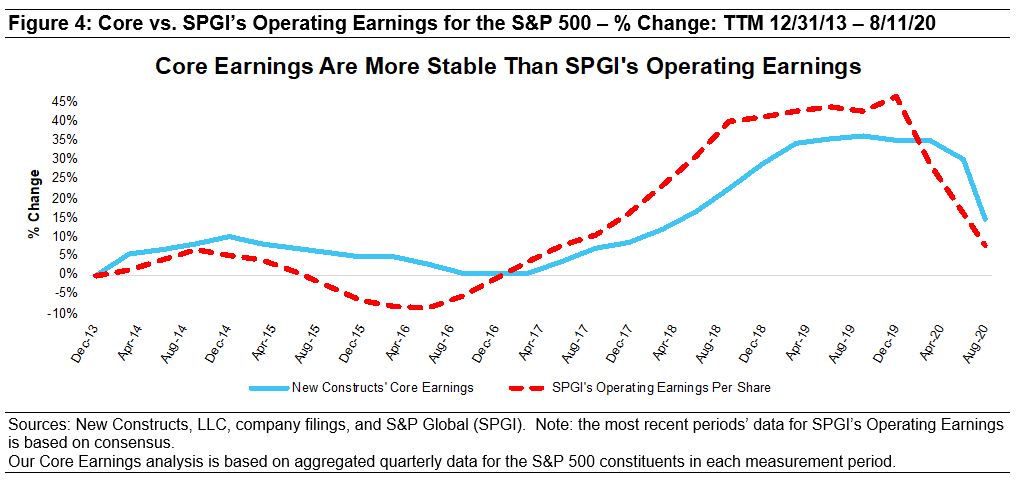

Trailing 12-month (TTM) core earnings for the S&P 500 have fallen 15% since the end of 2019 while consensus TTM for S&P Global’s operating earnings per share for the S&P 500 have fallen 26%. The COVID-19-induced economic downturn wiped out eight quarters’ worth of core earnings growth in just two quarters.

Figure 4 charts the percentage change in our core earnings and SPGI’s operating earnings. These differences at the aggregate level come from even larger differences at the individual company level.

Lower risk — sell the riskiest stocks

Below are some of the stocks that we think present abnormally high risk. Selling these stocks would provide most investors with more than healthy gains. Nevertheless, this strategy is directed more to fiduciaries than traders, who see the recent price performance as reason for holding these positions. Fiduciaries need more than price momentum to justify investing in a given stock.

1. Wayfair W, -5.35% — This Online Retailer is Furnishing Investors With Risk

2. Tesla TSLA, +2.78% — Tesla: The Most Dangerous Stock for Fiduciaries

3. Uber UBER, -0.50% — The Emperor Has No Clothes – Uber’s Business Model Is Broken

4. Carvana CVNA, -5.79% — You Won’t Find a Bargain With This Car Dealer

5. Beyond Meat BYND, -3.06% — Competition Will Eat This Firm Alive

Stocks to own instead

Since mid-April, we’ve identified several companies with strong underlying core earnings and valuations implying profits would never recover from COVID-induced lows. These stocks have not seen huge increases in their prices even though their cash flows are far superior to the companies above.

Our “See Through the Dip” thesis acknowledges that most of these firms’ profits are on the decline in the short term, however, their fundamentals, along with ample liquidity, will enable them not just to survive the economic downturn, but also thrive in a recovery. These stocks should be held through the market turmoil as we expect them to outperform the crowded passive strategies over the long term.

David Trainer is the CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and model economic earnings, and owns shares in SYSCO, DR Horton, Hyatt Hotels, JPMorgan Chase, Simon Property Group and Southwest Airlines. Kyle Guske II and Matt Shuler are investment analysts at New Constructs. They receive no compensation to write about any specific stock, style or theme. New Constructs doesn’t perform any investment-banking functions and doesn’t operate a trading desk. Follow them on Twitter @NewConstructs.

Also: This analysis of Wall Street stock ratings is sounding a warning for Tesla and 62 other stocks